Reebok 2009 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

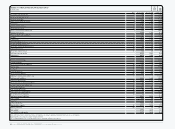

176 CONSOLIDATED FINANCIAL STATEMENTS Notes

Recognition of revenues Recognition of revenues

Sales are recognised at the fair value of the consideration received or receivable, net of returns,

trade discounts and volume rebates, when the significant risks and rewards of ownership of the

goods are transferred to the buyer, and when it is probable that the economic benefits associated

with the transaction will flow to the Group.

Royalty and commission income is recognised based on the contract terms on an accrual

basis.

Advertising and promotional expenditures Advertising and promotional expenditures

Production costs for media campaigns are included in prepaid expenses (other current and

non-current assets) until the services are received, and upon receipt expensed in full. Significant

TV media buying costs are expensed over the original duration of the broadcast.

Promotional expenses that involve payments, including one-time up-front payments for

promotional contracts, are expensed systematically over the term of the agreement.

Interest Interest

Interest is recognised as income or expense as incurred (using the “effective interest method”)

with the exception of interest that is directly attributable to the acquisition, construction or produc-

tion of a qualifying asset. This interest is capitalised as part of the cost of that asset.

Income taxes Income taxes

Current income taxes are computed in accordance with the applicable taxation rules established in

the countries in which the Group operates.

The Group computes deferred taxes for all temporary differences between the carrying

amount and the tax base of its assets and liabilities and tax loss carry-forwards. As it is not per-

mitted to recognise a deferred tax liability for goodwill, the Group does not compute any deferred

taxes thereon.

Deferred tax assets arising from deductible temporary differences and tax loss carry-

forwards which exceed taxable temporary differences are only recognised to the extent that it

is probable that the company concerned will generate sufficient taxable income to realise the

associated benefit.

Income tax is recognised in the income statement except to the extent that it relates to items

recognised directly in equity, in which case it is recognised in equity.

Equity compensation benefits Equity compensation benefits

Stock options were granted to members of the Executive Board of adidas AG as well as to the

managing directors/senior vice presidents of its affiliated companies and to further senior execu-

tives of the Group in connection with the Management Share Option Plan (MSOP) of adidas AG

see also Note 38. The company has the choice to settle a potential obligation by issuing new shares

or providing the equivalent cash compensation. When options are exercised and the company

decides to issue new shares, the proceeds received net of any transaction costs are credited to

share capital and capital surplus. The company has so far chosen to issue new shares.

In accordance with IFRS 2, an expense and a corresponding entry to equity for equity-settled

stock options and an expense and a liability for cash-settled stock options is recorded.

The Group has applied IFRS 2 retrospectively and has taken advantage of the transitional

provisions of IFRS 2 with respect to equity-settled awards. As a result, the Group has applied IFRS

2 only to equity-settled awards granted after November 7, 2002, that had not yet vested on January

1, 2005 [Tranche V (2003)].

Estimation uncertainties and judgementsEstimation uncertainties and judgements

The preparation of financial statements in conformity with IFRS requires the use of assumptions

and estimates that affect reported amounts and related disclosures. Although such estimates are

based on Management’s best knowledge of current events and actions, actual results may ulti-

mately differ from these estimates.

The key assumptions concerning the future and other key sources of estimation uncertainty

at the balance sheet date which have a significant risk of causing a material adjustment to

the carrying amounts of assets and liabilities within the next financial year are outlined in the

respective Notes, in particular goodwill see Note 12, trademarks see Note 13, provisions see

Note 19, pensions see Note 23, derivatives see Note 28 as well as deferred taxes see Note 33.

Judgements have for instance been used in classifying leasing arrangements as well as in

determining valuation methods for intangible assets.

Assets/liabilities classified as held-for-sale 03

Part of the assets of GEV Grundstücksgesellschaft Herzogenaurach mbH & Co. KG and adidas AG

as well as assets of Immobilieninvest und Betriebsgesellschaft Herzo-Base GmbH & Co. KG are

presented as disposal groups held-for-sale following a Memorandum of Understanding signed in

2009 (land and buildings/leasehold improvements). Selling negotiations have commenced. Alter-

natives are currently under assessment and a final decision is expected in June 2010. At Decem-

ber 31, 2009, the disposal groups contained assets amounting to € 53 million (2008: € 12 million).

In addition, the Memorandum of Understanding includes assets of € 51 million in the USA and a

warehouse of € 20 million in the Netherlands.