Reebok 2009 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132 GROUP MANAGEMENT REPORT – FINANCIAL REVIEW BUSINESS PERFORMANCE BY SEGMENT Wholesale Business Performance

Wholesale Business Performance

The Wholesale segment comprises the adidas and Reebok business activities with retailers. In 2009, currency-neutral sales in

the Wholesale segment decreased 9%. In euro terms, Wholesale sales declined 8% to € 7.174 billion from € 7.758 billion in the

prior year. Gross margin decreased 2.1 percentage points to 41.6% (2008: 43.7%). This was mainly a result of higher input costs

and a highly promotional retail environment. Gross profit decreased 12% to € 2.981 billion in 2009 from € 3.387 billion in 2008.

Segmental operating costs as a percentage of sales decreased 0.1 percentage points to 8.9% (2008: 9.0%). As a result of the

gross margin decline, which could not be offset by lower operating costs as a percentage of sales, segmental operating margin

decreased 2.0 percentage points to 32.7% in 2009 versus 34.7% in the prior year. In absolute terms, segmental operating profit

declined 13% to € 2.346 billion in 2009 versus € 2.692 billion in 2008.

Currency-neutral segmental

sales decline 9%

In 2009, revenues for the Wholesale seg-

ment declined 9% on a currency-neutral

basis. adidas Sport Performance and

Reebok sales declined compared to the

prior year while revenues at adidas Sport

Style increased. Currency translation

effects positively impacted segment rev-

enues in euro terms. Sales in the Whole-

sale segment declined 8% to € 7.174 bil-

lion in 2009 from € 7.758 billion in 2008.

Currency-neutral Wholesale sales

decline in nearly all regions

Currency-neutral sales for the Wholesale

segment decreased in all regions except

Latin America in 2009. Currency-neutral

revenues in Western Europe declined 8%

due to decreases in most major markets.

Revenues in European Emerging Markets

decreased 13% on a currency-neutral

basis, primarily due to lower sales in

Russia as a result of the devaluation of

the Russian rouble against its func-

tional currency, the US dollar, which

could not be offset by price increases.

Currency- neutral Wholesale sales in

North America declined 16% due to

declines in both the USA and Canada.

Revenues in Greater China decreased

20% on a currency- neutral basis. Sales

in Other Asian Markets declined 5% on a

currency- neutral basis due to declines in

Japan which more than offset increases

in other markets. In Latin America,

currency-neutral sales grew 16%, sup-

ported by double-digit increases in all

major markets and the effects resulting

from consolidation of new companies in

the region in the prior year.

Currency translation effects had a mixed

impact on regional sales in euro terms.

Sales in Western Europe declined 10% in

2009 to € 2.643 billion (2008: € 2.936 bil-

lion). In European Emerging Markets,

sales decreased 13% to € 475 million

from € 543 million in 2008. Revenues

in North America declined 11% to

€ 1.295 billion in 2009 versus € 1.461 bil-

lion in the prior year. In Greater China,

revenues decreased 14% to € 855 mil-

lion in 2009 (2008: € 999 million). Sales

in Other Asian Markets increased 1% to

€ 1.041 billion in 2009 from € 1.029 bil-

lion in 2008, while revenues in Latin

America improved 10% to € 865 million in

2009 (2008: € 790 million).

N

°-

01

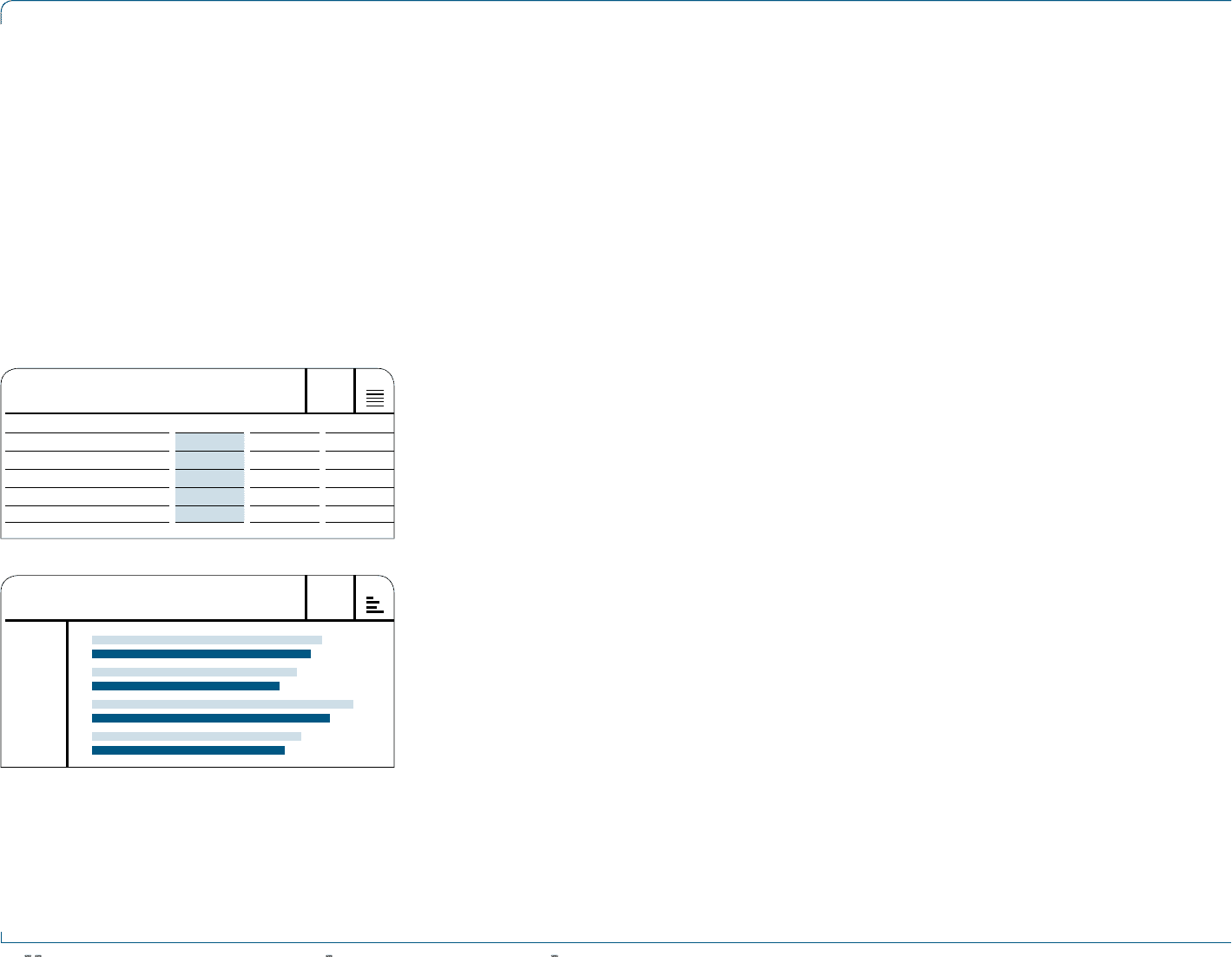

WHOLESALE AT A GLANCE

€ IN MILLIONS

2009 2008 Change

Net sales 7,174 7,758 (8%)

Gross profit 2,981 3,387 (12%)

Gross margin 41.6% 43.7% (2.1pp)

Segmental operating profit 2,346 2,692 (13%)

Segmental operating margin 32.7% 34.7% (2.0pp)

N

°-

02

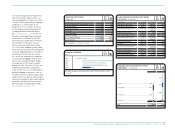

WHOLESALE NET SALES BY QUARTER

€ IN MILLIONS

Q1 2008

Q1 2009

Q2 2008

Q2 2009

Q3 2008

Q3 2009

Q4 2008

Q4 2009

1,968

1,876

1,755

1,608

2,241

2,040

1,794

1,650