Reebok 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120 GROUP MANAGEMENT REPORT – FINANCIAL REVIEW GROUP BUSINESS PERFORMANCE Income Statement

N

°-

28

N

°-

29

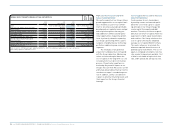

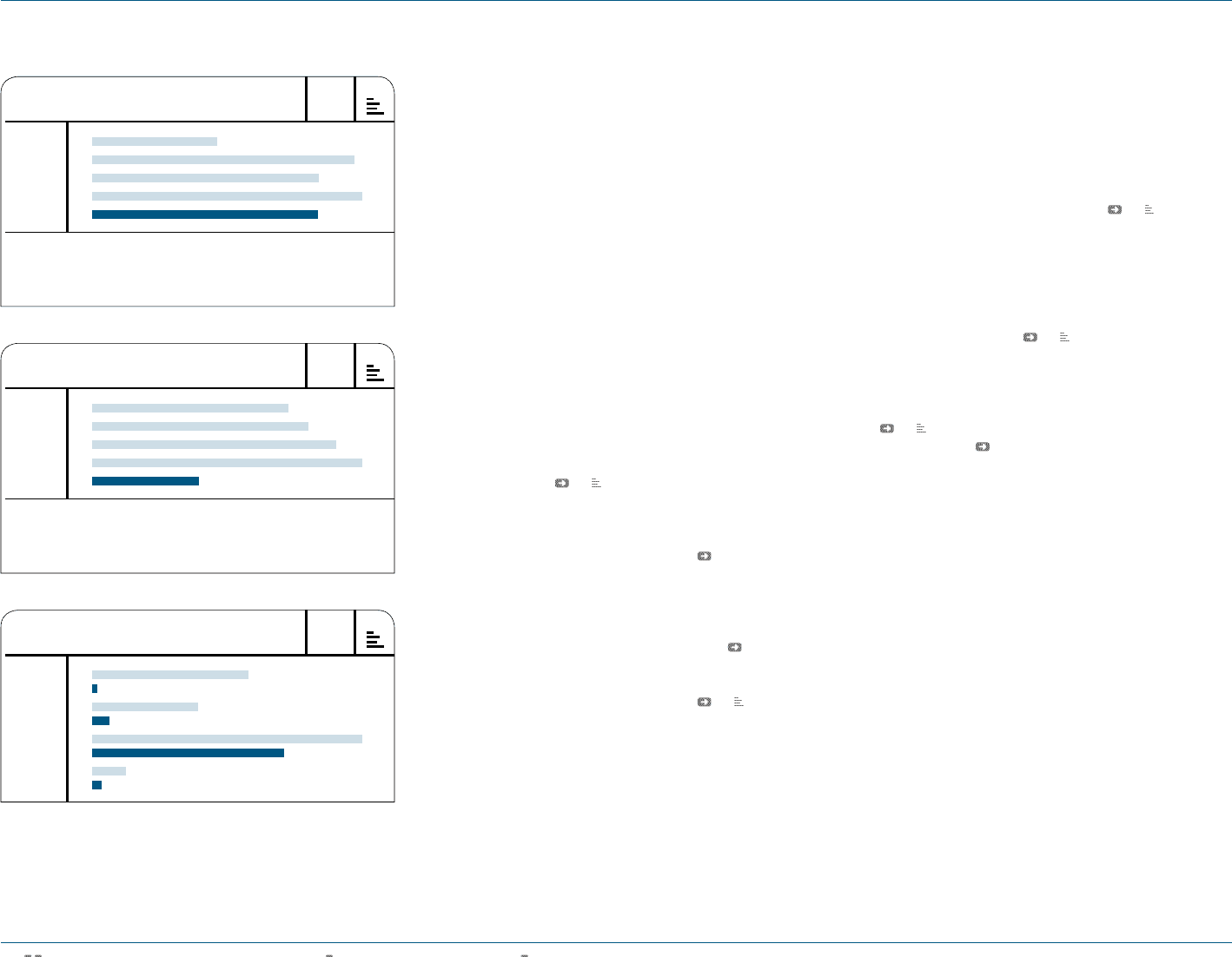

FINANCIAL EXPENSES

€ IN MILLIONS

INCOME BEFORE TAXES

€ IN MILLIONS

2005 1 )

2006 2 )

2007

2008

2009

2005 1 )

2006 2 )

2007

2008

2009

94

197

170

203

169

655

723

815

904

358

1) Reflects continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok, Rockport and Reebok-CCM Hockey from February 1, 2006

onwards.

1) Reflects continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok, Rockport and Reebok-CCM Hockey from February 1, 2006

onwards.

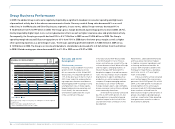

N

°-

30

INCOME BEFORE TAXES BY QUARTER

€ IN MILLIONS

Q1 2008

Q1 2009

Q2 2008

Q2 2009

Q3 2008

Q3 2009

Q4 2008

Q4 2009

250

9

169

28

431

306

54

16

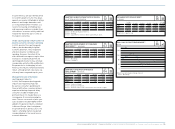

Number of Group employees

increases 2%

At the end of December 2009, the Group

employed 39,596 people. This represents

an increase of 2% versus the prior year

level of 38,982. New hirings related to

the expansion of the Group’s own-

retail store base were the main driver

of this develop ment. These more than

offset declines due to reorganisation

initiatives and a hiring freeze the Group

implemented for all non-retail-related

functions. On a full-time equivalent basis,

the number of employees decreased

4% to 34,437 at the end of 2009 (2008:

35,977).

EBITDA declines 39%

The Group’s earnings before interest,

taxes, depreciation and amortisation of

tangible and intangible assets (EBITDA)

decreased 39% to € 780 million in 2009

(2008: € 1.280 billion) see 24. Depre-

ciation and amortisation expense for tan-

gible and intangible assets with limited

useful lives grew 28% to € 299 million in

2009 (2008: € 234 million). This develop-

ment was mainly a result of increased

fixed assets related to our own-retail

expansion and impairment losses related

to Reebok’s distribution rights in China.

In accordance with IFRS, intangible

assets with indefinite useful lives (good-

will and trademarks) are tested annually

and additionally when there are indica-

tions of potential impairment. No impair-

ment of intangible assets with unlimited

useful lives was incurred in 2009 and

2008.

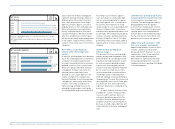

Operating margin declines

5.0 percentage points

The operating margin of the adidas Group

decreased 5.0 percentage points to 4.9%

in 2009 (2008: 9.9%). The operating

margin decline was due to the decrease

in Group gross margin as well as higher

other operating expenses as a percent-

age of sales. As a result, Group operating

profit decreased 53% to € 508 million

versus € 1.070 billion in 2008 see 26.

Financial income down 49%

Financial income decreased 49% to

€ 19 million in 2009 from € 37 million

in the prior year, mainly due to changes

in the fair value of financial instruments

see Note 32, p. 202.

Financial expenses decrease 17%

Financial expenses decreased 17% to

€ 169 million in 2009 (2008: € 203 mil-

lion) see Note 32, p. 202. Negative

exchange rate variances were more than

compensated by lower interest expenses

see 28.

Income before taxes decreases 60%

Income before taxes (IBT) as a percent-

age of sales decreased 4.9 percentage

points to 3.5% in 2009 from 8.4% in 2008.

This was a result of the Group’s operat-

ing margin decrease. IBT for the adidas

Group declined 60% to € 358 million from

€ 904 million in 2008 see 29.

Net income attributable to

shareholders declines 62%

The Group’s net income attributable

to shareholders decreased 62% to

€ 245 million in 2009 from € 642 million

in 2008 see 31. The Group’s lower

operating profit was the primary reason

for this development. The Group’s tax

rate increased 2.7 percentage points to

31.5% in 2009 (2008: 28.8%), mainly due

to the write-down of deferred tax assets

see Note 33, p. 202.