Reebok 2009 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

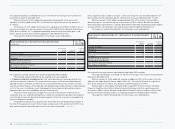

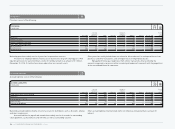

CONSOLIDATED FINANCIAL STATEMENTS Notes 185

The adidas AG share first traded above 110% (€ 28.05) of the conversion price of € 25.50 on more

than 20 trading days within the last 30 trading days in the fourth quarter of 2004. Consequently,

bondholders had the right to convert their convertible bonds into equity since January 1, 2005.

Gross borrowings decreased by € 806 million in 2009 compared to an increase of

€ 427 million in 2008.

In June 2009, a German private placement in an amount of € 200 million was issued,

consisting of a three-year and five-year tranche. Additionally, adidas International Finance

B.V., a fully owned and guaranteed subsidiary of adidas AG, issued a Eurobond in an amount of

€ 500 million in July 2009.

Borrowings are denominated in a variety of currencies in which the Group conducts its

business. The largest portions of effective gross borrowings (before liquidity swaps for cash

management purposes) as at December 31, 2009 are denominated in euros (2009: 61%; 2008:

57%) and US dollars (2009: 33%; 2008: 39%).

The weighted average interest rate on the Group’s gross borrowings remained stable at 5.2%

in 2009 (2008: 5.2%).

As at December 31, 2009, the Group had cash credit lines and other long-term financing

arrangements totalling € 5.9 billion (2008: € 6.5 billion); thereof unused credit lines accounted

for € 4.1 billion (2008: € 4.0 billion). In addition, the Group had separate lines for the issuance of

letters of credit and guarantees in an amount of approximately € 0.4 billion (2008: € 0.3 billion).

The Group’s outstanding financings are unsecured and may include standard financial

covenants, which are reviewed on a quarterly basis. These covenants may include limits on the

disposal of fixed assets, the maximum amount of debt secured by liens, cross default provisions

and change of control. In addition, certain financial arrangements contain equity ratio covenants,

minimum equity covenants as well as net loss covenants.

As of December 31, 2009, and December 31, 2008, actual shareholders’ equity was well

above the amount of the minimum equity covenant. Likewise, the relevant amount of net income

clearly exceeded net loss covenants.

The amounts disclosed as borrowings represent outstanding borrowings under the following

arrangements with aggregated expiration dates as follows:

N

°-

1 7

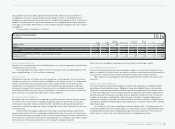

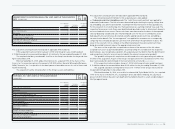

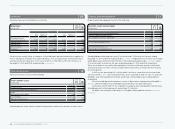

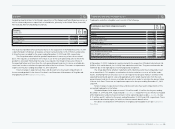

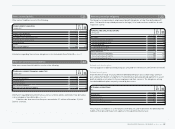

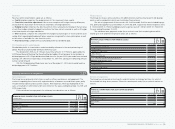

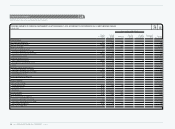

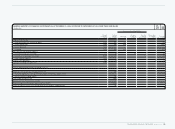

GROSS BORROWINGS AS AT DECEMBER 31, 2009

€ IN MILLIONS

Up to

1 year Between 1

and 3 years Between 3

and 5 years After

5 years Total

Bank borrowings incl.

commercial paper — 103 — — 103

Private placements 198 458 324 186 1,166

Eurobond — — 498 — 498

Convertible bond — — — — —

Total 198 561 822 186 1,767

In accordance with the long-term funding strategy, the bank borrowings and commercial paper

with short-term maturities are also classified as long-term borrowings as they represent perma-

nent funding volumes that are covered by the committed long-term syndicated loan.

N

°-

1 7

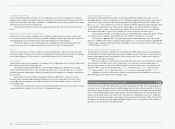

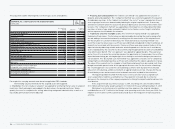

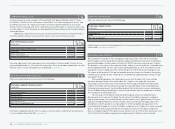

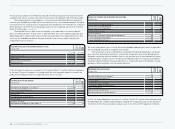

GROSS BORROWINGS AS AT DECEMBER 31, 2008

€ IN MILLIONS

Up to

1 year Between 1

and 3 years Between 3

and 5 years After

5 years Total

Bank borrowings incl.

commercial paper — — 748 — 748

Private placements 404 462 332 234 1,432

Convertible bond 393 — — — 393

Total 797 462 1,080 234 2,573

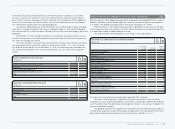

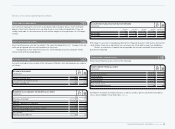

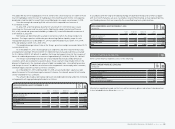

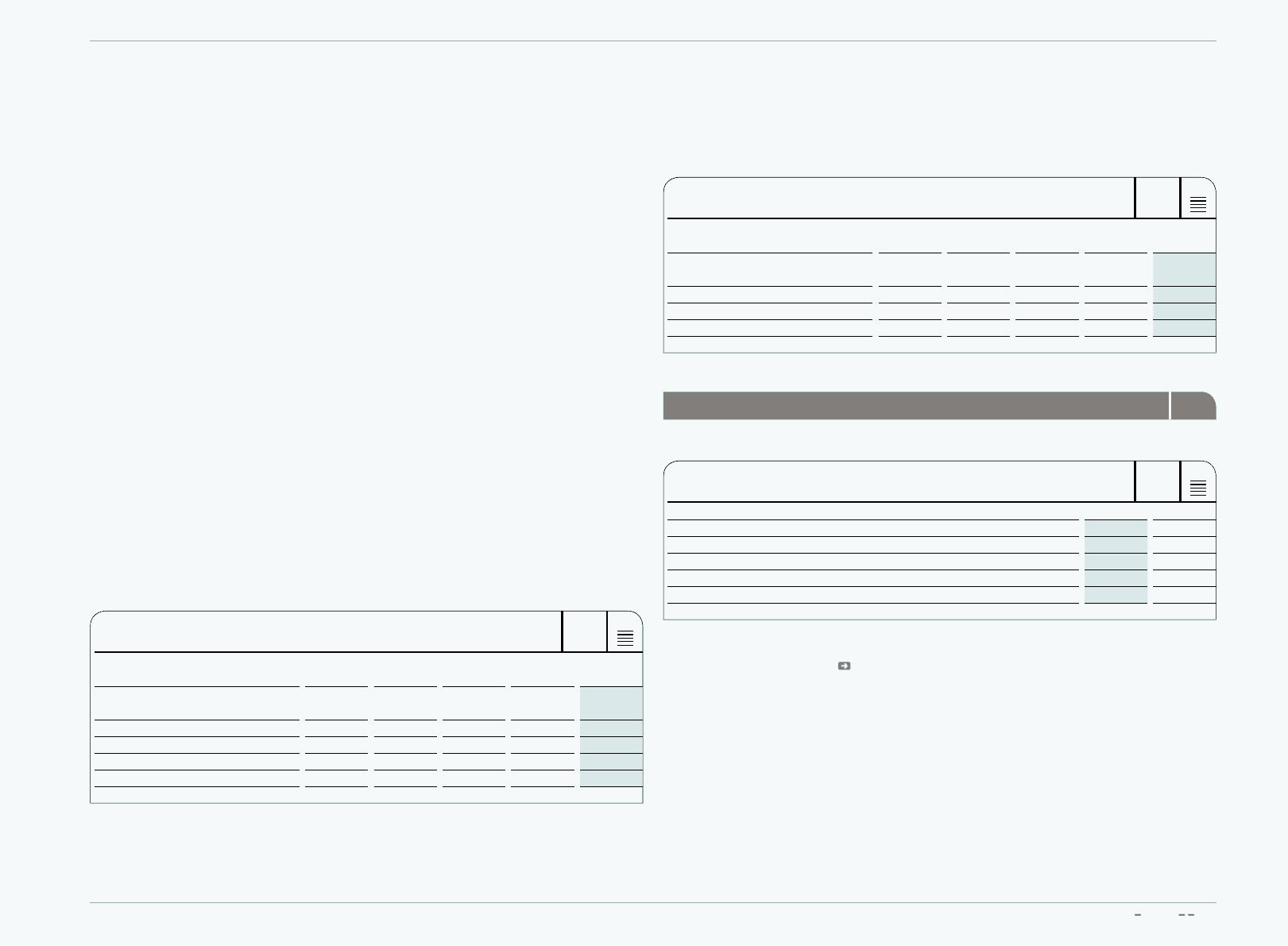

Other current financial liabilities 18

Other current financial liabilities consist of the following:

N

°-

1 8

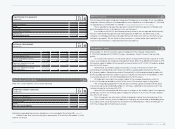

OTHER CURRENT FINANCIAL LIABILITIES

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008

Interest rate derivatives 2 —

Currency options 10 15

Forward contracts 69 42

Other financial liabilities 20 22

Other current financial liabilities 101 79

Information regarding forward contracts as well as currency options and interest rate derivatives

is also included in these Notes see Note 28.