Reebok 2009 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130 GROUP MANAGEMENT REPORT – FINANCIAL REVIEW GROUP BUSINESS PERFORMANCE Treasury

N

°-

51

N

°-

49

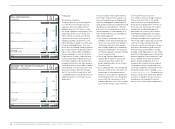

INTEREST RATE DEVELOPMENT 1 )

IN %

NET CASH (NET BORROWINGS)

€ IN MILLIONS

2005

2006

2007

2008

2009

2005

2006 1 )

2007

2008

2009

4.0

4.8

5.3

5.2

5.2

551

(2,231)

(1,766)

(2,189)

(917)

1) Weighted average interest rate of gross borrowings.

1) At end of period.

1) Including Reebok, Rockport and Reebok-CCM Hockey from February 1, 2006

onwards.

N

°-

50

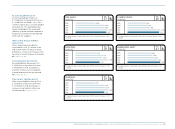

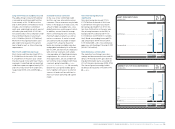

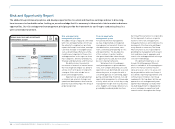

NET BORROWINGS BY QUARTER 1 )

€ IN MILLIONS

Q1 2008

Q1 2009

Q2 2008

Q2 2009

Q3 2008

Q3 2009

Q4 2008

Q4 2009

2,073 2,883

2,260 2,732

2,593

2,294

2,189

917

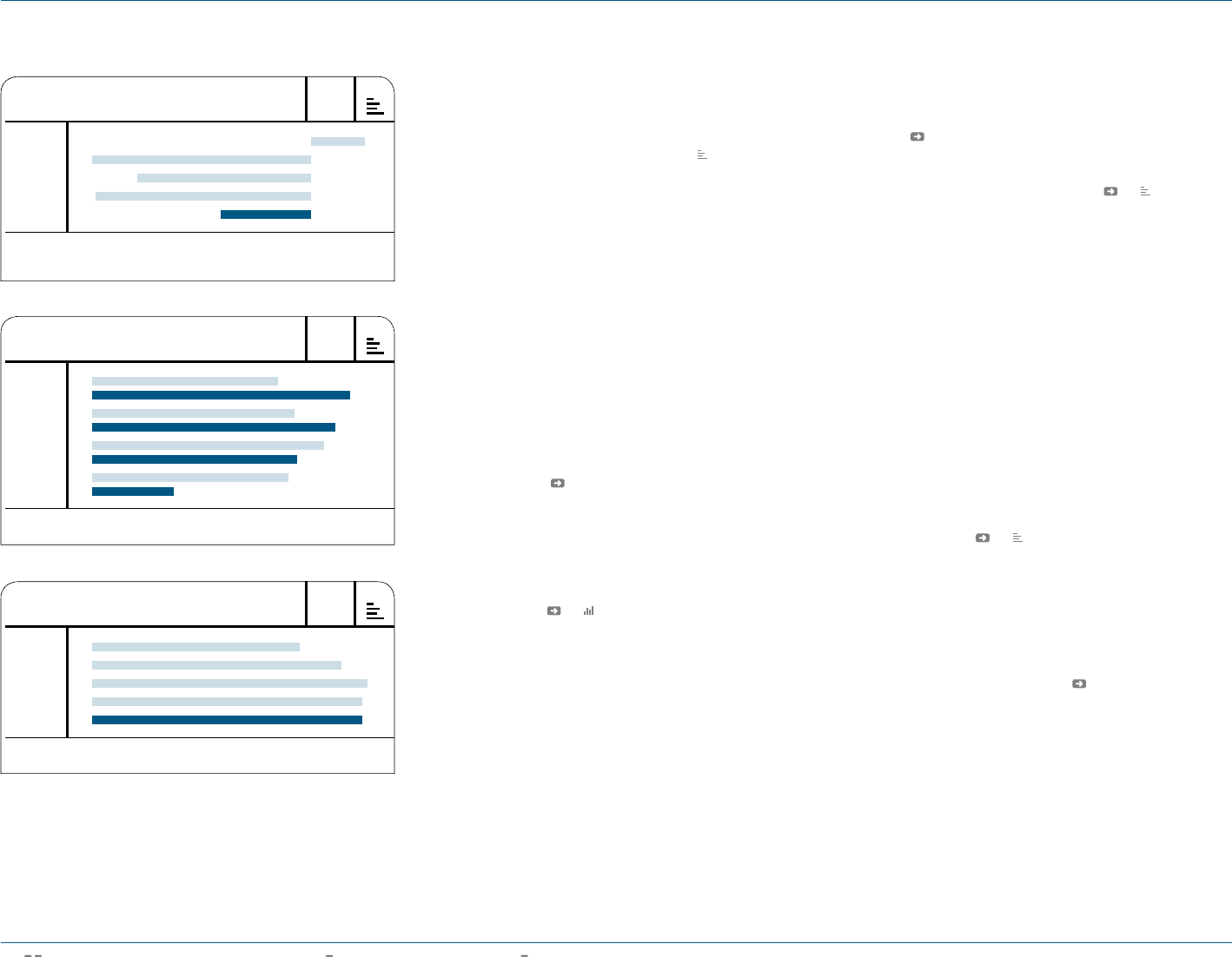

Financing structure improved

significantly

Over the course of 2009, we extended

the Group’s debt maturity profile, fur-

ther optimising our financing structure.

In June, we issued a German private

placement in an amount of € 200 mil-

lion, consisting of a three-year and

five-year tranche. Additionally, adidas

International Finance B.V., a fully owned

and guaranteed subsidiary of adidas

AG, issued a Eurobond in a nominal

amount of € 500 million in July 2009.

The bond has a maturity of five years,

an annual coupon of 4.75% and was

priced with a spread of 200 basis points

above the respective Euro mid-swap.

The transaction was multiple times

oversubscribed. In October, the Group

announced the early redemption of its

€ 400 million convertible bond. Following

the announcement, the bond was fully

converted by holders see Our Share,

p. 42. As a result, the Group’s financing

structure improved considerably with

the term structure of debt maturities

now more evenly spread. At the end of

2009, total refinancing needs in the next

12 months amounted to € 198 million

(2008: € 797 million) see 55.

Interest rate unchanged

The weighted average interest rate on

the Group’s gross borrowings remained

stable at 5.2% in 2009 (2008: 5.2%) see

51. Positive effects from lower interest

rates on short-term borrowings were

offset by the higher share of longer-term

borrowings in the Group’s financing mix,

which carry a higher average interest

rate. Long-term fixed-rate financing

amounted to 68% of the Group’s total

financing at the end of 2009 (2008: 58%).

Variable financing amounted to 32% of

total financing at the end of the year

(2008: 42%).

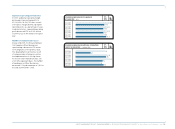

Net debt position decreases

by € 1.272 billion

Net borrowings at December 31, 2009

amounted to € 917 million, which

represents a substantial decrease of

€ 1.272 billion, or 58%, versus € 2.189 bil-

lion in the prior year see 49. This

development significantly exceeded our

original target of net debt to be below

the prior year level communicated at the

beginning of 2009. Lower working capital

requirements and lower capital expendi-

ture than originally planned positively

influenced this development. The strong

reduction was also supported by the

complete conversion of our € 400 million

convertible bond in the fourth quarter.

Currency effects had a positive impact of

€ 12 million on net borrowings develop-

ment. On a net debt basis, the utilisation

of credit facilities available to the Group

at the end of 2009 was 16% versus 33%

in the prior year. The Group’s financial

leverage declined to 24.3% at the end

of 2009 versus 64.6% in the prior year

see 53. As a result, we achieved our

medium-term goal of financial leverage

below 50%. Efficient management of our

capital structure continues to be a top

management priority. Therefore, to limit

financing risks while ensuring sufficient

flexibility, we now aim to maintain a ratio

of net borrowings over EBITDA of less

than two times see Subsequent Events and

Outlook, p. 156.