Reebok 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

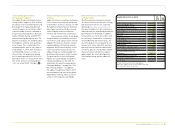

Compensation ReportCompensation Report 1 ) 1 )

For the adidas Group, transparent and comprehensible reporting on the compensation of the Executive Board and Supervisory

Board are essential elements of good corporate governance. In the following, we summarise the principles of the compensation

system of the Executive Board and Supervisory Board and outline the structure and level of Executive Board and Supervisory

Board compensation. We are also reporting on the benefits the members of our Executive Board will receive if they resign

from office or retire.

1) This Compensation Report is a component of the audited Group Management Report and is also part of the

Declaration on Corporate Governance including the Corporate Governance Report.

Responsibility of the Supervisory BoardResponsibility of the Supervisory Board

Following preparation by the General

Committee, the individual compensa-

tion of our Executive Board members is

discussed and determined by the entire

Supervisory Board in accordance with

the German Act on the Appropriate-

ness of Management Board Remunera-

tion (Gesetz zur Angemessenheit der

Vorstandsvergütung – VorstAG) effective

as of August 5, 2009 and a correspond-

ing regulation stipulated in the Rules of

Procedure for the Supervisory Board. In

addition, the Supervisory Board resolves

upon the Executive Board compensa-

tion system following the proposal by the

General Committee and is also respon-

sible for its regular review.

In the financial year 2009, the

Supervisory Board had the compensation

system examined in detail by an external

compensation expert being independent

of the Executive Board and the company.

This examination showed that the current

compensation system had, to a large

extent, already been in compliance with

the new statutory regulations and only

few adjustments were required.

Compensation systemCompensation system

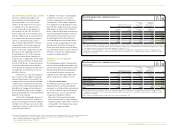

The compensation system of our Execu-

tive Board, which includes fixed and vari-

able elements, consists of the following

components:

non-performance-related compen-

sation component,

performance-related compensation

component,

compensation component with long-

term incentive effect.

The individual components are structured

as follows:

The non-performance-related com-

pensation component consists of a

fixed annual salary paid in twelve

monthly instalments. Other benefits

are granted in addition. These benefits

are primarily composed of the values

set in accordance with tax guidelines

for the private use of a company

car and the payment of insurance

premiums.

The performance-related compensa-

tion component is paid as a variable

Performance Bonus. Its amount

is linked to the fixed annual salary

and is determined by the individ-

ual performance of the respective

Executive Board member as well as

by the development of income before

taxes (IBT) and the reduction of net

debt. The Performance Bonus is paid

out following the end of the respec-

tive financial year upon adoption of

the annual financial statements and

determination of target achievement.

As a compensation component with a

long-term incentive effect, our Execu-

tive Board members receive compen-

sation from the Long-Term Incentive

Plan 2009/2011 (LTIP 2009/2011).

Payments resulting from the LTIP

2009/2011 (LTIP Bonus) depend on the

fulfilment of the following perform-

ance criteria which are exactly defined

in the LTIP 2009/2011, with different

weightings:

Increase of consolidated net income

Reduction of net debt (adjusted for

non-operating effects)

Sales growth with regard to the

Reebok, Rockport and Reebok-CCM

Hockey brands as well as

38 TO OUR SHAREHOLDERS Compensation Report

Absolute and relative share price

development,

each measured over the three-year

period from 2009 to 2011. The amount

of the LTIP Bonus is calculated by

multiplying the accumulated degree

of achievement of the performance

cri teria by the target bonus deter-

mined for each member of the Execu-

tive Board in advance. The individual

payout amount of the LTIP Bonus is

limited to a maximum of 150% of the

individual target bonus (Cap). If the

degree of target achievement lies

below 50%, no LTIP Bonus will be

paid. The possible payout of the LTIP

Bonus will be effected following the

approval of the consolidated financial

statements for the period ending on

December 31, 2011.

A compensation component resulting

from a management share option plan

does not exist and is not planned.