Reebok 2009 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

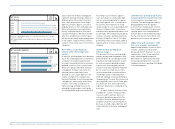

124 GROUP MANAGEMENT REPORT – FINANCIAL REVIEW GROUP BUSINESS PERFORMANCE Balance Sheet and Cash Flow Statement

Non-current accrued liabilities

down 41%

Non-current accrued liabilities declined

41% to € 22 million at the end of 2009

from € 37 million in 2008. This was partly

as a result of a decrease in the accruals

for goods and services not yet invoiced.

Equity grows due to full conversion

of convertible bond

Shareholders’ equity rose 11% to

€ 3.771 billion at the end of 2009 ver-

sus € 3.386 billion in 2008 see 41. The

full conversion of our convertible bond

and the net income generated during the

period were the main contributors to this

development. Declines in the fair value

of financial instruments, the dividend

paid during the period and currency

translation effects negatively impacted

this development see Note 26, p. 189.

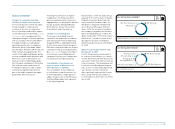

Expenses related to off-balance

sheet items

Our most important off-balance sheet

commitments are operating leases,

which are related to retail stores, offices,

warehouses and equipment. The Group

has entered into various operating leases

as opposed to property acquisitions to

reduce exposure to property value fluc-

tuations. Rent expenses increased 14% to

€ 480 million in 2009 from € 422 million

in the prior year, mainly due to the con-

tinued expansion of the adidas Group’s

own-retail activities see Note 27, p. 193.

N

°-

42

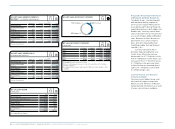

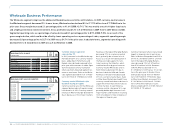

CHANGE IN CASH AND CASH EQUIVALENTS

€ IN MILLIONS

Cash and cash

equivalents at

the end of 2008

Net cash

provided by

operating

activities

Net cash used

in investing

activities

Net cash used

in financing

activities

Cash and cash

equivalents at the

end of 2009 1 )

1) Includes a positive exchange rate effect of € 7 million.

244

1,198 (162)

(512)

775

N

°-

43

N

°-

44

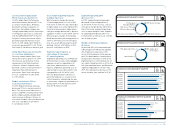

2009 CAPITAL EXPENDITURE BY SEGMENT

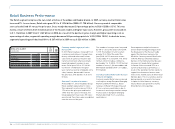

2009 CAPITAL EXPENDITURE BY TYPE

10% Wholesale

16% IT

30% Retail

32% Own retail

6% Other Businesses

10% Retailer support

54% HQ/Consolidation

42% Other

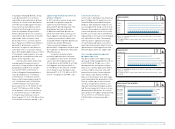

Cash flow development reflects lower

working capital needs

In 2009, net cash inflow from operating

activities was € 1.198 billion (2008:

€ 497 million). The increase in cash pro-

vided by operating activities compared to

the prior year was primarily due to lower

working capital needs.

Net cash outflow from invest-

ing activities was € 162 million (2008:

€ 444 million) and was mainly related to

spending for property, plant and equip-

ment such as investments in the furnish-

ing and fitting of stores in our Retail

segment, in new office buildings and in

IT systems.

Net cash used in financing activities

totalled € 512 million (2008: € 106 mil-

lion). Cash inflows from financing activi-

ties were mainly related to proceeds from

the issue of a five-year Eurobond in a

nominal amount of € 500 million. Cash

outflows from financing activities in an

amount of € 508 million and € 404 mil-

lion were attributable to the repayment

of long-term and short-term borrowings,

respectively. In addition, adidas AG paid

dividends in an amount of € 97 million to

its shareholders.

Exchange rate effects in an amount

of € 7 million positively impacted the

Group’s cash position in 2009 (2008:

€ 2 million). As a result of all these

developments, cash and cash equivalents

increased by € 531 million to € 775 mil-

lion at the end of 2009 (2008: € 244 mil-

lion) see 42.

Capital expenditure reduced

Capital expenditure is the total cash

expenditure for the purchase of tangible

and intangible assets. Group capital

expenditure decreased 37% to € 240 mil-

lion in 2009 (2008: € 380 million). The

Retail segment accounted for 30% of

Group capital expenditure (2008: 36%).

Investments primarily related to the

expansion of our store base for the

adidas and Reebok brands. Expenditure

in the Wholesale segment accounted for

10% of total capital expenditure (2008:

7%). Capital expenditure in Other Busi-

nesses accounted for 6% of total expend-

iture (2008: 5%). The remaining 54% of

Group capital expenditure was recorded

in HQ/Consolidation (2008: 52%) and

was mainly related to investments into

new office buildings and IT infrastructure

see 43 and Global Operations, p. 88.