Reebok 2009 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

200 CONSOLIDATED FINANCIAL STATEMENTS Notes

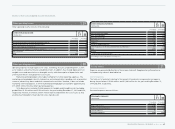

A total net fair value of negative € 57 million (2008: € 111 million) for forward contracts related

to hedging instruments falling under hedge accounting as per definition of IAS 39 was recorded

in hedging reserve. The remaining net fair value of € 5 million (2008: € 9 million) mainly related

to liquidity swaps for cash management purposes and forward contracts hedging intercompany

dividend receivables was recorded in the income statement. The total fair value of € 10 million

(2008: € 16 million) for outstanding currency options related to cash flow hedges.

The fair value adjustments of outstanding cash flow hedges for forecasted sales will be

reported in the income statement when the forecasted sales transactions are recorded. The

vast majority of these transactions are forecasted to occur in 2010. As at December 31, 2009,

inventories were adjusted by € 4 million which will be recognised in the income statement in 2010.

In hedging reserve, an amount of negative € 3 million (2008: negative € 3 million) is

included for hedges of net investments in foreign entities. This reserve will remain until the

investment in the foreign entity is divested.

In order to determine the fair values of its derivatives that are not publicly traded, the

adidas Group uses generally accepted quantitative financial models based on market conditions

prevailing at the balance sheet date.

The fair values of the derivatives were determined applying the “zero method”. The “zero

method” is a theoretical model for the determination of forward rates based on deposit and swap

interest rates. An alternative method is the “par method” which uses actively traded forward

rates. A comparison of the fair valuation based on the alternative methods revealed no substantive

differences.

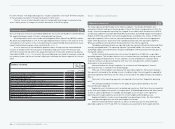

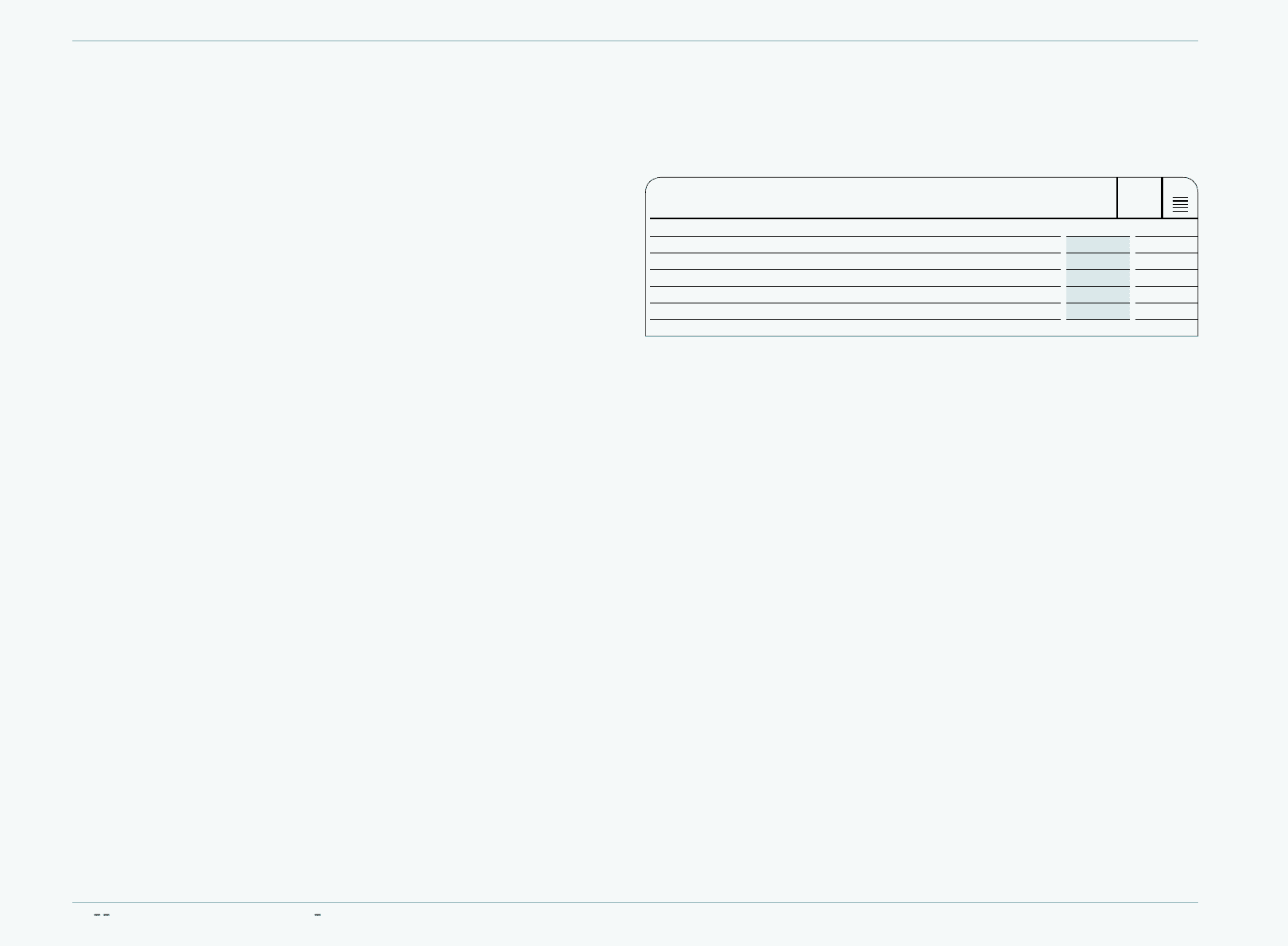

Financial instruments for the hedging of interest rate riskFinancial instruments for the hedging of interest rate risk

Interest rate hedges which were outstanding as at December 31, 2009 and 2008, respectively

expire as detailed below:

N

°-

28

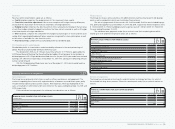

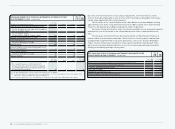

EXPIRATION DATES OF INTEREST RATE HEDGES

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008

Within 1 year 139 23

Between 1 and 3 years 150 184

Between 3 and 5 years — 105

After 5 years 81 83

Total 370 395

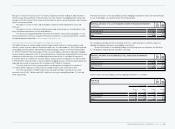

The above summary for 2009 includes interest rate and cross-currency interest rate swaps in

the amount of € 79 million (2008: € 105 million) which are classified as fair value hedges pursu-

ant to IAS 39. The aim of one cross-currency interest rate swap which was classified as a fair

value hedge at December 31, 2009 was to turn the financing into euro while retaining the financ-

ing method. The aim of the US dollar interest rate swap which was classified as a fair value

hedge was to obtain variable financing for a private placement in US dollar. The total positive

fair value of € 4 million (2008: € 7 million) was offset by a total negative fair value change in the

hedged private placements in the amount of € 4 million (2008: € 7 million).

The above summary further includes interest rate swaps in the nominal amount of

€ 279 million (2008: € 279 million), which are classified as cash flow hedges pursuant to IAS 39.

The goal of these hedges is to protect future cash flows arising from private placements with

variable interest rates by generating synthetic fixed interest rate financing. These interest rate

swaps classified as cash flow hedges had a positive fair value in the amount of € 0 million (2008:

€ 1 million) and a negative fair value of € 10 million (2008: negative € 6 million). The negative

fair value change of € 2 million (2008: negative € 5 million) for interest rate swaps which were

classified as cash flow hedges was booked in hedging reserves. A nominal amount of € 129 mil-

lion for interest rate swaps classified as cash flow hedges relates to private placements which

mature in 2010. The remaining interest rate swaps classified as cash flow hedges in a nominal

amount of € 45 million and € 105 million secure variable interest payments arising from private

placements with maturities in 2011 and 2012, respectively.