Reebok 2009 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

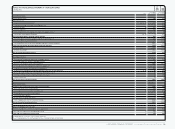

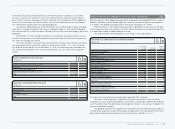

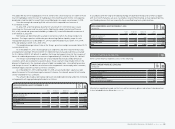

CONSOLIDATED FINANCIAL STATEMENTS Notes 177

Furthermore, the previous Reebok warehouse in the UK has been classified as an asset held-

for-sale as a result of the intention to sell in 2010 and the existence of purchase offers (Decem-

ber 31, 2009: € 2 million; December 31, 2008: € 2 million). In the first quarter of 2009, additional

assets of € 2 million were classified as held-for-sale. In 2009, impairment losses in the amount

of € 2 million were recognised in other operating expenses.

The previous adidas warehouse in the UK has been reclassified to property, plant and equip-

ment due to a change in conditions. For the years ending December 31, 2009 and 2008, deprecia-

tion in the amount of € 0 million has been reflected for the asset reclassified to property, plant and

equipment.

At December 31, 2008, a Rockport warehouse in the USA was classified as held-for-sale as

a result of the intention to sell and the existence of a purchase offer (€ 4 million). The warehouse

was sold in the third quarter of 2009.

Due to the intention to sell and several existing letters of intent, Gekko Brands, LLC, which

was acquired within the scope of the acquisition of Ashworth, Inc. see Note 4, was classified

as a disposal group held-for-sale. At December 31, 2008, this disposal group contained assets

of € 10 million less liabilities of € 6 million. Gekko Brands, LLC, was sold in the first quarter

of 2009.

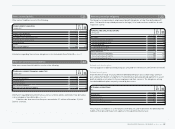

N

°-

03

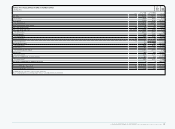

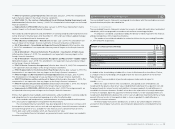

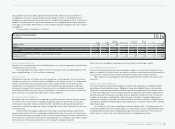

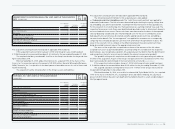

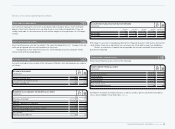

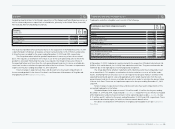

ASSETS CLASSIFIED AS HELD-FOR-SALE

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008

Accounts receivable and other current assets 18 14

Inventories — 4

Property, plant and equipment, net 108 10

Trademarks and other intangible assets, net — 3

Total 126 31

N

°-

03

LIABILITIES CLASSIFIED AS HELD-FOR-SALE

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008

Accounts payable — 2

Provisions — 1

Deferred tax liabilities — 3

Total — 6

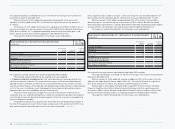

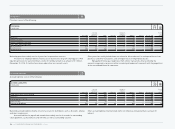

Acquisition/Disposal of subsidiaries as well as assets and liabilities 04

Effective January 1, 2009, adidas International B.V. acquired the outstanding 25% of the shares of

Reebok’s subsidiary in Spain, Reebok Spain S.A., Alicante, for a purchase price in the amount of

€ 12 million. The goodwill resulting from this transaction amounted to € 1 million.

Effective January 1, 2009, adidas International B.V. acquired 51% of the shares of Life Sport

Ltd. for a purchase price in the amount of ILS 25.6 million. Based in Holon (Israel), Life Sport Ltd.

is a marketing company for adidas products in Israel.

The acquisition had the following effect on the Group’s assets and liabilities:

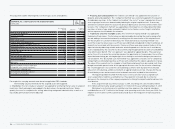

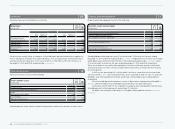

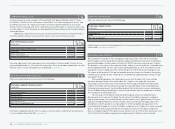

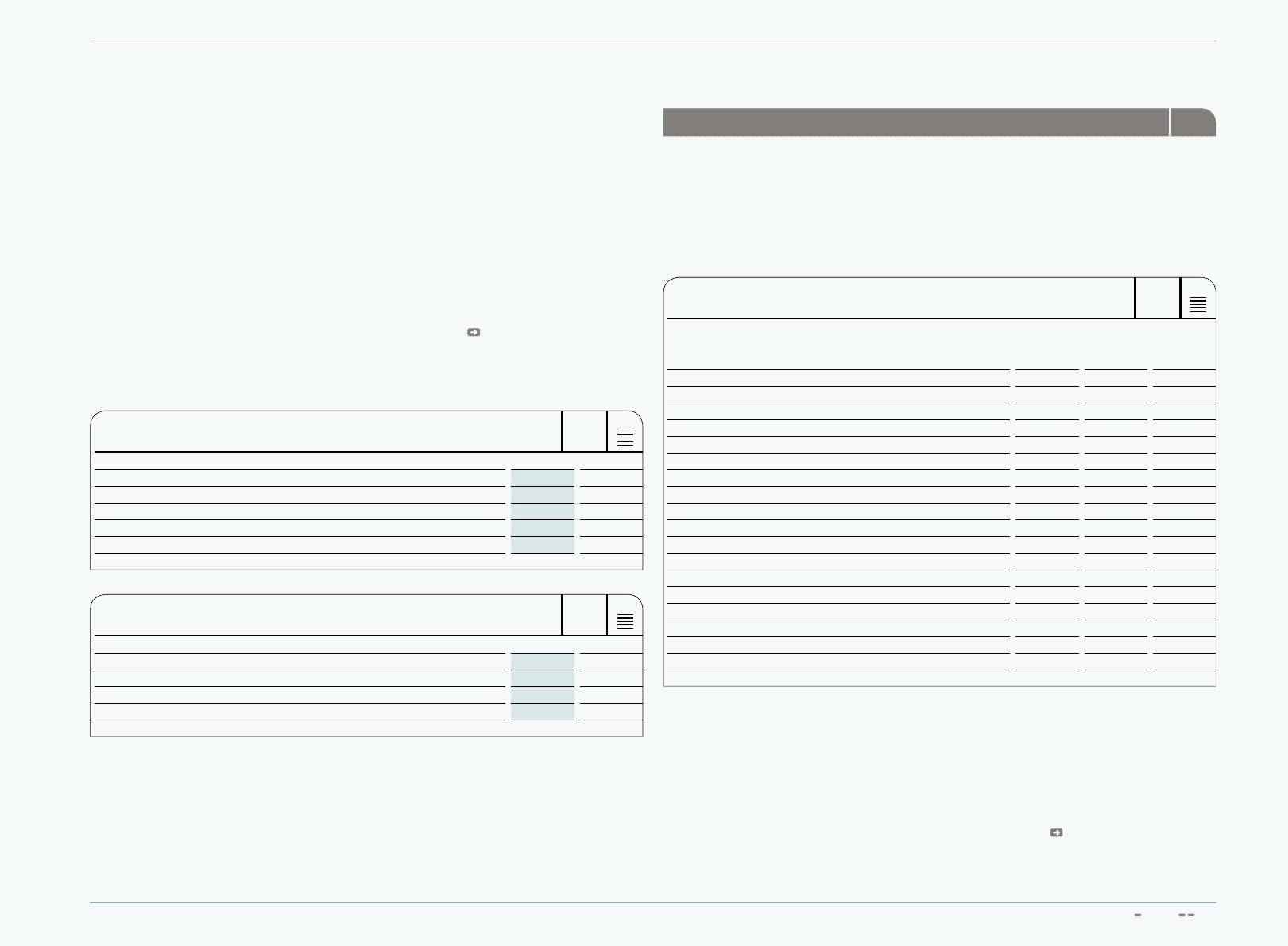

N

°-

04

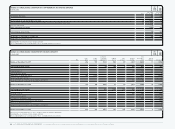

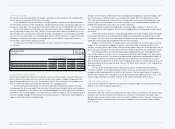

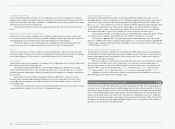

LIFE SPORT LTD.’S NET ASSETS AT THE ACQUISITION DATE

€ IN MILLIONS

Pre-acquisition

carrying

amounts Fair value

adjustments

Recognised

values on

acquisition

Cash and cash equivalents 0 — 0

Accounts receivable 5 — 5

Inventories 7 — 7

Other current assets 2 — 2

Property, plants and equipment, net 6 — 6

Other intangible assets 0 1 1

Non-current financial assets 0 — 0

Deferred tax assets 0 — 0

Current financial liabilities (9) — (9)

Accounts payable (7) — (7)

Other current liabilities (3) — (3)

Non-current financial liabilities (1) — (1)

Pensions and similar obligations (0) — (0)

Net assets 0 1 1

Goodwill arising on acquisition 4

Purchase price settled in cash 5

Cash and cash equivalents acquired 0

Cash outflow on acquisition 5

Pre-acquisition carrying amounts were based on applicable IFRS standards.

The excess of the acquisition cost paid versus the net of the amounts of the fair values

assigned to all assets acquired and liabilities assumed was recognised as goodwill. Any acquired

asset that did not meet the identification and recognition criteria for an asset was included in the

amount recognised as goodwill.

The goodwill arising on this acquisition was allocated to the cash-generating unit adidas at

the time of the acquisition. As part of the Group’s reorganisation in the second half of 2009, it has

been reallocated and is denominated in the local functional currency see also Note 2.