Reebok 2009 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234

|

|

CONSOLIDATED FINANCIAL STATEMENTS Notes 207

Additional cash flow information 36

In 2009, the line item “Acquisition of subsidiaries and other business units net of cash acquired”

in the consolidated statement of cash flows includes the acquisition of Life Sport Ltd. and Bones

in Motion, Inc. see Note 4.

In 2008, this line item includes the acquisition of Saxon Athletic Manufacturing, Inc., Reebok

Productos Esportivos Brasil Ltda. (formerly Comercial Vulcabras Ltda.), Textronics, Inc. and

Ashworth, Inc. see Note 4.

Current revolving financial transactions are offset within financing activities.

Commitments and contingencies 37

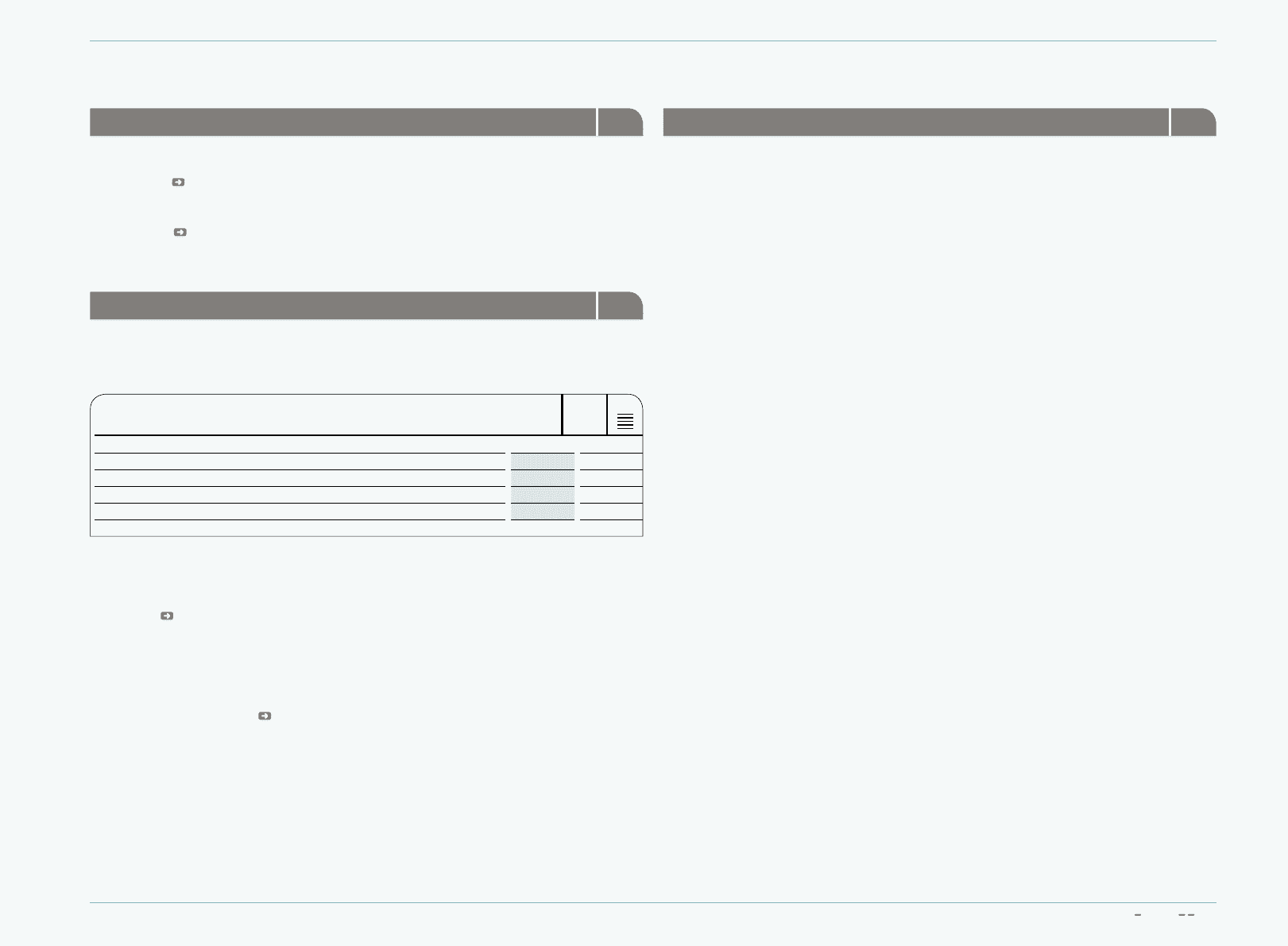

Other financial commitments Other financial commitments

The Group has other financial commitments for promotion and advertising contracts, which

mature as follows:

N

°-

37

FINANCIAL COMMITMENTS FOR PROMOTION AND ADVERTISING

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008

Within 1 year 554 386

Between 1 and 5 years 1,403 1,082

After 5 years 594 611

Total 2,551 2,079

Commitments with respect to advertising and promotion maturing after five years have remaining

terms of up to 13 years from December 31, 2009.

Information regarding commitments under lease and service contracts is also included in

these Notes see Note 27.

LitigationLitigation

The Group is currently engaged in various lawsuits resulting from the normal course of business,

mainly in connection with license and distribution agreements as well as competition issues. The

risks regarding these lawsuits are covered by provisions when a reliable estimate of the amount

of the obligation can be made see Note 19. In the opinion of Management, the ultimate liabilities

resulting from such claims will not materially affect the consolidated financial position of the

Group.

Equity compensation benefits 38

Management Share Option Plan (MSOP) of adidas AG Management Share Option Plan (MSOP) of adidas AG

Under the Management Share Option Plan (MSOP) adopted by the shareholders of adidas AG on

May 20, 1999, and amended by resolution of the Annual General Meeting on May 8, 2002, and on

May 13, 2004, the Executive Board was authorised to issue non-transferable stock options for up

to 1,373,350 no-par-value bearer shares to members of the Executive Board of adidas AG as well

as to managing directors/senior vice presidents of its related companies and to other executives

of adidas AG and its related companies until August 27, 2004. The granting of stock options took

place in tranches not exceeding 25% of the total volume for each fiscal year.

A two-year vesting period and a term of approximately seven years upon their respective

issue applies for the stock options.