Reebok 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

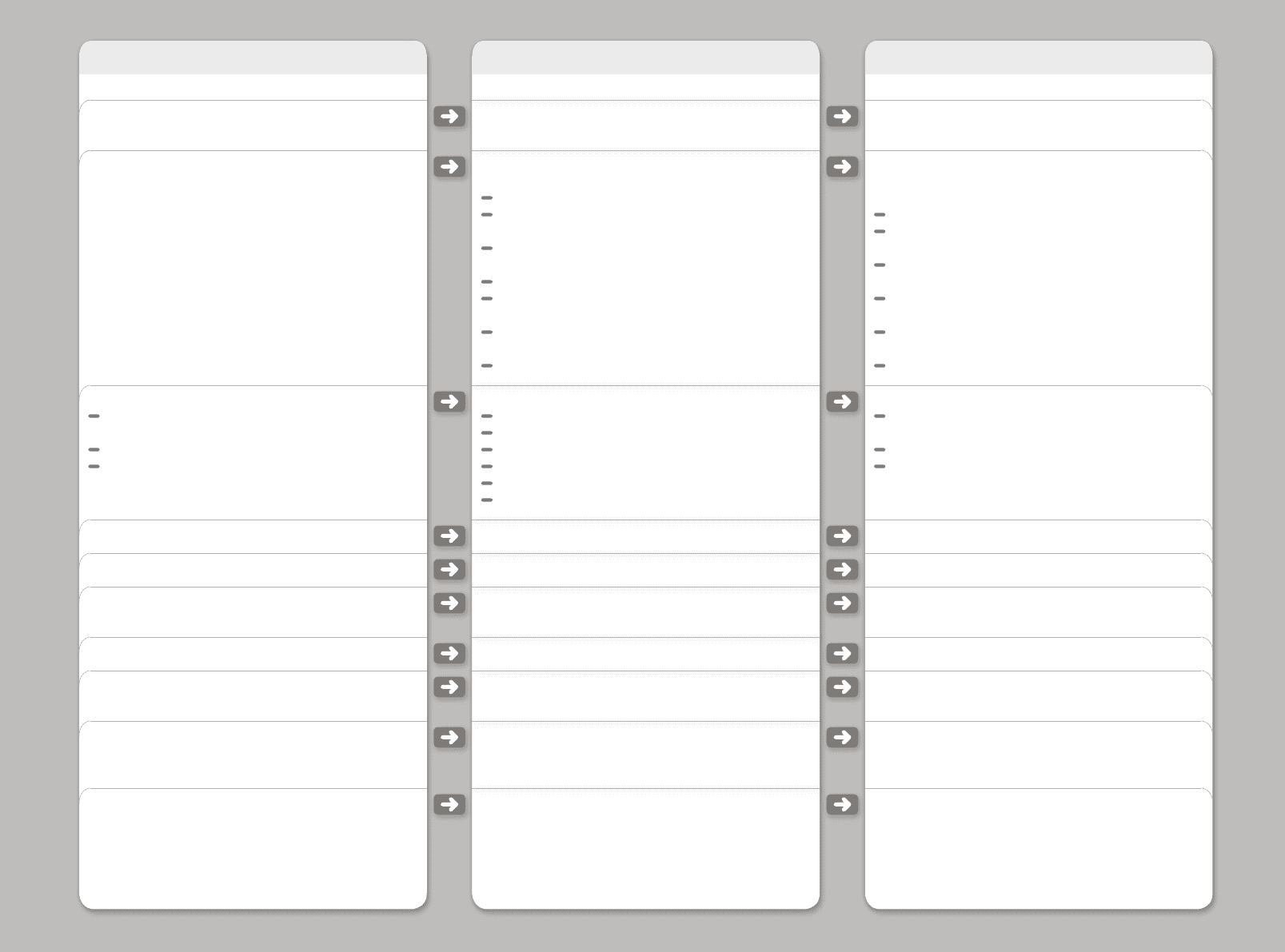

TARGETS 2009

Low- to mid-single-digit currency-neutral sales decline

Bring major new concepts, technology evolutions and

revolutions to market

On a currency-neutral basis:

low- to mid-single-digit sales decline for adidas

segment

at least stable sales for Reebok segment

low-single-digit sales increase at TaylorMade-adidas

Golf

Gross margin decline (2008: 48.7%)

Operating margin decline (2008: 9.9%)

Reduce operating working capital as a percentage of

sales (2008: 24.5%)

Capital expenditure range € 300 million – € 400 million

Reduce net borrowings (2008: € 2.189 billion)

Net income attributable to shareholders and diluted

earnings per share decline (2008: € 642 million and

€ 3.07, respectively)

Further increase shareholder value

RESULTS 2009

Net sales reach € 10.4 billion;

Group currency-neutral sales decrease 6%

Major 2009 product launches:

adidas:

adiSTAR® Salvation running shoe

F50i football boot

Reebok:

EasyTone™ shoe

TaylorMade-adidas Golf:

R9™ metalwood, Burner® family of irons

Penta TP ball

Rockport:

DresSport® 2

Reebok-CCM Hockey:

U+™ Crazy Light Stick

On a currency-neutral basis:

Wholesale segment sales decline 9%

Retail segment sales increase 7%

Total adidas brand sales decline 5%

Total Reebok brand sales decline 8%

Sales of Other Businesses decline 4%

TaylorMade-adidas Golf revenues decline 2%

Gross margin: 45.4%

Operating margin: 4.9%

Operating working capital as a percentage of sales

improves to 24.3%

Capital expenditure: € 240 million

Net borrowings reduced substantially to € 917 million;

year-end financial leverage: 24.3%

Net income attributable to shareholders declines 62%

to € 245 million;

diluted earnings per share decline 60% to € 1.22

adidas AG share price increases 39%;

dividend of € 0.35 per share (subject to

Annual General Meeting approval)

OUTLOOK 2010

Low- to mid-single-digit currency-neutral sales increase

Bring major new concepts, technology evolutions and

revolutions to market, such as:

adidas:

F50 football boot

miCoach training system

Reebok:

ZigTech™ training shoe

TaylorMade-adidas Golf:

R9™ SuperTri Driver

Rockport:

TruWALK footwear collection

Reebok-CCM Hockey:

11K skates

On a currency-neutral basis, sales to increase:

at a low- to mid-single-digit rate for Wholesale

segment

at a high-single-digit rate for Retail segment

at a low-single-digit rate for Other Businesses

Increase gross margin to a level between 46% and 47%

Increase operating margin to a level around 6.5%

Further reduction of operating working capital as a

percentage of sales

Capital expenditure range € 300 million – € 400 million

Further reduction of net borrowings;

net borrowings/EBITDA ratio to be maintained below 2

Diluted earnings per share to increase to a level

between € 1.90 and € 2.15

Further increase shareholder value