Reebok 2009 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CONSOLIDATED FINANCIAL STATEMENTS Notes 179

N

°-

04

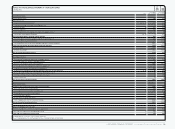

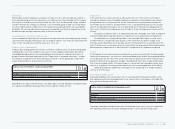

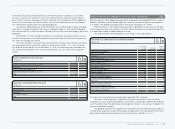

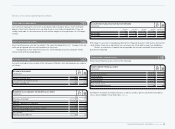

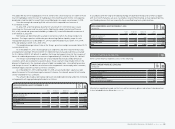

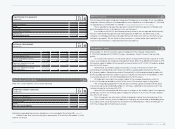

REEBOK PRODUCTOS ESPORTIVOS BRASIL LTDA.’S NET ASSETS AT THE ACQUISITION

DATE

€ IN MILLIONS

Pre-acquisition

carrying

amounts Fair value

adjustments

Recognised

values on

acquisition

Inventories 2 — 2

Other current assets 0 — 0

Net assets 2 — 2

Goodwill arising on acquisition —

Purchase price settled in cash 2

Cash and cash equivalents acquired —

Cash outflow on acquisition 2

Pre-acquisition carrying amounts were based on applicable IFRS standards.

If this acquisition had occurred on January 1, 2008, total Group net sales would have been

€ 10.8 billion and net income would have been € 641 million for the year ending December 31, 2008.

The acquired subsidiary contributed € 6 million to the Group’s net income for the period from

April to December 2008.

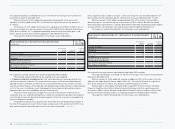

Effective September 5, 2008, adidas International, Inc. acquired 100% of the shares of Tex-

tronics, Inc. for a purchase price in the amount of US $ 35 million. Based in Wilmington/Delaware

(USA), Textronics, Inc. is a specialist in the development of wearable sensors for use in fitness and

health monitoring.

The acquisition had the following effect on the Group’s assets and liabilities:

N

°-

04

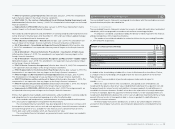

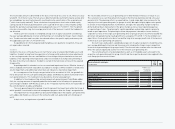

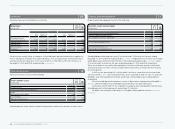

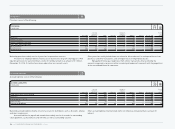

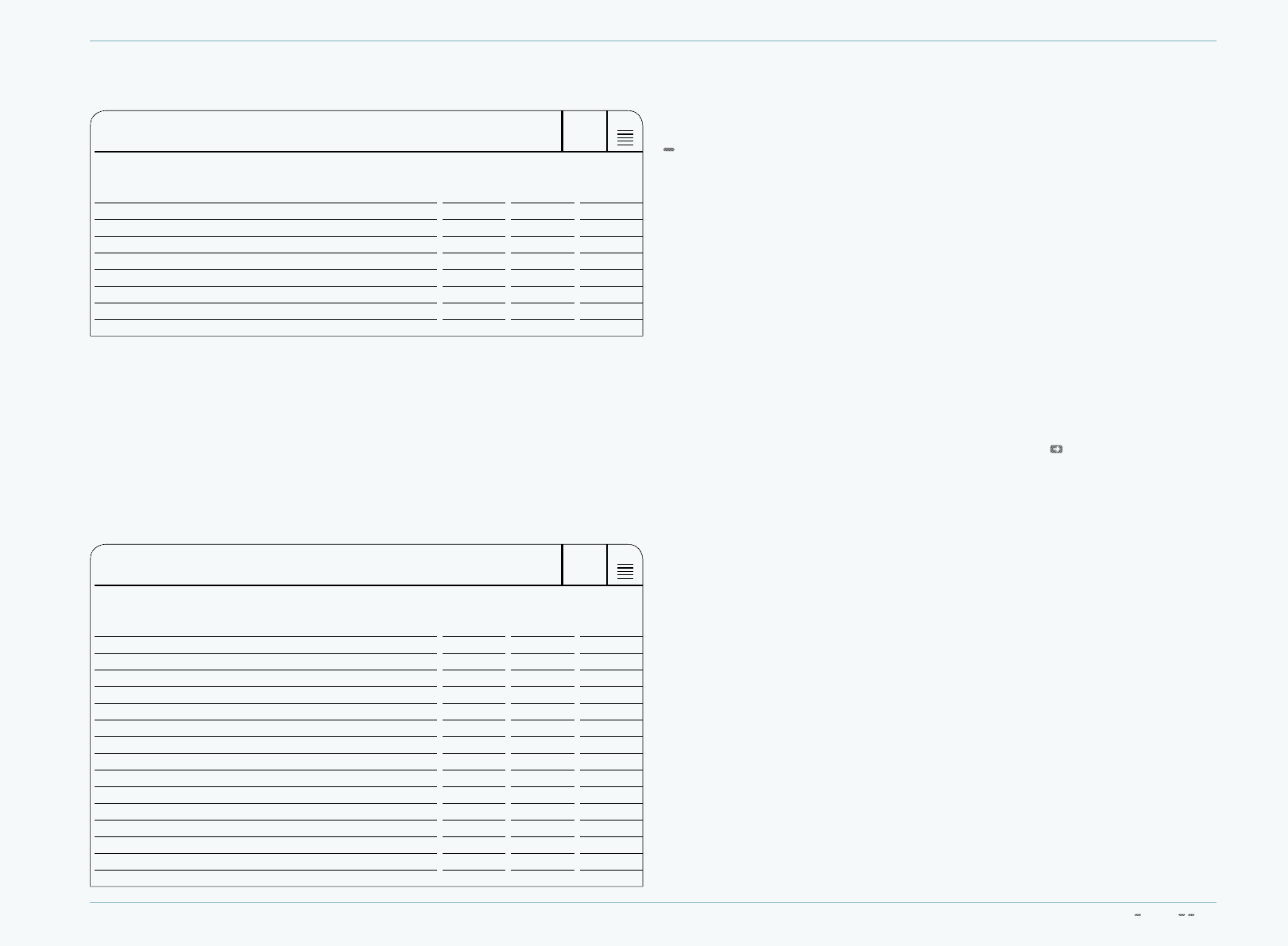

TEXTRONICS, INC.’S NET ASSETS AT THE ACQUISITION DATE

€ IN MILLIONS

Pre-acquisition

carrying

amounts Fair value

adjustments

Recognised

values on

acquisition

Cash and cash equivalents 0 — 0

Inventories 0 — 0

Other current assets 0 — 0

Property, plant and equipment, net 0 — 0

Trademarks and other intangible assets, net — 9 9

Deferred tax assets — 3 3

Accounts payable (0) — (0)

Other current liabilities (0) — (0)

Deferred tax liabilities — (3) (3)

Net assets 0 9 9

Goodwill arising on acquisition 16

Purchase price settled in cash 25

Cash and cash equivalents acquired 0

Cash outflow on acquisition 25

Pre-acquisition carrying amounts were based on applicable IFRS standards.

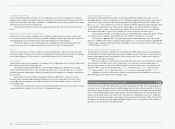

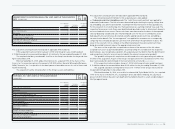

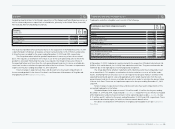

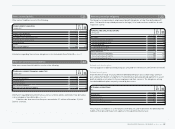

The following valuation methods for the acquired assets were applied:

Trademarks and other intangible assets: The “relief-from-royalty method” was applied for

trademarks/trade names. The fair value was determined by discounting the royalty savings after

tax and adding a tax amortisation benefit, resulting from the amortisation of the acquired asset.

For the valuation of core technology, the “multi-period-excess-earnings method” was used. The

respective future excess cash flows were identified and adjusted in order to eliminate all elements

not associated with these assets. Future cash flows were measured on the basis of the expected

sales by deducting variable and sales-related imputed costs for the use of contributory assets.

Subsequently, the outcome was discounted using the appropriate discount rate and adding a

tax amortisation benefit. The “income approach” was applied for covenants not-to-compete by

comparing the estimated prospective cash flows with and without the agreements in place. The

value of the covenants not-to-compete is the difference between these discounted cash flows

being discounted to present value at the appropriate discount rate.

The excess of the acquisition cost paid versus the net of the amounts of the fair values

assigned to all assets acquired and liabilities assumed, taking into consideration the respective

deferred taxes, was recognised as goodwill. Any acquired asset that did not meet the identification

and recognition criteria for an asset was included in the amount recognised as goodwill.

The goodwill arising on this acquisition was allocated to the cash-generating unit adidas at

the time of the acquisition. As part of the Group’s reorganisation in the second half of 2009, it has

been reallocated and is denominated in the local functional currency see also Note 2.

If this acquisition had occurred on January 1, 2008, total Group net sales would have been

€ 10.8 billion and net income would have been € 640 million for the year ending December 31, 2008.

The acquired subsidiary contributed net losses of € 1 million to the Group’s net income for

the period from September to December 2008.

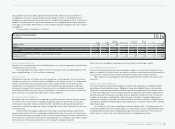

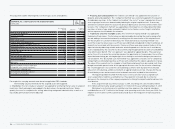

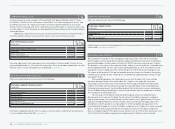

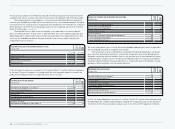

Effective November 20, 2008, as a result of a takeover bid, Taylor Made Golf Co., Inc. acquired

100% of the shares of Ashworth, Inc., including all direct and indirect holdings for a purchase

price of US $ 30 million. Based in Carlsbad/California (USA), Ashworth is a well-established golf

lifestyle apparel brand.