Reebok 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TO OUR SHAREHOLDERS Our Share 43

N

°-

02

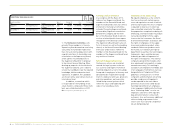

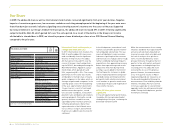

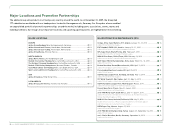

ADIDAS AG MARKET CAPITALISATION

AT YEAR-END € IN MILLIONS

2005

2006

2007

2008

2009

8,122

7,679

10,438

5,252

7,902

N

°-

03

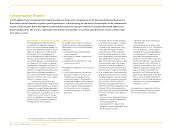

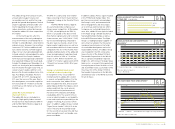

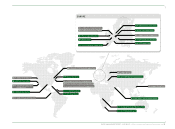

ADIDAS AG HIGH AND LOW SHARE PRICES

PER MONTH 1)

Jan. 2009 Dec. 2009

40

30

20

—

30-day moving average

|

High and low share prices

1) Based on daily closing prices.

Source: Bloomberg.

The adidas Group first half year results,

announced on August 5, were well

received by investors and further sup-

ported the upward development. Several

analysts’ upgrades and favourable com-

ments regarding the Group’s efforts to

reduce inventories and net borrowings

helped the adidas AG share outperform

the market.

In the fourth quarter, after the

announcement of the early redemption

of our € 400 million convertible bond on

October 7, all bondholders converted into

ordinary shares. However, the resulting

issuance of 15.7 million additional ordi-

nary shares had only a limited negative

impact on our share price development.

Instead, analysts acknowledged the early

achievement of the Group’s medium-

term financial leverage target and better

than expected third quarter results pub-

lished at the beginning of November. As a

result, our share price performed better

than the market through to year-end, as

several analysts expressed their confi-

dence in the Group’s medium-term strat-

egy. Accordingly, the adidas AG share

closed 2009 at € 37.77, having gained

39% over the course of the year. Due to

this development, our market capitalisa-

tion increased to € 7.9 billion at the end

of 2009 versus € 5.3 billion at the end of

2008 see 02.

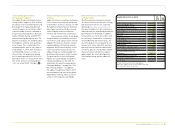

adidas AG share member of adidas AG share member of

important indicesimportant indices

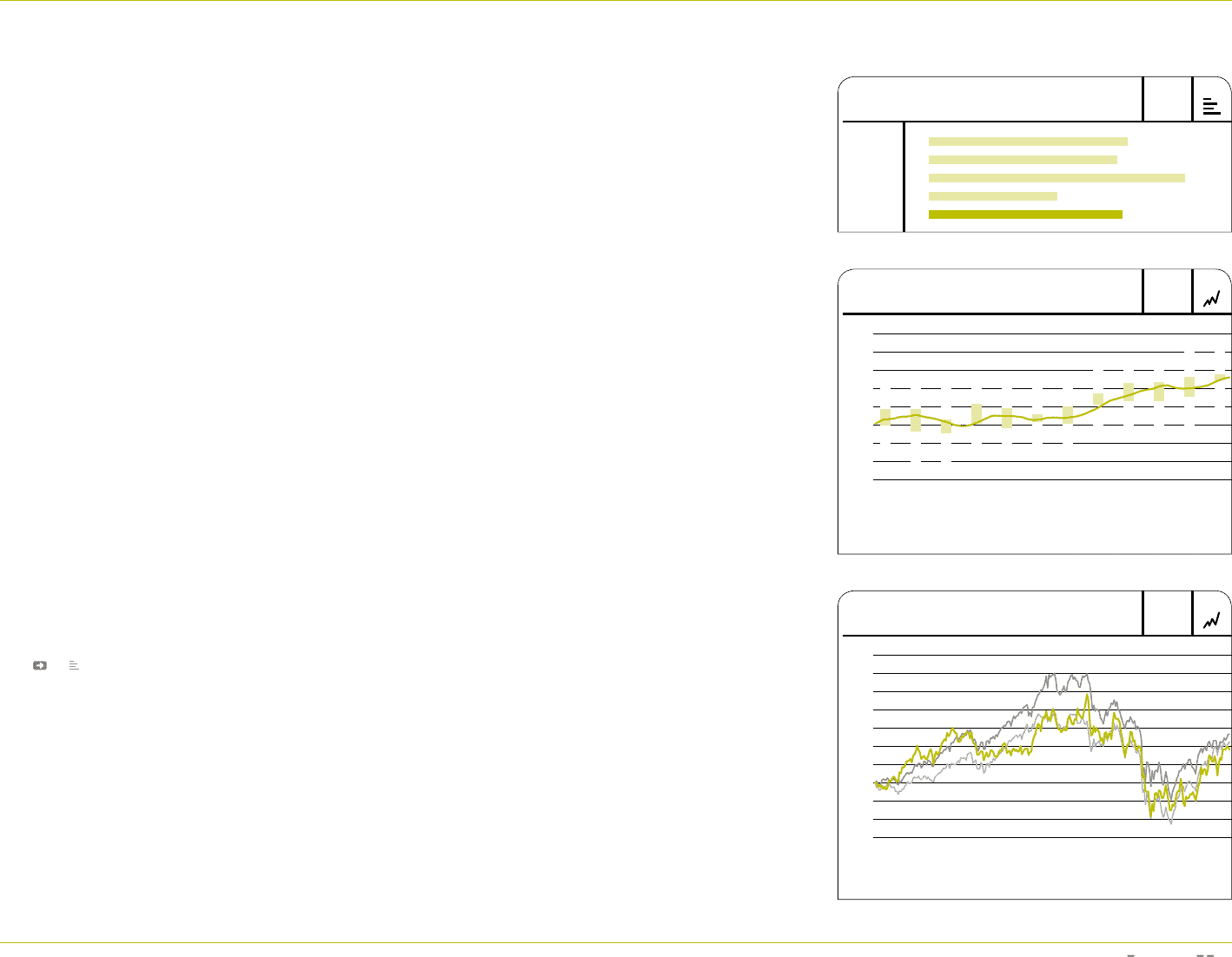

The adidas AG share is included in a

variety of high-quality indices around

the world, most importantly the DAX-30

and the MSCI World Textiles, Apparel &

Luxury Goods Index.

The DAX-30 is a blue chip stock market

index consisting of the 30 major German

companies trading on the Frankfurt Stock

Exchange.

The MSCI World Textiles, Apparel

& Luxury Goods Index comprises our

Group’s major competitors. At December

31, 2009, our weighting in the DAX-30,

which is calculated on the basis of free

float market capitalisation and 12-month

share turnover, was 1.49% (2008: 1.19%).

Our increased weighting compared to

the prior year was mainly a result of our

higher market capitalisation, as well as a

more moderate decline in share turnover

compared to the rest of the market. Aver-

age daily trading volume of the adidas AG

share (excluding bank trades) declined

from 2.0 million in 2008 to 1.4 million

shares in 2009. Within the DAX-30, we

ranked 17 on market capitalisation (2008:

19) and 22 on turnover (2008: 25) at year-

end 2009.

Strong sustainability track record Strong sustainability track record

reflected in index membershipsreflected in index memberships

In recognition of our social and envi-

ronmental efforts, adidas AG is listed

in several sustainability indices. For the

tenth consecutive time, adidas AG has

been included in the Dow Jones Sustain-

ability Indexes (DJSI). The indexes, which

analyse and track the social, environ-

mental and financial performance of

more than 300 companies worldwide,

rated adidas AG for the seventh time in

a row as industry leader in sustainability

issues and corporate responsibility in the

category “Clothing, Accessories & Foot-

wear”. In addition, adidas AG was named

“Super Sector Leader” 2009/2010 in the

sector “Personal & Household Goods”

for the second consecutive time and thus

ranks among the most sustainable com-

panies worldwide.

In addition, adidas AG was again included

in the FTSE4Good Europe Index. This

positive reassessment acknowledges

the Group’s social, environmental and

ethical engagement, and encourages

us to continue and intensify our efforts

to improve our sustainability perform-

ance. Also, adidas AG was again included

in the Vigeo Group’s Ethibel Excellence

Sustainability Index Europe as well as

in the ASPI Eurozone Index. The Vigeo

Group is a leading European supplier of

extra-financial analysis that measures

companies’ performance in the fields

of sustainable development and social

responsibility. Further, the adidas Group

was included for the fifth consecutive

time in the list of The Global 100 Most

Sustainable Corporations in the World.

This is a project initiated by Corporate

Knights Inc. with Innovest Strategic Value

Advisors Inc., a research firm specialised

in analysing extra-financial drivers of risk

and shareholder value. Launched in 2005,

the annual list of The Global 100 Most

Sustainable Corporations in the World is

unveiled each year at the World Economic

Forum in Davos.

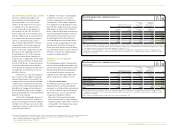

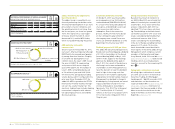

N

°-

04

FIVE-YEAR SHARE PRICE DEVELOPMENT 1 )

Dec. 31, 2004 Dec. 31, 2009

190

160

130

100

70

—

adidas AG

—

DAX-30

—

MSCI World Textiles, Apparel & Luxury Goods Index

1) Index: December 31, 2004 = 100.

29.20

29.19

26.47

30.61

29.50

27.88

30.08

33.63

36.50

36.60

38.13

38.76

24.94

23.01

22.73

25.14

23.99

25.71

25.28

30.42

31.48

31.50

32.64

37.19