Reebok 2009 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

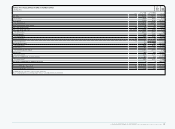

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW Subsequent Events and Outlook 159

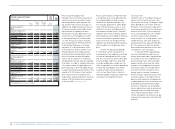

adidas Group sales development

expected to differ regionally

We expect Group currency-neutral

revenue development to differ regionally

in 2010. In Western Europe, we expect

a positive stimulus for Group revenues

from sales related to the 2010 FIFA World

Cup™. However, we believe macroeco-

nomic pressures on consumer spending

will continue to have an adverse effect on

Group sales development in this region.

In European Emerging Markets, the sta-

bilisation of the Russian rouble compared

to 2009, as well as gradual improvements

in underlying consumption trends in sev-

eral of the region’s markets are expected

to have a positive impact on Group sales

development. In North America, we

expect to benefit from our strong market

position in the emerging toning category.

However, ongoing high price sensitivity

among consumers as well as cautious

retailer buying habits are projected to

continue to weigh on Group sales growth

in this region. In Greater China, further

initiatives to manage inventory levels at

retail are expected to result in declin-

ing sales versus the prior year in the

first half of 2010. In the second half

year, Group revenues in this region are

forecasted to increase again. In Other

Asian Markets, overall macroeconomic

challenges in the Japanese market will

burden Group sales development while

the region’s emerging markets are

expected to perform robustly. Lastly, in

Latin America, the strong positioning of

our brands as well as positive impetus

from sales associated with the 2010 FIFA

World Cup™ are projected to result in

revenue growth for the Group in 2010.

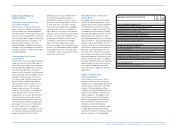

Group gross margin to improve in 2010

In 2010, the adidas Group gross margin

is forecasted to increase to a level

between 46% and 47% (2009: 45.4%).

Improvements are expected in all

segments. Group gross margin will

benefit from lower levels of clearance

sales compared to the prior year. This will

be a result of a lower inventory position

at the beginning of 2010 compared to

the prior year. In addition, sourcing costs

are expected to decline compared to the

prior year as a result of reduced material

costs and lower capacity utilisation

among suppliers. However, these positive

effects are expected to be partly offset

by several negative impacts: Ongoing

price pressures from a highly competitive

retail environment, in particular in more

mature markets, are forecasted to have a

negative impact on Group gross margin.

In addition, hedging terms in 2010 will

be less favourable compared to the

prior year. Finally, the recent increase

of import duties in Latin America is

projected to negatively affect Group gross

margin.

N

°-

01

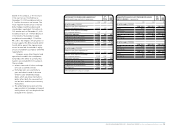

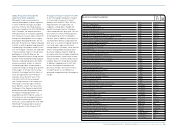

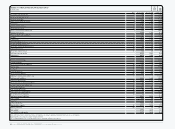

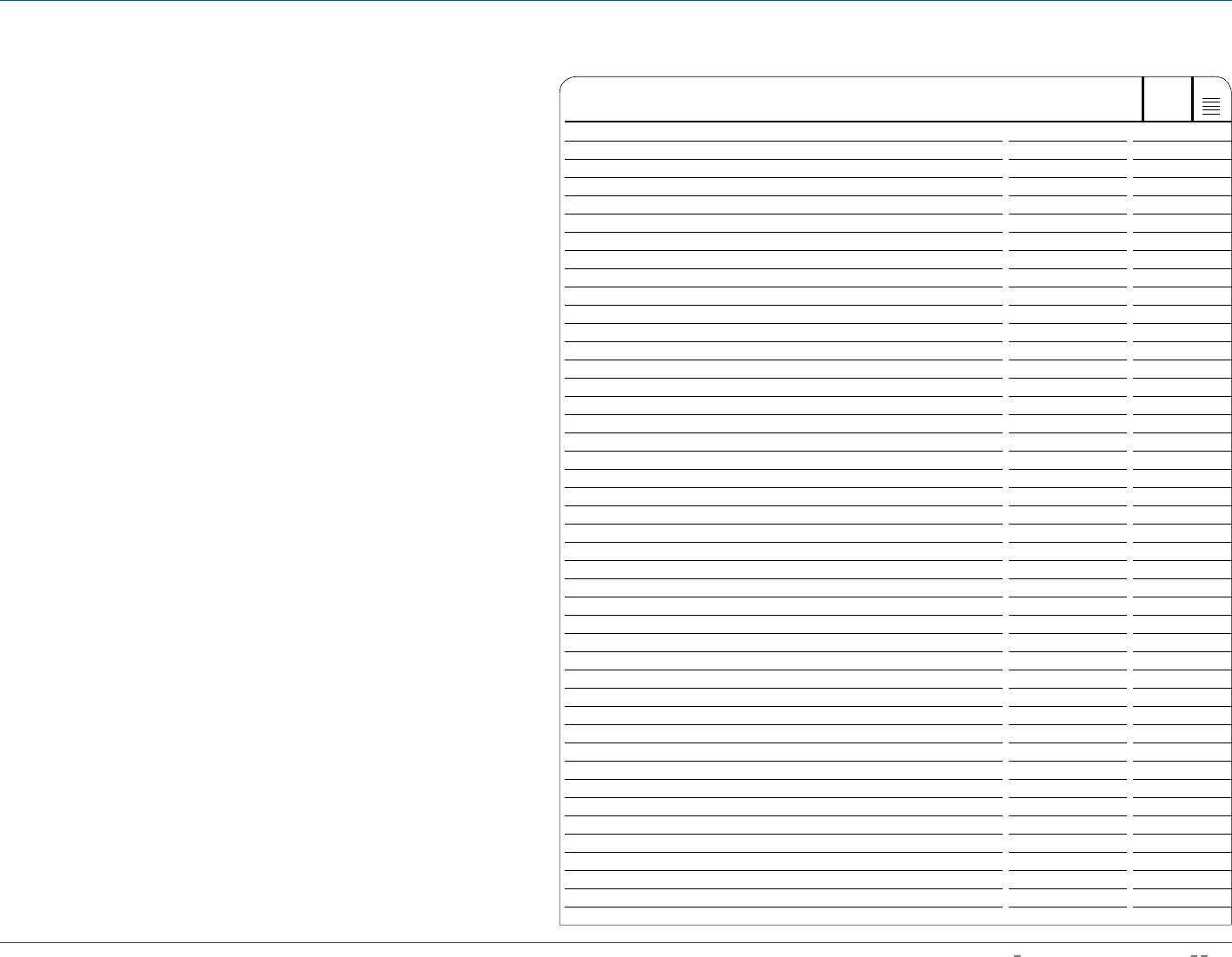

MAJOR 2010 PRODUCT LAUNCHES

Product Brand Launch Month

adiPURE™ football boot adidas January

STAR WARS™ Originals line adidas January

Supernova™ GLIDE running shoe adidas January

miCoach training system adidas January

adiSTAR® Salvation running shoe adidas January

adidas by Stella McCartney performance cycling collection adidas January

TECHFIT™ PowerWEB™ men’s training apparel adidas February

UEFA Champions League Finale ball and footwear package adidas March

TERREX outdoor apparel and footwear adidas March

SUPER TREKKING outdoor footwear adidas March

2010 FIFA World Cup™ package adidas March

F50 football boot adidas June

Supernova™ Sequence and Supernova™ Riot running shoes adidas June

Men’s and women’s Fluid training shoes adidas June

High Performance BOUNCE™ running shoe adidas August

adidas Basketball Team Signature collection adidas November

Training Day collection men’s training apparel Reebok January

Cirque du Soleil collection Reebok February

RunTone™ men’s footwear Reebok March

U-Form 4-Speed football cleat Reebok May

ZigEnergy and ZigFuel men’s footwear Reebok June

TrainTone™ women’s footwear Reebok June

Reebok | Emporio Armani footwear Reebok June

JUKARI Fit to Flex™ women’s footwear Reebok July

JumpTone™ men’s footwear Reebok July

Reebok | EA7 collection Reebok August

ZigSlash and ZigReenergize basketball footwear Reebok October

Burner® SuperFast driver and fairway woods TaylorMade January

Burner® W (women’s) golf ball TaylorMade February

R9™ SuperTri driver TaylorMade February

Rossa® Monza® Spider Vicino putter TaylorMade March

Burner® SuperLaunch irons TaylorMade April

Men’s FORMOTION™ apparel adidas Golf January

Men’s/women’s CLIMACOOL® apparel with soft-touch COOLMAX™ adidas Golf January

Men’s adiPURE™ apparel adidas Golf February

Women’s adiPURE™ apparel adidas Golf May

Men’s/women’s EZ-Tech Performance Ashworth September

Men’s/women’s Doeskin Outerwear Ashworth September

TruWALK men's and women’s footwear Rockport August

Reebok 11K skates Reebok Hockey January

CCM U+™ OCTOLIGHT stick CCM Hockey April

CCM U+™ PRO Protective CCM Hockey April