Reebok 2009 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

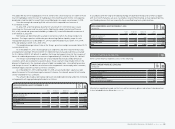

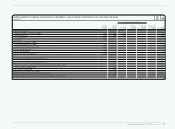

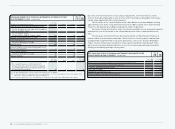

CONSOLIDATED FINANCIAL STATEMENTS Notes 191

Contingent Capital 2006

The nominal capital is conditionally increased by up to € 20,000,000 divided into not more than

20,000,000 shares (Contingent Capital 2006) as at balance sheet date. The contingent capital

increase will be implemented only to the extent that holders of the subscription or conversion

rights or the persons obliged to exercise the subscription or conversion duties based on the bonds

with warrants or convertible bonds, which are issued or guaranteed by the company or an affili-

ated company pursuant to the authorisation of the Executive Board by resolution of the Annual

General Meeting of May 11, 2006, make use of their subscription or conversion rights or, if they are

obliged to exercise the subscription or conversion rights, they meet their obligations to exercise

the warrant or convert the bond. The Executive Board is authorised, subject to Supervisory Board

approval, to fully exclude shareholders’ rights when issuing warrants and/or convertible bonds, if

the bonds with warrants and/or convertible bonds are issued at a price which is not significantly

below the market value of these bonds. The limit for subscription right exclusions of 10% of the

registered nominal capital in accordance with § 186 section 3 sentence 4 in conjunction with § 221

section 4 sentence 2 AktG shall be observed.

The Executive Board of adidas AG did not issue subscription or conversion rights, or shares

from the Contingent Capital 2006 in the financial year 2009 or in the period following the balance

sheet date up to and including February 19, 2010.

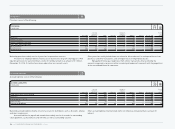

Repurchase of adidas AG sharesRepurchase of adidas AG shares

At the Annual General Meeting on May 7, 2009, the shareholders of the company cancelled the

authorisation to repurchase adidas AG shares granted by the Annual General Meeting on May 8,

2008, which had partly been used in 2008, but not in the year under review. At the same time, the

shareholders granted the Executive Board an authorisation to repurchase adidas AG shares in an

amount totalling up to 10% of the nominal capital until November 6, 2010. The authorisation may

be used by the company and also by its subsidiaries or by third parties appointed by the company

or a subsidiary, on behalf of the company or its subsidiaries. See Disclosures pursuant to § 315 Sec-

tion 4 of the German Commercial Code, p. 129 for further information.

The authorisation was not utilised in the year under review and up to and including February

19, 2010.

Convertible bond Convertible bond

The 2.5% convertible bond with conversion rights into adidas AG shares issued by adidas

International Finance B.V. on October 8, 2003 and absolutely and irrevocably guaranteed by

adidas AG, in the aggregate principal amount of € 400,000,000 and with a term ending on October

8, 2018 was redeemed prematurely on October 8, 2009 being effective November 23, 2009. Up to

and including November 9, 2009, all conversion rights deriving from the outstanding 7,999 bonds

were exercised. Following the completion of the conversion process, 15,684,274 new shares based

on the Contingent Capital 2003/II of the company were issued. The new shares are entitled to

dividends as of the beginning of the financial year 2009.

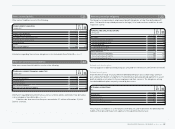

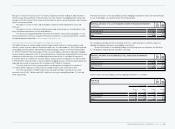

Changes in the percentage of voting rightsChanges in the percentage of voting rights

Pursuant to § 160 section 1 number 8 AktG, existing shareholdings which have been notified

to the company in accordance with § 21 section 1 or section 1a German Securities Trading Act

(Wertpapierhandelsgesetz – WpHG) need to be disclosed.

The Capital Research and Management Company, Los Angeles, USA, informed the company by letter

on January 5, 2009, pursuant to § 21 section 1 sentence 1 WpHG, that on December 19, 2008, their

voting interest in adidas AG exceeded the threshold of 5% and amounted to 5.01% of the voting rights

(9,695,127 shares) on this date. All of these voting rights are attributable to the Capital Research and

Management Company, in accordance with § 22 section 1 sentence 1 number 6 WpHG.

The Euro Pacific Growth Fund, Los Angeles, USA, informed the company by letter on Janu-

ary 19, 2009, pursuant to § 21 section 1 WpHG, that on January 13, 2009, their voting interest in

adidas AG had exceeded the threshold of 3% and amounted to 3.11% of the voting rights (6,021,253

shares) on this date.

The Bank of New York Mellon Corporation, New York, USA, informed the company by letter

on February 3, 2009 in accordance with § 21 section 1 sentence 1 WpHG that on January 14, 2009,

their voting interest in adidas AG exceeded the threshold of 3% and amounted to 3.05% of the vot-

ing rights (5,901,424 shares) on this date. All of these voting rights are attributable to the Bank of

New York Mellon Corporation in accordance with § 22 section 1 sentence 1 number 6 in conjunc-

tion with § 22 section 1 sentence 2 WpHG.

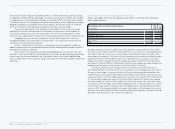

The UBS AG, Zurich, Switzerland, informed the company by letter on March 3, 2009, pursuant

to § 21 section 1 WpHG, that on February 25, 2009, their voting interest in adidas AG had exceeded

the threshold of 3% and amounted to 3.37% of the voting rights (6,525,021 shares) on this date.

0.23% of these voting rights (442,894 shares) are attributable to UBS AG in accordance with § 22

section 1 sentence 1 number 1 WpHG.

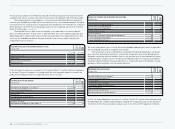

The UBS AG, Zurich, Switzerland, informed the company by letter on March 4, 2009, pursu-

ant to § 21 section 1 WpHG, that on February 26, 2009, their voting interest in adidas AG had fallen

below the threshold of 3% and amounted to 1.04% of the voting rights (2,010,607 shares) on this

date. 0.23% of these voting rights (442,832 shares) are attributable to UBS AG in accordance with

§ 22 section 1 sentence 1 number 1 WpHG.

The Fidelity International, Tadworth, Great Britain, informed the company by letter on March

4, 2009 on behalf of FMR LLC, Boston, USA, pursuant to § 21 section 1 WpHG, that on February

26, 2009, their voting interest in adidas AG had fallen below the threshold of 3% and amounted to

2.95% of the voting rights (5,700,013 shares) on this date. All of these voting rights are attributable

to the FMR LLC in accordance with § 22 section 1 sentence 1 number 6 in conjunction with § 22

section 1 sentence 2 WpHG.

The Invesco Ltd, Hamilton, Bermudas, informed the company by letter on March 27, 2009,

pursuant to § 21 section 1 WpHG, that on September 30, 2008, their voting interest in adidas AG

had fallen below the threshold of 3% and amounted to 2.97% of the voting rights (5,894,813 shares)

on this date. All of these voting rights are attributable to Invesco Ltd. in accordance with § 22 sec-

tion 1 sentence 1 number 6 in conjunction with § 22 section 1 sentence 2 WpHG.

The Invesco Holdings Company Limited, London, Great Britain, informed the company by let-

ter on March 27, 2009, pursuant to § 21 section 1 WpHG, that on September 30, 2008, their voting

interest in adidas AG had fallen below the threshold of 3% and amounted to 2.97% of the voting

rights (5,894,813 shares) on this date. All of these voting rights are attributable to Invesco Holdings

Limited in accordance with § 22 section 1 sentence 1 number 6 in conjunction with § 22 section 1

sentence 2 WpHG.

The IVZ Callco Inc., Halifax, Canada, informed the company by letter on March 27, 2009, pur-

suant to § 21 section 1 WpHG, that on September 30, 2008, their voting interest in adidas AG had

fallen below the threshold of 3% and amounted to 2.97% of the voting rights (5,894,813 shares) on

this date. All of these voting rights are attributable to IVZ Callco Inc. in accordance with § 22 sec-

tion 1 sentence 1 number 6 in conjunction with § 22 section 1 sentence 2 WpHG.