Reebok 2009 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

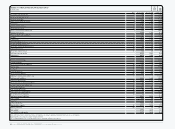

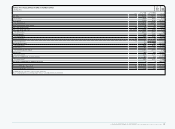

160 GROUP MANAGEMENT REPORT – FINANCIAL REVIEW Subsequent Events and Outlook

Group operating expenses to decrease

as a percentage of sales

In 2010, the Group’s operating expenses

as a percentage of sales are expected to

decrease modestly (2009: 42.3%). Sales

and marketing working budget expenses

as a percentage of sales are expected to

increase modestly versus the prior year

to support adidas presence at the 2010

FIFA World Cup™ as well as to sustain

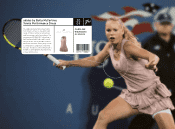

Reebok’s growth strategy in muscle

toning and conditioning. However, this

increase will be more than offset by

lower operating overhead expenditures

as a percentage of sales. This will be

largely due to the continued hiring freeze

in non-retail-related functions and vari-

ous efficiency improvement measures

introduced in 2009, such as the imple-

mentation of joint operating models for

the adidas and Reebok brands and the

elimination of regional headquarters.

These efficiency gains will outweigh

higher administrative and personnel

expenses in the Retail segment as a

result of the build-up of management

expertise and the planned expansion of

the Group’s store base.

We expect the number of employees

within the adidas Group to increase

versus the prior year level. Ongoing

initiatives to streamline our organisation

are forecasted to be more than offset by

new hirings related to own-retail expan-

sion. The majority of new hirings will

be employed on a part-time basis and

located in emerging markets.

The adidas Group will continue to spend

around 1% of sales on research and

development in 2010. Areas of particular

focus include training, running, football,

basketball and outdoor at adidas, and

women’s fitness and men’s training at

Reebok see Research and Development,

p. 92. The number of employees working

in research and development through-

out the Group will remain virtually

unchanged in 2010.

Operating margin to show improvement

In 2010, we expect the operating margin

for the adidas Group to be around 6.5%

(2009: 4.9%). Gross margin improvements

as well as lower operating expenses as

a percentage of sales are expected to

contribute to the improvement compared

to the prior year.

Earnings per share to increase to a

level between € 1.90 and € 2.15

Earnings per share are expected to

increase strongly to a level between

€ 1.90 and € 2.15 (2009 diluted earnings

per share: € 1.22). Top-line improve-

ment and an increased operating margin

will be the primary drivers of this posi-

tive development. In addition, we expect

lower interest rate expenses as a result

of a lower average level of net borrowings

in 2010 compared to the prior year. The

Group tax rate is expected to be slightly

below the prior year level (2009: 31.5%)

as a result of the non-recurrence of prior

year charges related to the write down of

deferred tax assets.

Operating working capital as a

percentage of sales to improve

Improving operating working capital

management continues to be a priority

in our efforts to optimise cash flow from

operations. In 2010, our goal is to reduce

average operating working capital as

a percentage of sales (2009: 24.3%).

Optimisation of order volumes based on

expected sales development and rigor-

ous monitoring of inventory ageing are

at the forefront of our activities. We will

also focus on tightly managing accounts

receivable and payment terms with our

suppliers.

Investment level to be between

€ 300 million and € 400 million

In 2010, investments in tangible and

intangible assets are expected to amount

to € 300 million to € 400 million (2009:

€ 240 million). Investments will focus

on adidas and Reebok controlled space

initiatives, in particular in emerging

markets. These investments will account

for almost 50% of total investments in

2010. Other areas of investment include

the further development of the adidas

Group Headquarters in Herzogenaurach,

Germany, and the increased deployment

of SAP and other IT systems in major

subsidiaries within the Group. The most

important factors in determining the

exact level and timing of investments will

be the rate at which we are able to suc-

cessfully secure own-retail opportunities.

All investments within the adidas Group

in 2010 are expected to be fully financed

through cash generated from operations.

N

°-

02

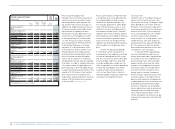

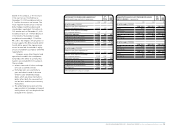

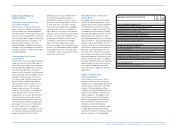

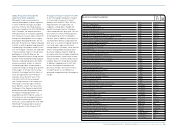

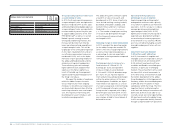

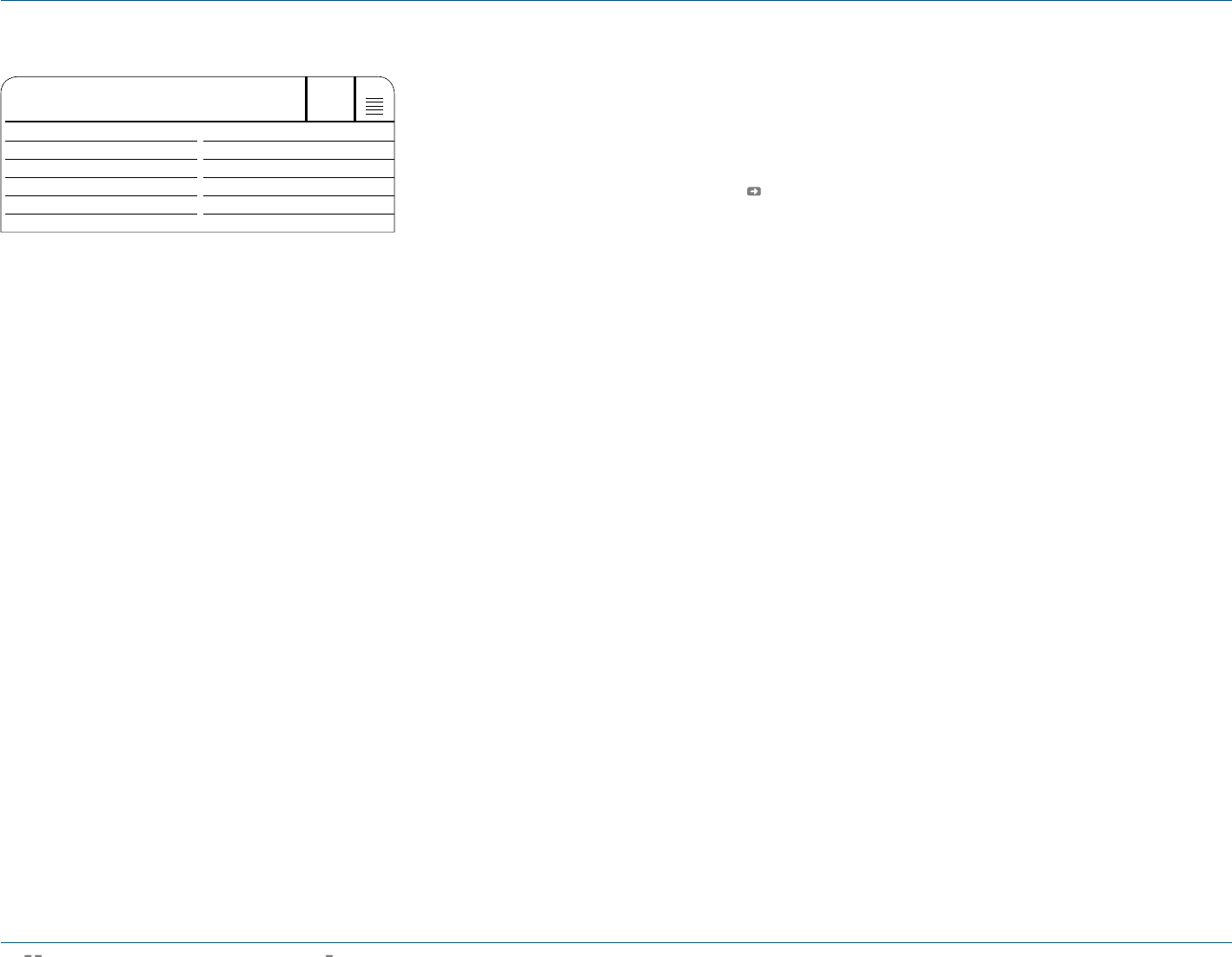

ADIDAS GROUP 2010 OUTLOOK

Currency-neutral sales low- to mid-single-digit increase

Gross margin 46% to 47%

Operating margin around 6.5%

Earnings per share € 1.90 to € 2.15