Reebok 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROUP MANAGEMENT REPORT – OUR GROUP Global Sales Strategy 55

Customer and range segmentation

to drive effectiveness

Rolling out standardised product

range packages around the globe is an

important part of the Group’s wholesale

strategy. The initiative, which was first

designed and implemented in Europe,

involves a customer segmentation

strategy that facilitates the systematic

allocation of differentiated product pack-

ages to groups of comparable customers.

This segmentation is broadly based on a

distinction between sports and lifestyle

retailers that either have an up-market

“brand-driven” positioning or a value-

oriented “commercial” positioning. By

best suiting their specific needs, this

provides Global Sales a platform to

better exploit market potential, while at

the same time supporting the reduc-

tion of complexity and costs. In addition,

Wholesale continues to partner with

retailers on increasing the level and

quality of sell-through information the

Group receives. This creates a mutually

beneficial understanding of their needs

that will help the Group become a more

valuable and reliable business partner to

our retailers, driving incremental busi-

ness opportunities.

Retail Space Management to

drive efficiency

Retail Space Management (RSM) com-

prises all business models helping Global

Sales to expand controlled space in retail.

The Wholesale function is cooperating

with retailers along the entire supply

chain to bring best-in-class service all

the way through to the point of sale. By

helping to improve the profitability per

square metre for the Group’s retail part-

ners as well as improving product avail-

ability, we can achieve higher customer

satisfaction, thus driving share of retail

shelf space.

The three predominant models to

drive the success of RSM for the adidas

Group are Never-out-of-stock, FLASH

collections and Franchising.

Never-out-of-stock (NOOS): The NOOS

programme comprises a core range

of basic articles, mostly on an 18 – 24

months lifecycle, that are selling across

all channels and markets. Overall, the

NOOS replenishment model secures high

levels of product availability throughout

the season, allowing for quick adaptation

to demand patterns. Retailers have to

provide dedicated retail space, co-invest

in fixtures and fittings and commit to a

“first fill” representing about 25% of total

expected seasonal demand to participate

in this programme. In return, customers

can profit from significantly reduced

inventory risk on these products. Most

NOOS articles are on an end-to-end

supply chain, thus limiting the adidas

Group’s inventory risk as we re-produce

following customer demand.

FLASH collections: The FLASH pro-

gramme consists of pre-defined collec-

tion packages that are delivered every

4 – 6 weeks to retailers’ doors, including

basic point-of-sale promotional materi-

als to promote dedicated retail space

provided by the retailer. All articles of the

FLASH packages are exclusively devel-

oped for this programme with the inten-

tion to bring freshness to the retail space.

With a short development lead time, we

are able to reflect recent product and

colour trends in the FLASH range. As no

samples are available during sell-in, the

customers buy into a business propos-

ition rather than traditionally selecting

individual articles. In return for this

commitment, the retailers have the right

to selectively return articles of every

FLASH collection that have not sold out

during the defined retail window. Overall,

the FLASH programme helps to improve

brand image while limiting inventory

risk for the customers. The FLASH pro-

gramme has been started in 2010, with

full-scale rollout planned from 2012

onwards.

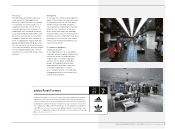

Franchising: Mono-branded store

franchising is one of the Group’s prime

growth opportunities, as it offers superior

brand presentation. Franchise stores are

financed and operated by franchise part-

ners. The adidas Group normally con-

tributes to the costs for brand- specific

fixtures and fittings each store has to be

equipped with.

Further, we support our franchise

partners with a comprehensive franchise

concept, including range propos itions,

IT systems, training concepts, and

guidelines for store building and store

operations. This ensures that the quality

of the brand presentation and the service

offered to the consumer are at all times

high and comparable to our own retail

stores.

Harmonisation and standardisation

of processes to exploit leverage

While understanding that market and

consumer needs require differentiated

distribution policies, the establishment

of the Global Sales function is also an

enabler to further leverage the size of

our Group and reduce complexity by

implementing best operational practices

across our wholesale activities. The har-

monisation and standardisation particu-

larly of back-end processes can help to

further reduce cost through simplified

IT systems and applications. Similarly,

and already started in Europe, we are

rolling out a trade terms policy that

rewards customer performance either

by higher efficiency (e.g. in logistics) or

better sell-out support (e.g. by point-of-

sale activation). As part of this effort we

will harmonise trade terms definitions,

and we have established regular report-

ing, delivering meaningful benchmarks

that allow us to tightly control our

investments.