Reebok 2009 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234

|

|

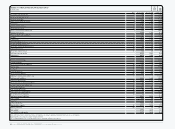

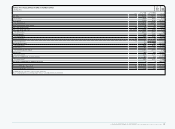

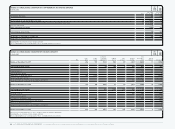

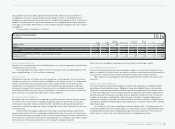

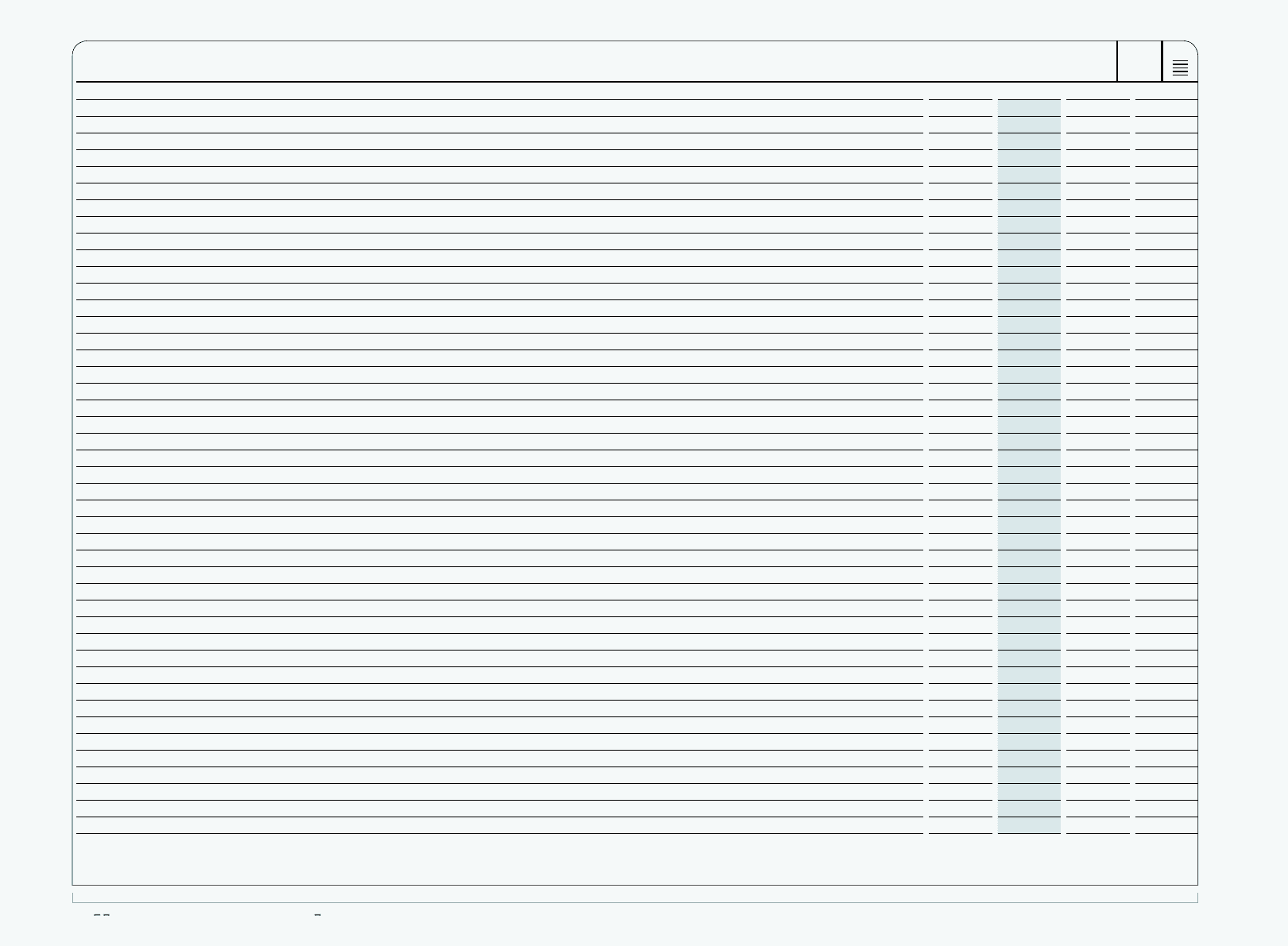

166 CONSOLIDATED FINANCIAL STATEMENTS Consolidated Balance Sheet

N

°-

01

ADIDAS AG CONSOLIDATED BALANCE SHEET (IFRS)

€ IN MILLIONS

Note Dec. 31, 2009 Dec. 31, 2008 Change in %

Cash and cash equivalents 5 775 244 218.0

Short-term financial assets 6 75 141 (46.5)

Accounts receivable 7 1,429 1,624 (12.0)

Other current financial assets 8 160 287 (44.3)

Inventories 9 1,471 1,995 (26.3)

Income tax receivables 33 89 110 (18.9)

Other current assets 10 360 502 (28.4)

Assets classified as held for sale 3 126 31 296.1

Total current assets 4,485 4,934 (9.1)

Property, plant and equipment 11 723 886 (18.4)

Goodwill 12 1,478 1,499 (1.4)

Trademarks 13 1,342 1,390 (3.4)

Other intangible assets 13 160 204 (21.2)

Long-term financial assets 14 91 96 (5.3)

Other non-current financial assets 15 58 60 (4.8)

Deferred tax assets 33 412 344 19.6

Other non-current assets 16 126 120 4.5

Total non-current assets 4,390 4,599 (4.6)

Total assets 8,875 9,533 (6.9)

Short-term borrowings 17 198 797 (75.1)

Accounts payable 1,166 1,218 (4.3)

Other current financial liabilities 18 101 79 28.2

Income taxes 33 194 321 (39.5)

Provisions 19 320 324 (1.3)

Accrued liabilities 20 625 684 (8.7)

Other current liabilities 21 232 216 7.5

Liabilities classified as held for sale 3 0 6 (100.0)

Total current liabilities 2,836 3,645 (22.2)

Long-term borrowings 17 1,569 1,776 (11.7)

Other non-current financial liabilities 22 25 23 7.1

Pensions and similar obligations 23 157 132 19.0

Deferred tax liabilities 33 433 463 (6.3)

Non-current provisions 19 29 28 2.3

Non-current accrued liabilities 20 22 37 (40.7)

Other non-current liabilities 24 28 29 (7.7)

Total non-current liabilities 2,263 2,488 (9.1)

Share capital 209 194 8.1

Reserves 212 (10) —

Retained earnings 3,350 3,202 4.6

Shareholders’ equity 26 3,771 3,386 11.3

Minority interests 25 5 14 (61.0)

Total equity 3,776 3,400 11.1

Total liabilities and equity 8,875 9,533 (6.9)

From 2009, other (non-)current financial assets/liabilities are shown separately from other (non-)current assets/liabilities.

Rounding differences may arise in percentages and totals.

The accompanying Notes are an integral part of these consolidated financial statements.