Reebok 2009 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

198 CONSOLIDATED FINANCIAL STATEMENTS Notes

N

°-

28

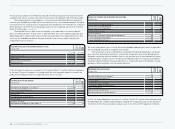

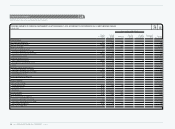

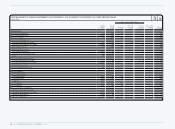

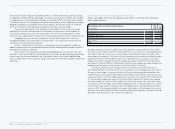

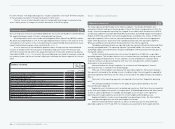

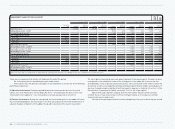

FAIR VALUE HIERARCHY OF FINANCIAL INSTRUMENTS ACCORDING TO IFRS 7

AS AT DECEMBER 31, 2009 € IN MILLIONS

Fair value hierarchy, aggregated by category Fair value

Dec. 31, 2009 Level 1 Level 2 Level 3

Financial assets at fair value through profit or loss

thereof: designated as such upon initial recognition

(Fair Value Option – FVO) —

thereof: Held for Trading

(Financial Assets Held for Trading – FAHfT) 193 114 79 1 )

Available-for-Sale Financial Assets (AfS) 12 12

Other financial assets

Derivatives being part of a hedge 28 28

Financial assets 233 154 79

Financial Liabilities at fair value through profit or loss

Held for Trading (FLHfT) 21 21

Other financial liabilities

Derivatives being part of a hedge 85 85

Financial liabilities 106 106

Fair value

Jan. 1, 2009 gains losses Fair value

Dec. 31, 2009

1) This category relates to a 10% investment in

FC Bayern München AG of € 79 million. Dividends

are distributed by FC Bayern München AG instead

of regular interest payments. 77 2 — 79

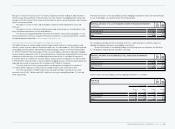

Level 1 is based on quoted prices in active markets for identical assets or liabilities.

Level 2 is based on inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either

directly (i.e. as prices) or indirectly (i.e. derived from prices).

Level 3 is based on inputs for the asset or liability that are not based on observable market data (unobservable inputs).

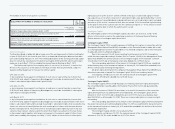

Due to the short-term maturities of cash and cash equivalents, short-term financial assets,

accounts receivable and payable as well as other current receivables and payables, their respec-

tive fair values approximate their carrying amount.

The fair values of non-current financial assets and liabilities are estimated by discounting

expected future cash flows using current interest rates for debt of similar terms and remaining

maturities, and adjusted by an adidas Group specific credit risk premium.

Fair values of long-term financial assets classified as available-for-sale are based on quoted

market prices in an active market or are calculated as present values of expected future cash

flows.

The fair values of forward contracts and currency options are determined on the basis of

market conditions at the balance sheet date. The fair value of a currency option is determined

using generally accepted models to calculate option prices, such as the “Garman-Kohlhagen-

model”. The fair market value of an option is influenced not only by the remaining term of the

option, but also by other determining factors such as the actual foreign exchange rate and the

volatility of the underlying foreign currency base.

N

°-

28

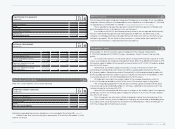

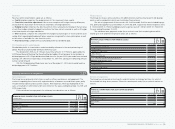

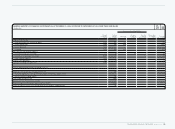

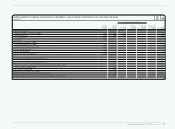

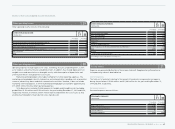

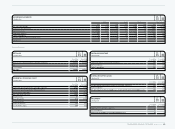

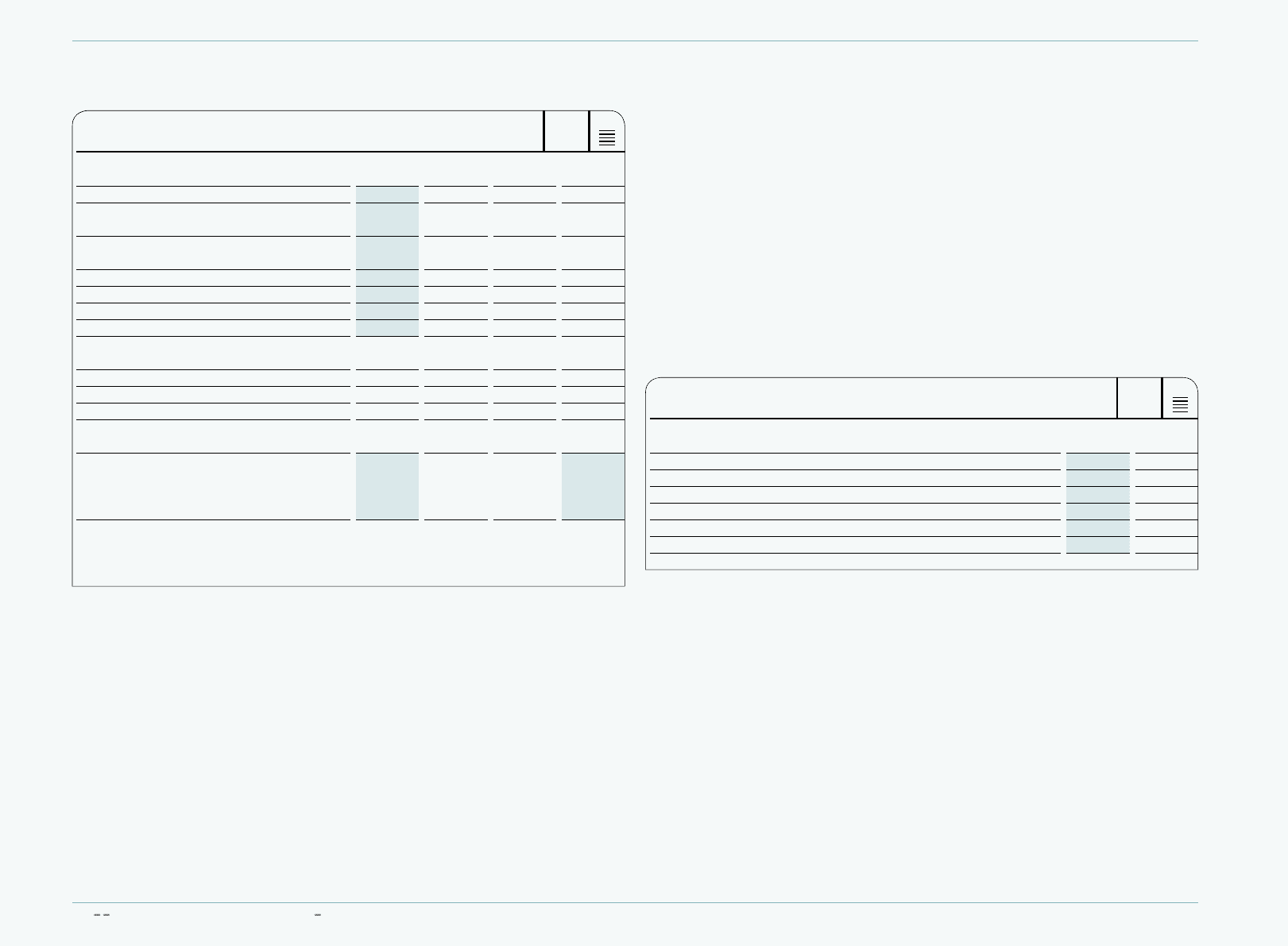

NET GAINS OR (LOSSES) OF FINANCIAL INSTRUMENTS RECOGNISED IN THE

CONSOLIDATED INCOME STATEMENT € IN MILLIONS

Year ending

Dec. 31, 2009 Year ending

Dec. 31, 2008

Financial assets or financial liabilities at fair value through profit or loss 4 (6)

thereof: designated as such upon initial recognition — —

thereof: classified as held for trading 4 (6)

Loans and receivables (44) (27)

Available-for-sale financial assets — —

Financial liabilities measured at amortised cost 5 11