Reebok 2009 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134 GROUP MANAGEMENT REPORT – FINANCIAL REVIEW BUSINESS PERFORMANCE BY SEGMENT Retail Business Performance

Retail Business Performance

The Retail segment comprises the own-retail activities of the adidas and Reebok brands. In 2009, currency-neutral Retail sales

increased 7%. In euro terms, Retail sales grew 10% to € 1.906 billion (2008: € 1.738 billion). Currency-neutral comparable

store sales declined 6% versus the prior year. Gross margin decreased 2.9 percentage points to 58.6% (2008: 61.5%). This was

mainly a result of effects from the devaluation of the Russian rouble and higher input costs. However, gross profit increased 4%

to € 1.116 billion in 2009 from € 1.069 billion in 2008. As a result of the decline in gross margin and higher operating costs as

a percentage of sales, segmental operating margin decreased 4.8 percentage points to 14.0% (2008: 18.8%). In absolute terms,

segmental operating profit declined 18% to € 267 million in 2009 versus € 326 million in 2008.

Currency-neutral segmental sales

increase 7%

In 2009, Retail revenues increased 7% on

a currency-neutral basis. Concept store,

factory outlet and other retail format

sales were all up versus the prior year.

Currency translation effects positively

impacted segment revenues in euro

terms. Sales grew 10% to € 1.906 bil-

lion from € 1.738 billion in the prior

year. Currency-neutral comparable store

sales, however, decreased 6% versus

the prior year, with declines in all store

formats.

Own-retail store base increases

At December 31, 2009, the adidas Group

Retail segment operated 2,212 stores.

This represents a net increase of 328 or

17% versus the prior year-end level of

1,884. Over the course of the year, the

Group opened 416 new stores. 88 stores

were closed. Two stores were remodelled

over the course of the year.

The number of concept stores increased

by 184 to 1,203 at the end of 2009 (2008:

1,019). The number of factory outlets

grew by 74 to 755 at the end of the

year (2008: 681). Concession corners

increased by 71 to 244 (2008: 173). Other

formats, which include e-commerce,

declined by 1 to 10 (2008: 11). Of the total

number of stores, 1,626 were adidas and

586 Reebok branded (2008: 1,311 adidas,

573 Reebok).

Currency-neutral Retail sales increase

in nearly all regions

Currency-neutral Retail sales increased

in all regions except European Emerging

Markets and North America. Retail

revenues in Western Europe increased

8% on a currency-neutral basis due to

increases in most major markets except

France. Sales in European Emerging

Markets declined 1% on a currency-

neutral basis.

Store expansion and price increases

almost offset the negative impact from

the devaluation of the Russian rouble

against the functional currency, the

US dollar. Currency-neutral Retail sales

in North America remained stable as

declines in the USA were offset by sales

increases in Canada. Retail revenues

in Greater China increased 57% on a

currency-neutral basis primarily as a

result of the opening of factory outlets to

support the clearance of excess inven-

tories in this market. Sales in Other Asian

Markets grew 11% on a currency-neutral

basis primarily as a result of increases

in Japan. In Latin America, currency-

neutral Retail sales grew 51%, mainly

driven by new store openings.

N

°-

01

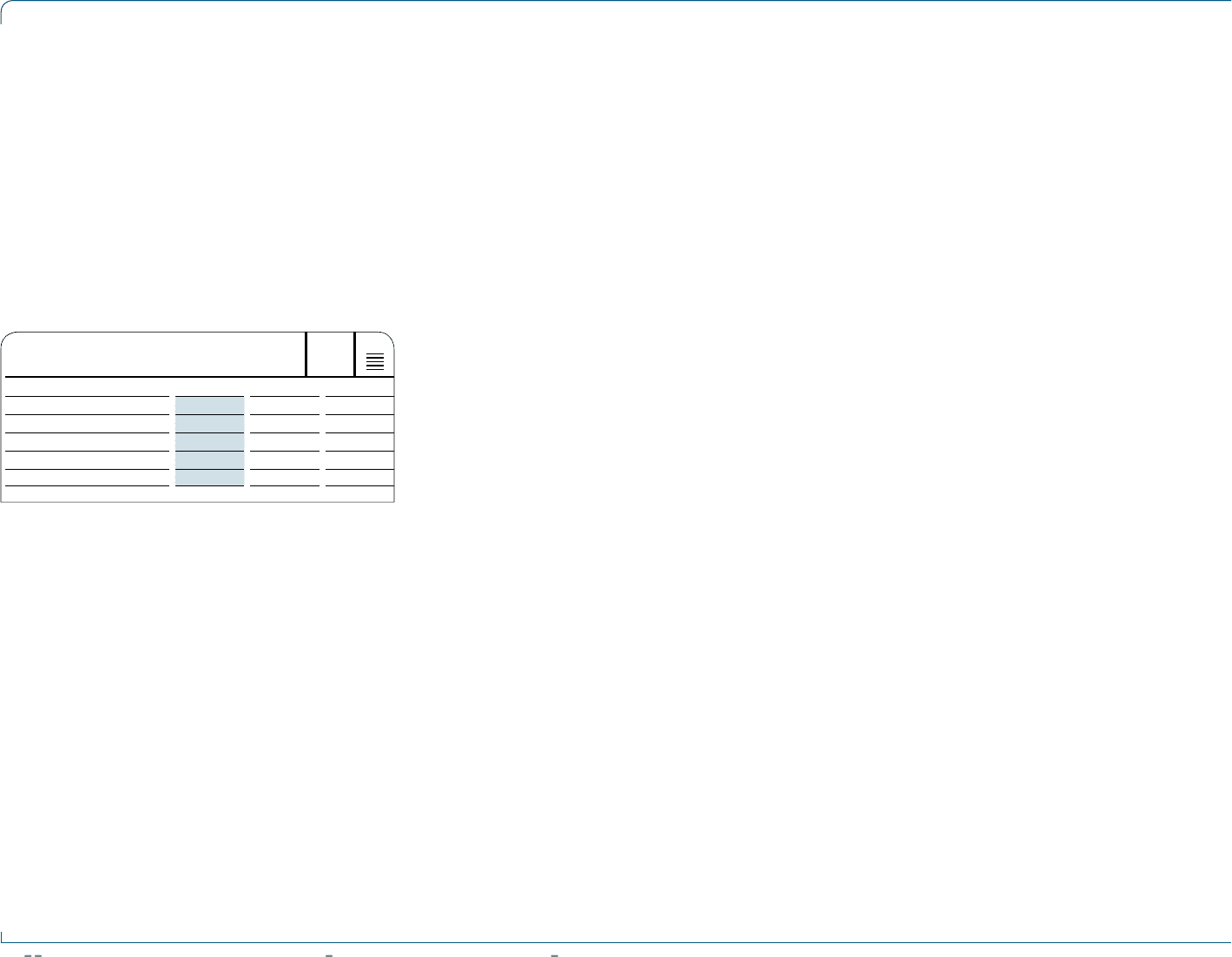

RETAIL AT A GLANCE

€ IN MILLIONS

2009 2008 Change

Net sales 1,906 1,738 10%

Gross profit 1,116 1,069 4%

Gross margin 58.6% 61.5% (2.9pp)

Segmental operating profit 267 326 (18%)

Segmental operating margin 14.0% 18.8% (4.8pp)