Reebok 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

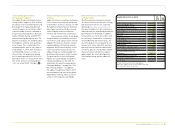

42 TO OUR SHAREHOLDERS Our Share

Our ShareOur Share

In 2009, the adidas AG share as well as international stock markets recovered significantly from prior year declines. Negative

impacts of recessionary pressures, low consumer confidence and rising unemployment at the beginning of the year were more

than offset by major economic indicators signalling an accelerating economic recovery over the course of the year. Supported

by rising confidence in our Group’s medium-term prospects, the adidas AG share increased 39% in 2009. It thereby significantly

outperformed the DAX-30, which gained 24% over the same period. As a result of the decline in the Group’s net income

attributable to shareholders in 2009, we intend to propose a lower dividend per share at our 2010 Annual General Meeting

compared to the prior year.

N

°-

01

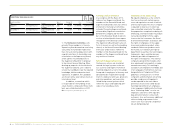

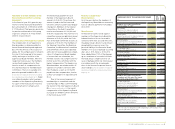

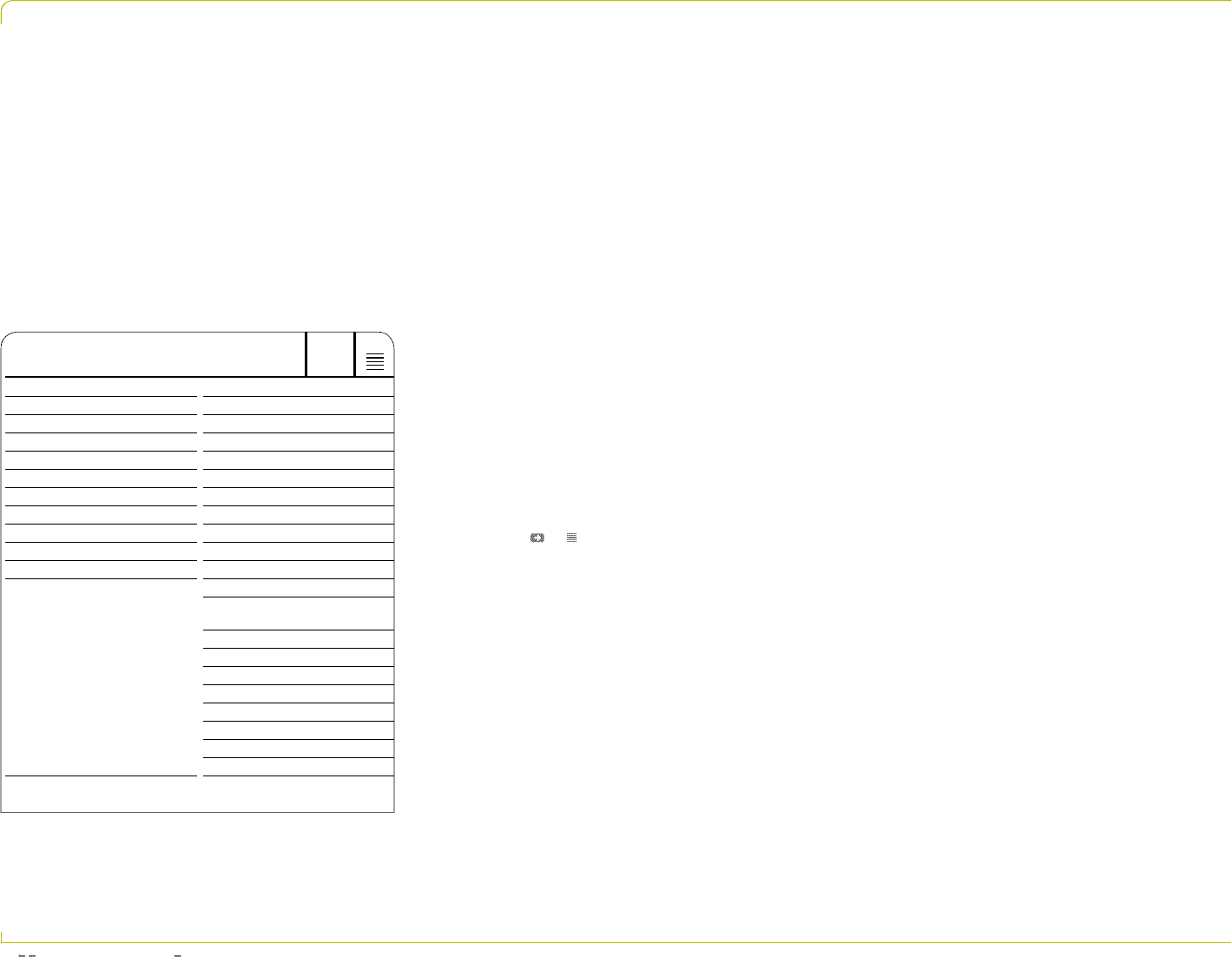

THE ADIDAS AG SHARE

Number of shares outstanding

2009 average 196,220,166

At year-end 2009 1 ) 209,216,186

Type of share No-par-value share

Free float 100%

Initial Public Offering November 17, 1995

Share split June 6, 2006 (in a ratio of 1: 4)

Stock exchange All German stock exchanges

Stock registration number (ISIN) DE0005003404

Stock symbol ADS, ADSG.DE

Important indices DAX-30

MSCI World Textiles,

Apparel & Luxury Goods

Deutsche Börse Prime Consumer

Dow Jones STOXX

Dow Jones EURO STOXX

Dow Jones Sustainability

FTSE4Good Europe

Ethibel Index Excellence Europe

ASPI Eurozone Index

ECPI Ethical Index EMU

1) All shares carry full dividend rights.

International stock markets perform International stock markets perform

strongly after weak prior yearstrongly after weak prior year

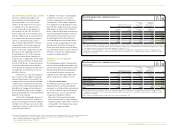

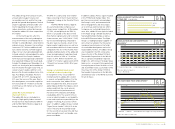

In 2009, international stock markets, the

DAX-30 and the adidas AG share recov-

ered considerably from the significant

declines in the prior year. The adidas

AG share price increased 39% over the

course of the year, clearly outperform-

ing the DAX-30, but underperforming the

MSCI World Textiles, Apparel & Luxury

Goods Index, which gained 24% and

53%, respectively see 05. The strong

performance of the latter was mainly

attributable to the high share of luxury

goods companies in the index, which on

average outperformed companies in the

sporting goods sector. At the beginning

of the year, equity markets declined to

12-year lows as a result of continued

weak economic data points, record

low consumer confidence, rising unem-

ployment rates and depressed corporate

earnings prospects. During the second

quarter, markets started to recover,

spurred by further monetary and fiscal

stimuli by policymakers. Better than

expected results of the US bank stress

test as well as rising oil and commod-

ity prices also added to positive investor

sentiment.

In the third quarter, international stock

markets sustained the positive momen-

tum and gained substantially. This was

mainly attributable to major economic

indicators signalling that the economic

and financial crisis had passed its trough,

further solidifying market participants’

expectations of an approaching recovery.

Better than expected corporate results

and positive news flow during the Q2

earnings season added to the trend. In

the fourth quarter, increases in global

indices moderated. Deteriorating sover-

eign debt ratings and mixed economic

data points led to volatile international

stock markets as question marks were

raised about the pace and magnitude of

the economic recovery.

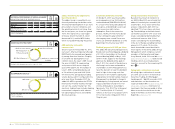

adidas AG share price recovers adidas AG share price recovers

significantlysignificantly

In line with equity market performance,

the adidas AG share price declined at

the beginning of the year, continuing the

downward trend from 2008.

While the announcement of cost-saving

initiatives and better than expected 2008

annual results positively impacted our

share price, weak retail sales data and

the lack of catalysts for a quick eco-

nomic recovery burdened our share

price performance throughout the first

quarter. In line with market sentiment

improvements at the beginning of the

second quarter, the adidas AG share

recovered the losses of the previous

quarter. However, the announcement

of our first quarter results on May 5

negatively impacted our share price on

the day and immediately following the

announcement. From mid-May onwards,

however, the adidas AG share started

to increase again due to several broker

upgrades and in line with general market

trends. During the third quarter, positive

momentum continued.