Reebok 2009 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

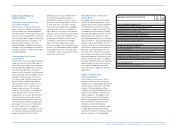

158 GROUP MANAGEMENT REPORT – FINANCIAL REVIEW Subsequent Events and Outlook

Greater China sporting goods

market continues to grow

In Greater China, the sporting goods

industry’s footprint is expected to con-

tinue expanding in 2010, albeit at con-

siderably lower rates compared to 2008.

While the first half year development will

still be depressed due to the clearance of

excess inventory at retail, growth is likely

to be more pronounced in the second

half. Rising income levels and growing

sports participation rates are expected

to support the trend. In addition, the

expansion of local brands will positively

contribute to industry development.

Other Asian markets sporting goods

sales mixed

In other Asian markets, sporting goods

sales development is expected to differ

from region to region. While sales in

Japan are forecasted to decline slightly

as a result of the negative effects from

low levels of private consumption and

consumer confidence, emerging Asian

countries such as India or Vietnam are

projected to post solid growth. This

mainly relates to rising income levels

in these countries as well as to govern-

mental programmes aimed at increas-

ing sports participation among the

population.

Latin American sporting goods industry

affected by higher import duties

In Latin America, growth of the sporting

goods industry is expected to continue in

2010, also fuelled by the positive impact

of sales related to the 2010 FIFA World

Cup™ in South Africa. Nevertheless,

higher import duties in key markets such

as Brazil are forecasted to dampen the

industry growth prospects for interna-

tional manufacturers see Risk and Oppor-

tunity Report, p. 140.

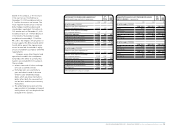

adidas Group sales to be at least in

line with economic growth rates

Based on our strength in innovation,

operational execution and regional

diversification, we are confident that the

Group’s net sales increase in 2010 will

be at least in line with the growth rates

of the global economy. We also expect

Group sales growth to be at least in

line with the overall development of the

sporting goods industry.

adidas Group sales to increase at a

low- to mid-single-digit rate in 2010

We expect adidas Group sales to increase

at a low- to mid-single-digit rate on a

currency-neutral basis in 2010. Despite

the projected global economic recovery,

sales development will be negatively

tempered by a slow turnaround in con-

sumer demand and continuing cautious

retailer behaviour. This will be a result of

sustained high unemployment rates in

many major markets and only moderate

improvements in consumer confidence.

However, positive impacts from the 2010

FIFA World Cup™, our high exposure to

fast-growing emerging markets as well

as improvements at the Reebok brand

are forecasted to more than offset these

negative effects.

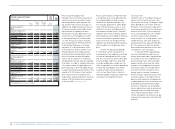

Currency-neutral Wholesale revenues

expected to increase moderately

We project currency-neutral Wholesale

segment revenues to increase at a low-

single-digit rate compared to the prior

year. Order backlog development as

well as positive retailer and trade show

feedback support our growth expecta-

tions for 2010. Currency-neutral adidas

Sport Performance sales are forecasted

to increase, supported by strong football

sales in connection with the 2010 FIFA

World Cup™, for which adidas is an

Official Sponsor. Sales in other major

categories are expected to decline.

adidas Sport Style revenues are projected

to increase on a currency-neutral basis

as a result of increasing momentum in

new product lines, such as adidas Style

Essentials. Currency-neutral Reebok

sales are expected to increase due to

double-digit revenue growth in Women’s

Fitness as well as improvements in the

Men’s Training category.

Retail sales to increase at a

high-single-digit rate on a

currency-neutral basis

adidas Group currency-neutral Retail

segment sales are projected to grow at

a high-single-digit rate in 2010. Expan-

sion of the Group’s own-retail store

base will be the primary driver of the

revenue increase. The Group expects a

net increase of its store base by around

125 adidas and Reebok stores in 2010,

depending on the timing and availability

of desired locations. We forecast to open

around 150 new stores. New stores will

primarily be located in emerging mar-

kets in Eastern Europe. Approximately

25 stores will be closed over the course

of the year. Around 200 stores will be

remodelled. Comparable store sales are

expected to increase at a low-single-digit

rate compared to the prior year. Due to

ongoing high price sensitivity of con-

sumers, factory outlets are expected to

perform better than concept stores as a

result of lower average price points.

Currency-neutral sales of Other

Businesses to increase at a

low-single-digit rate

In 2010, revenues of Other Businesses

are expected to increase at a low-single-

digit rate on a currency-neutral basis.

TaylorMade-adidas Golf revenues are

projected to be stable compared to the

prior year. The positive effect from new

TaylorMade product launches in core

categories such as metalwoods and irons

will be offset by the non-recurrence of

prior year Ashworth sales from a licens-

ing agreement with a competitor that

was terminated in the first half of 2009.

Revenues at Rockport and Reebok-CCM

Hockey are forecasted to increase as a

result of improvements in the brands’

product portfolio and better consumer

reception.