Reebok 2009 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

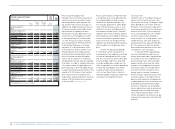

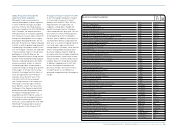

150 GROUP MANAGEMENT REPORT – FINANCIAL REVIEW Risk and Opportunity Report

Financing and liquidity risks

Liquidity risks arise from not having the

necessary resources available to meet

maturing liabilities with regard to tim-

ing, volume and currency structure. In

addition, the adidas Group faces the risk

of having to accept unfavourable financ-

ing terms due to liquidity restraints.

Our Group’s Treasury department uses

an efficient cash management system

to manage liquidity risk. At December

31, 2009, Group cash and cash equiva-

lents amounted to € 775 million (2008:

€ 244 million). Moreover, our Group

maintains € 2.2 billion bilateral short-

term credit lines and a € 2 billion com-

mitted medium-term syndicated loan

facility with international banks, which

does not include a market disruption

clause. The € 4.2 billion in credit lines

are designed to ensure sufficient liquidity

at all times. In order to mitigate financing

risks and to reduce the dependence on

bank financing, in 2009 the adidas Group

issued a German private placement in the

amount of € 200 million in two tranches

with a maturity of three and five years

respectively, and a Eurobond in a nominal

amount of € 500 million with a maturity

of five years see Treasury, p. 128.

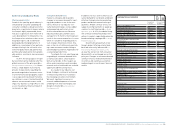

Future cash outflows arising from finan-

cial liabilities that are recognised in the

Consolidated Balance Sheet are pre-

sented in the adjacent table see 03.

This includes payments to settle obliga-

tions from borrowings as well as cash

outflows from cash-settled derivatives

with negative market values. Financial

liabilities that may be settled in advance

without penalty are included on the basis

of the earliest date of potential repay-

ment. Cash flows for variable-interest

liabilities are determined with reference

to the conditions at the balance sheet

date.

In 2009, we reduced net debt by

€ 1.272 billion, which resulted in the

achievement of our medium-term target

of financial leverage below 50% at year-

end. As a result of this effort and in light

of our available credit lines, financing

structure and business model, we con-

tinue to regard the occurrence probability

of financing and liquidity risks, which

could also lead to increased interest

costs, as low. Nevertheless, failure to

maintain liquidity could have a high finan-

cial impact on Group performance.

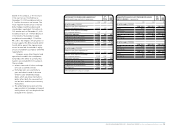

Currency risks

Currency risks for the adidas Group are

a direct result of multi-currency cash

flows within the Group. The biggest single

driver behind this risk results from the

mismatch of the currencies required for

sourcing our products versus the denom-

inations of our sales. The vast majority

of our sourcing expenses are in US dol-

lars while sales are denominated in

other currencies to a large extent – most

notably the euro. Our main exposures

are presented in the adjacent table see

04. The exposure from firm commit-

ments and forecasted transactions was

calculated on a one-year basis.

In line with IFRS 7 requirements,

we have estimated the impact on net

income and shareholders’ equity based

on changes in our most important cur-

rency exchange rates. The calculated

impacts mainly result from fair value

changes of our hedging instruments.

The analysis does not include effects

that arise from the translation of our

foreign entities’ financial statements

into the Group’s reporting currency. The

sensitivity analysis is based on the net

balance sheet exposure, including inter-

company balances from monetary assets

and liabilities denominated in foreign

currencies. Moreover, all outstanding

currency derivatives were re-evaluated

using hypothetical foreign exchange

rates to determine the effects on net

income and equity. The analysis was per-

formed on the same basis for both 2008

and 2009.

N

°-

03

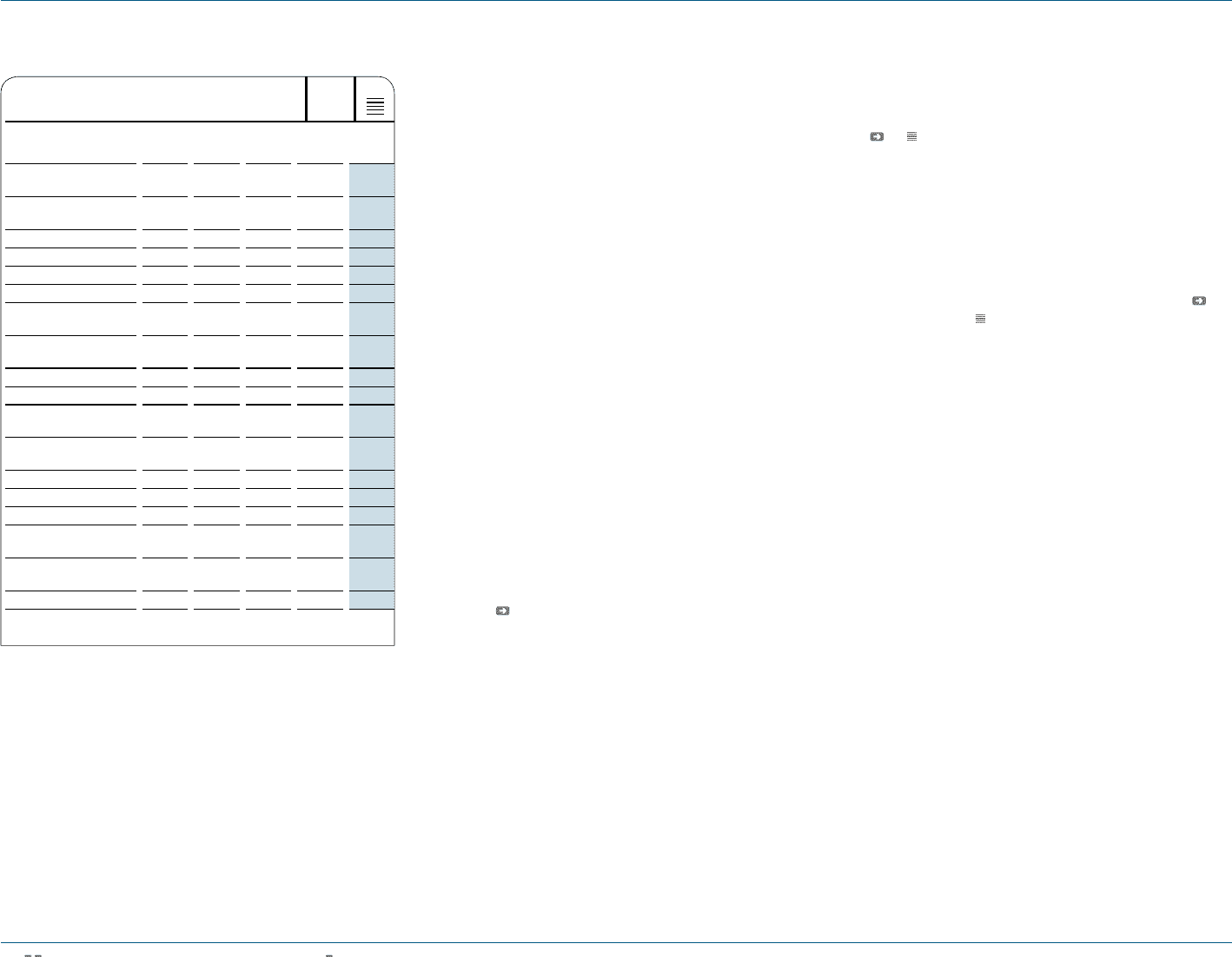

FUTURE CASH OUTFLOWS 1 )

€ IN MILLIONS

Up to 1

year

Between

1 and 3

years

Between

3 and 5

years After

5 years Total

As at December 31,

2009

Bank borrowings incl.

commercial paper 103 103

Private placements 245 537 370 201 1,353

Eurobond 24 48 538 610

Convertible bond

Accounts payable 1,166 — — — 1,166

Other financial

liabilities 21 0 1 1 23

Derivative financial

liabilities 81 23 1 1 106

Total 1,640 609 909 203 3,361

As at December 31,

2008

Bank borrowings incl.

commercial paper 748 748

Private placements 462 539 374 261 1,636

Convertible bond 408 408

Accounts payable 1,218 — — — 1,218

Other financial

liabilities 25 1 2 28

Derivative financial

liabilities 57 15 6 2 80

Total 2,918 555 380 265 4,118

1) Rounding differences may arise in totals.