Reebok 2009 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

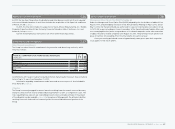

202 CONSOLIDATED FINANCIAL STATEMENTS Notes

Personnel expenses which are directly attributable to the production costs of goods are included

within the cost of sales.

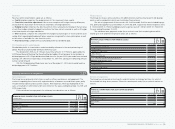

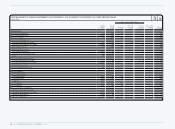

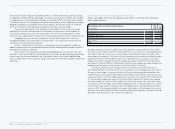

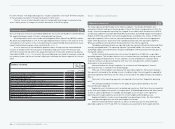

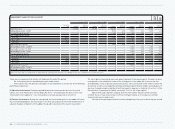

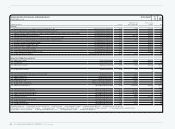

Financial income/financial expenses 32

Financial result consists of the following:

N

°-

32

FINANCIAL INCOME

€ IN MILLIONS

Year ending

Dec. 31, 2009 Year ending

Dec. 31, 2008

Interest income from financial instruments measured at amortised cost 11 30

Interest income from financial instruments at fair value through profit or loss 5 7

Interest income from non-financial assets — —

Net foreign exchange gains — —

Fair value gains from available-for-sale investments — —

Other 3 0

Financial income 19 37

N

°-

32

FINANCIAL EXPENSES

€ IN MILLIONS

Year ending

Dec. 31, 2009 Year ending

Dec. 31, 2008

Interest expense on financial instruments measured at amortised cost 138 178

Interest expense on financial instruments at fair value through profit or loss — —

Interest expense on provisions and non-financial liabilities — —

Net foreign exchange losses 25 25

Other 6 —

Financial expenses 169 203

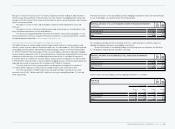

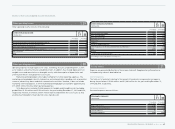

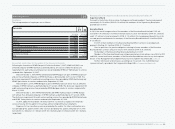

Interest income from financial instruments, measured at amortised cost, mainly consists of inter-

est income from bank deposits and loans.

Interest income/expense from financial instruments at fair value through profit or loss

mainly includes interest payments from investment funds as well as net interest payments from

interest derivatives not being part of a hedging relationship. Unrealised gains/losses from fair

value measurement of such financial assets are shown in other financial income or expenses.

Interest expense on financial instruments measured at amortised cost mainly includes inter-

est on borrowings and effects from using the “effective interest method”.

Interest expense on provisions and non-financial liabilities particularly includes effects from

measurement of provisions at present value and interest on non-financial liabilities such as tax

payables.

Other financial expenses include impairment losses on other financial assets amounting to

€ 5 million for the year ending December 31, 2009.

Also included in other financial expenses are minority interests, which are not recorded in

equity according to IAS 32.

Information regarding the Group’s available-for-sale investments, borrowings and financial

instruments is also included in these Notes see Notes 6, 14, 17 and 28.

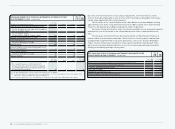

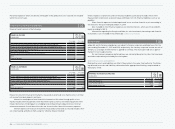

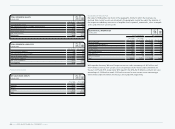

Income taxes 33

adidas AG and its German subsidiaries are subject to German corporate and trade taxes. For the

years ending December 31, 2009 and 2008, respectively, the statutory corporate income tax rate of

15% plus a surcharge of 5.5% thereon is applied to earnings. The municipal trade tax is approxi-

mately 11.6% of taxable income.

For non-German companies, deferred taxes are calculated based on tax rates that have been

enacted or substantively enacted by the closing date.

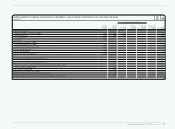

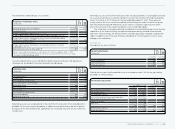

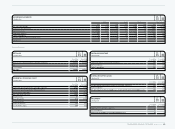

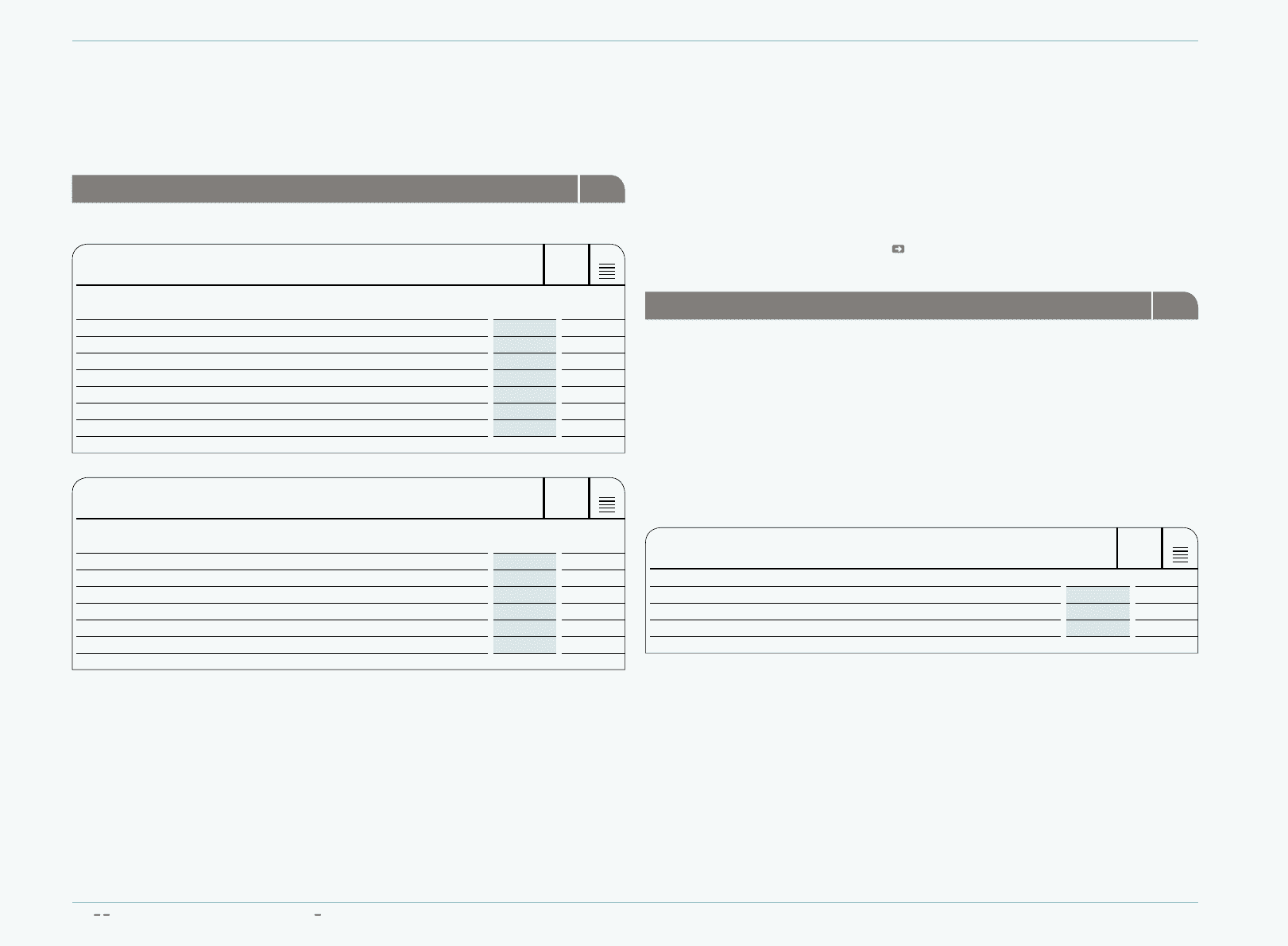

Deferred tax assets and liabilities Deferred tax assets and liabilities

Deferred tax assets and liabilities are offset if they relate to the same fiscal authority. The follow-

ing deferred tax assets and liabilities, determined after appropriate offsetting, are presented on

the balance sheet:

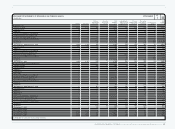

N

°-

33

DEFERRED TAX ASSETS/LIABILITIES

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008

Deferred tax assets 412 344

Deferred tax liabilities (433) (463)

Deferred tax assets, net (21) (119)