Reebok 2009 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122 GROUP MANAGEMENT REPORT – FINANCIAL REVIEW GROUP BUSINESS PERFORMANCE Balance Sheet and Cash Flow Statement

Balance Sheet and

Cash Flow Statement

Changes in accounting policy

The Group’s consolidated financial

statements are prepared in accordance

with International Financial Reporting

Standards (IFRS as adopted by the EU).

In 2009, there were relevant changes in

IFRS which were reflected in the Group’s

consolidation and accounting principles

see Note 1, p. 170. However, the impact

on the Group’s consolidated financial

statements from any such changes was

not material in the reporting period.

Total assets decrease 7%

At the end of 2009, total assets decreased

7% to € 8.875 billion versus € 9.533 bil-

lion in the prior year. This was primarily

attributable to a decrease in current

assets. A decrease in non-current

assets also impacted this development

see 37.

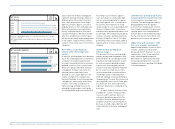

Group inventories down 26%

Group inventories decreased 26% to

€ 1.471 billion at the end of 2009 versus

€ 1.995 billion in 2008 see Note 9, p. 182.

On a currency-neutral basis, inventories

declined 27%. This was mainly a result of

reduced production volumes as well as

clearance of excess inventories at all our

brands see 38.

Accounts receivable decrease 12%

At the end of 2009, Group receivables

decreased 12% to € 1.429 billion (2008:

€ 1.624 billion) see Note 7, p. 181. On a

currency-neutral basis, receivables were

down 13%. This decrease reflects strict

discipline in implementing the Group’s

trade terms and improved collection of

receivables as the difficult economic situ-

ation eased in most markets at year-end

see 39.

Other current financial assets

down 44%

Other current financial assets decreased

44% to € 160 million at the end of 2009

from € 287 million in 2008 see Note 8,

p. 181. This development was mainly

due to the decrease of the fair value of

current forward contracts.

Other current assets down 28%

Other current assets decreased 28% to

€ 360 million at the end of 2009 from

€ 502 million in 2008, mainly as a result

of a decrease in prepayments see

Note 10, p. 182.

Fixed assets decline 7%

Fixed assets decreased 7% to € 3.794 bil-

lion at the end of 2009 versus € 4.074 bil-

lion in 2008. Additions in an amount of

€ 264 million were mainly related to the

continued expansion of our own-retail

activities and investment into the Group’s

IT infrastructure.

Additions were more than offset by

depreciation and amortisation amounting

to € 310 million, disposals of € 48 million

and a transfer of fixed assets to assets

held-for-sale totalling € 106 million. In

addition, negative currency translation

effects in an amount of € 80 million on

fixed assets denominated in currencies

other than the euro impacted this

development.

Assets held-for-sale increase 296%

At the end of 2009, assets held-for-

sale increased 296% to € 126 million

compared to € 31 million at the end of

2008, due to additional assets now being

in the scope of a sale see Note 3, p. 176.

Assets held-for-sale primarily relate to

the planned sale of land and buildings in

Herzogenaurach, Germany, as well as

certain office buildings and warehouses

in various other locations.

Other non-current assets increase 5%

Other non-current assets increased by

5% to € 126 million at the end of 2009

from € 120 million in 2008, mainly driven

by an increase in prepaid promotion con-

tracts see Note 16, p. 184.

N

°-

35

N

°-

36

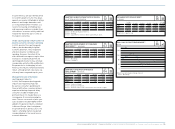

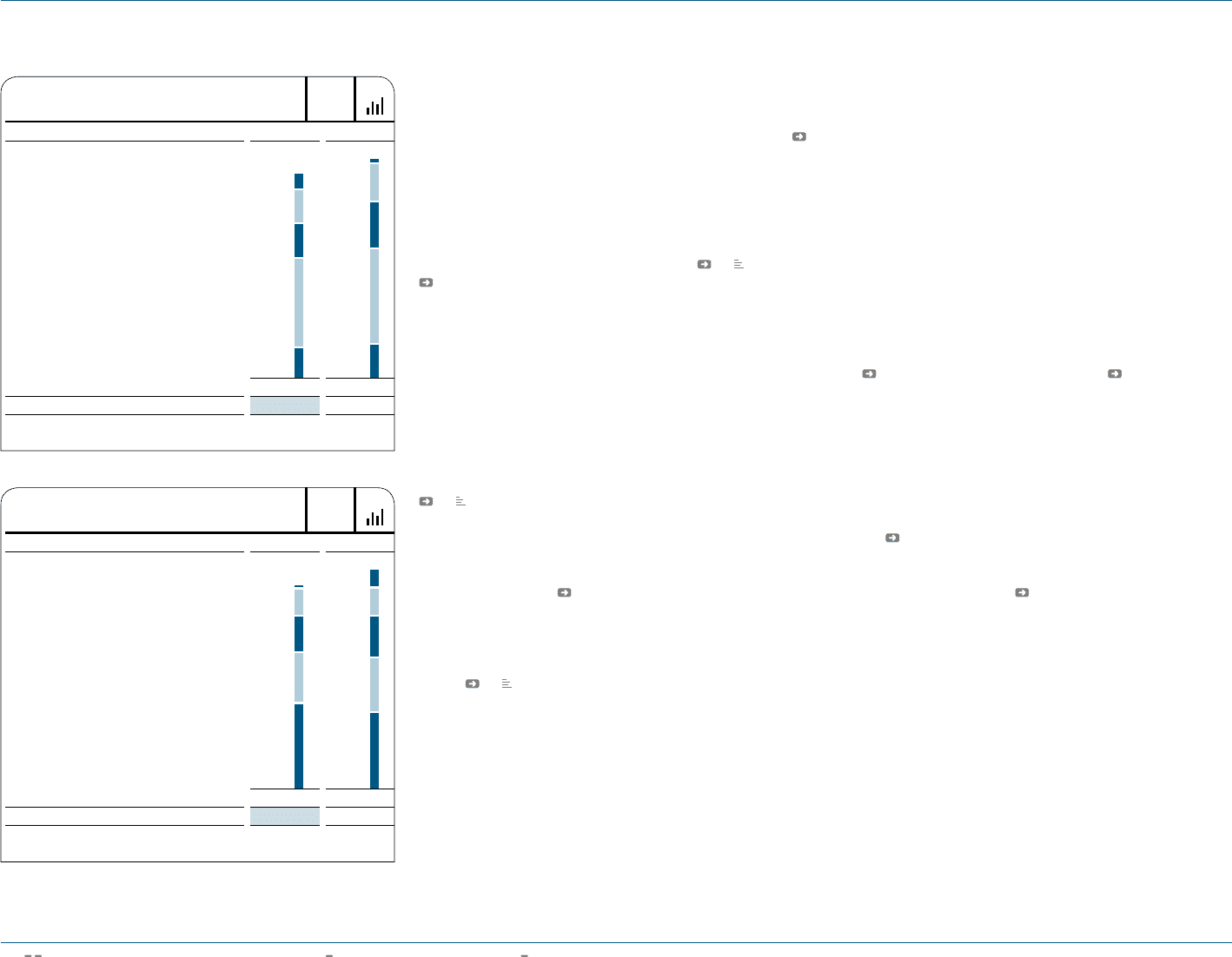

BALANCE SHEET STRUCTURE 1 )

IN % OF TOTAL ASSETS

BALANCE SHEET STRUCTURE 1 )

IN % OF TOTAL LIABILITIES AND EQUITY

Assets 2009 2008

Total assets (€ in millions) 8,875 9,533

1) For absolute figures see Consolidated Balance Sheet, p. 166.

Liabilities and equity 2009 2008

Total liabilities and equity (€ in millions) 8,875 9,533

1) For absolute figures see Consolidated Balance Sheet, p. 166.

Cash and cash equivalents ....................................8.7

Short-term borrowings ..........................................2.2

17.0

12.8

2.6

8.4

20.9

18.6

42.7

24.5

16.8

35.7

Fixed assets .........................................................42.8

Other liabilities .....................................................24.5

Accounts receivable .............................................16.1

Accounts payable .................................................13.1

Other assets .........................................................15.8

Total equity ...........................................................42.5

Inventories ...........................................................16.6

Long-term borrowings .........................................17.7