Reebok 2009 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW BUSINESS PERFORMANCE BY SEGMENT Other Businesses Performance 137

Other Businesses Performance

Other Businesses primarily include the TaylorMade-adidas Golf, Rockport and Reebok-CCM Hockey segments. In addition, the

segment Other centrally managed brands, which comprises brands such as Y-3, is also included. In 2009, currency-neutral sales

of Other Businesses decreased 4%. In euro terms, sales remained almost stable at € 1.283 billion (2008: € 1.285 billion). Gross

margin decreased 2.8 percentage points to 39.4% (2008: 42.2%). This was mainly a result of price repositioning initiatives at

TaylorMade-adidas Golf due to the negative golf market development. Gross profit decreased 7% to € 506 million in 2009 from

€ 543 million in 2008. As a result of the decline in gross margin and higher operating costs as a percentage of sales, segmental

operating margin decreased 4.3 percentage points to 21.9% (2008: 26.2%). In absolute terms, segmental operating profit

declined 17% to € 281 million in 2009 versus € 337 million in 2008.

N

°-

01

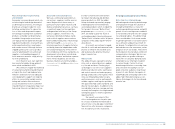

OTHER BUSINESSES AT A GLANCE

€ IN MILLIONS

2009 2008 Change

Net sales 1,283 1,285 (0%)

Gross profit 506 543 (7%)

Gross margin 39.4% 42.2% (2.8pp)

Segmental operating profit 281 337 (17%)

Segmental operating margin 21.9% 26.2% (4.3pp)

Currency-neutral sales of Other

Businesses decline 4%

In 2009, revenues for Other Businesses

declined 4% on a currency-neutral basis.

While sales declined in the segments

TaylorMade-adidas Golf, Rockport and

Reebok-CCM Hockey, revenues increased

at Other centrally managed brands.

Currency translation effects positively

impacted revenues in euro terms. Sales

of Other Businesses remained almost

stable at € 1.283 billion in 2009 (2008:

€ 1.285 billion).

Currency-neutral sales of Other

Businesses decline in nearly all regions

Currency-neutral sales of Other Busi-

nesses decreased in all regions except

Western Europe and Latin America.

Revenues in Western Europe increased

10% on a currency-neutral basis due

to higher TaylorMade-adidas Golf sales

in the region. Revenues in European

Emerging Markets decreased 2% on a

currency-neutral basis primarily due to

lower Reebok-CCM Hockey sales which

could not be offset by higher Rockport

revenues. Currency-neutral sales in

North America decreased 5% primarily

due to sales decreases at TaylorMade-

adidas Golf and Rockport. Revenues in

Greater China declined 9% on a currency-

neutral basis due to lower TaylorMade-

adidas Golf sales. Sales in Other Asian

Markets decreased 8% on a currency-

neutral basis, impacted by declines

at TaylorMade-adidas Golf. In Latin

America, currency-neutral sales grew 3%

as a result of increases at TaylorMade-

adidas Golf.

Currency translation effects had a mixed

impact on regional sales in euro terms.

Sales in Western Europe increased 3%

to € 214 million (2008: € 208 million). In

European Emerging Markets, sales grew

3% to € 30 million in 2009 from € 29 mil-

lion in 2008. Revenues in North America

declined 2% to € 685 million in 2009

versus € 695 million in the prior year. In

Greater China, revenues decreased 3% to

€ 24 million in 2009 (2008: € 25 million).

Sales in Other Asian Markets increased

1% to € 319 million in 2009 from

€ 316 million in 2008, and revenues in

Latin America decreased 1% to € 12 mil-

lion in 2009 (2008: € 12 million).

N

°-

02

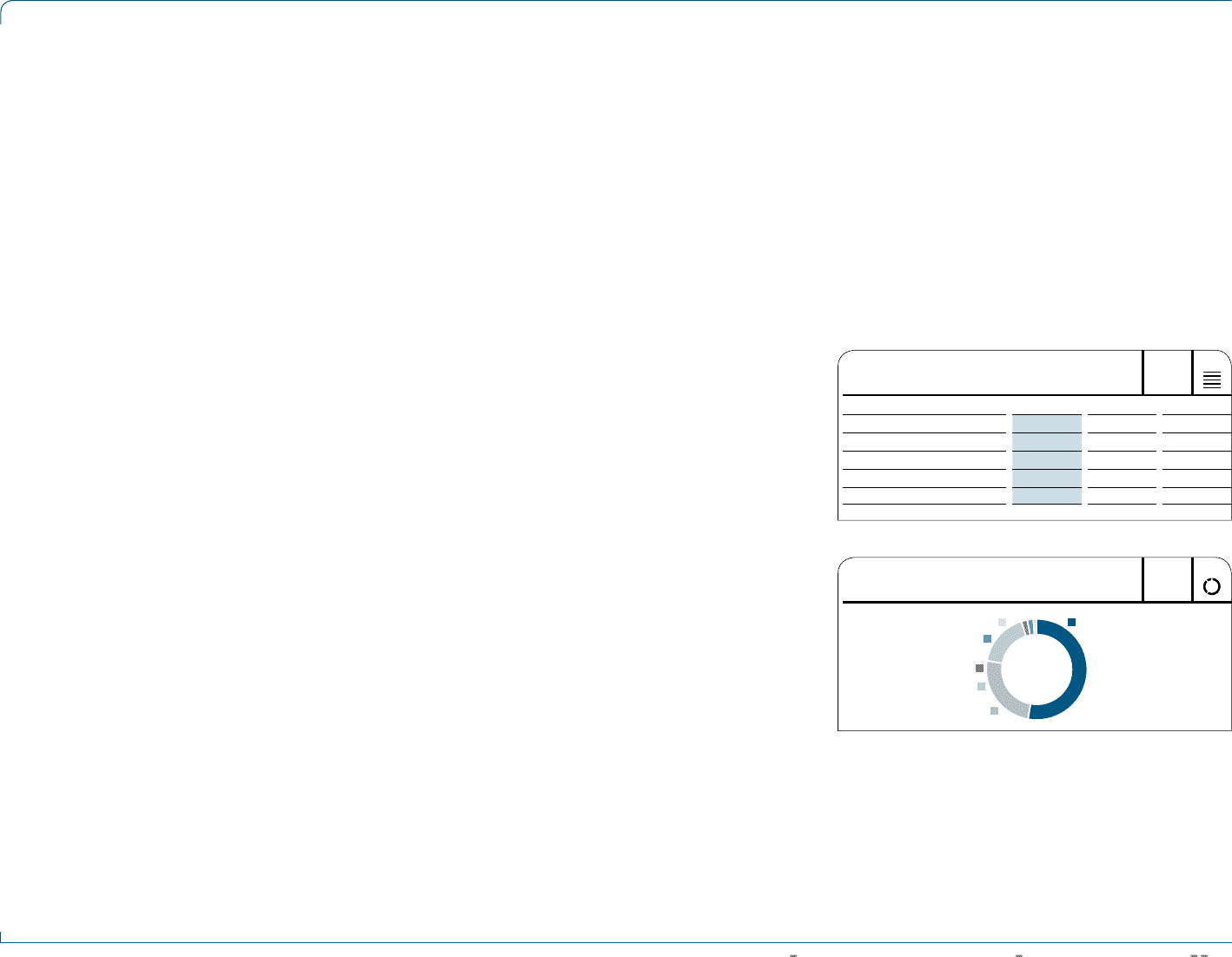

OTHER BUSINESSES NET SALES BY REGION

2% Greater China

25% Other Asian Markets

17% Western Europe

2% European

Emerging Markets

53% North America1% Latin America