Reebok 2009 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CONSOLIDATED FINANCIAL STATEMENTS Notes 193

Reserves Reserves

Reserves within shareholders’ equity are as follows:

Capital reserve: comprises the paid premium for the issuance of share capital.

Cumulative translation adjustments: this reserve comprises all foreign currency differences

arising from the translation of the financial statements of foreign operations.

Hedging reserve: comprises the effective portion of the cumulative net change in the fair value

of cash flow hedges related to hedged transactions that have not yet occurred as well as of hedges

of net investments in foreign subsidiaries.

Other reserves: comprise the cumulative net change of actuarial gains or losses and the asset

ceiling effect regarding defined benefit plans, expenses recognised for share option plans as well

as fair values of available-for-sale financial assets.

Retained earnings: comprise the accumulated profits less dividends paid.

Distributable profits and dividends Distributable profits and dividends

Distributable profits to shareholders are determined by reference to the retained earnings of

adidas AG and calculated under German Commercial Law.

The dividend for 2008 was € 0.50 per share (total amount: € 97 million), approved by the

2009 Annual General Meeting. The Executive Board of adidas AG will propose to shareholders a

dividend payment of € 0.35 per dividend-entitled share for the year 2009 to be made from retained

earnings of € 285 million reported as at December 31, 2009. The subsequent remaining amount

will be carried forward.

209,216,186 dividend-entitled shares exist as at December 31, 2009, which would lead to a

dividend payment of € 73 million.

Leasing and service arrangements 27

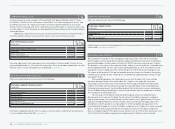

Operating leases Operating leases

The Group leases primarily retail stores as well as offices, warehouses and equipment. The

contracts regarding these leases with expiration dates of between one and fifteen years partly

include renewal options and escalation clauses. Rent expenses, which partly depend on net

sales, amounted to € 480 million and € 422 million for the years ending December 31, 2009 and

2008, respectively.

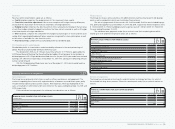

Future minimum lease payments for minimum lease durations are as follows:

N

°-

27

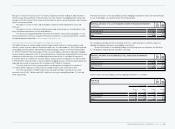

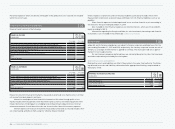

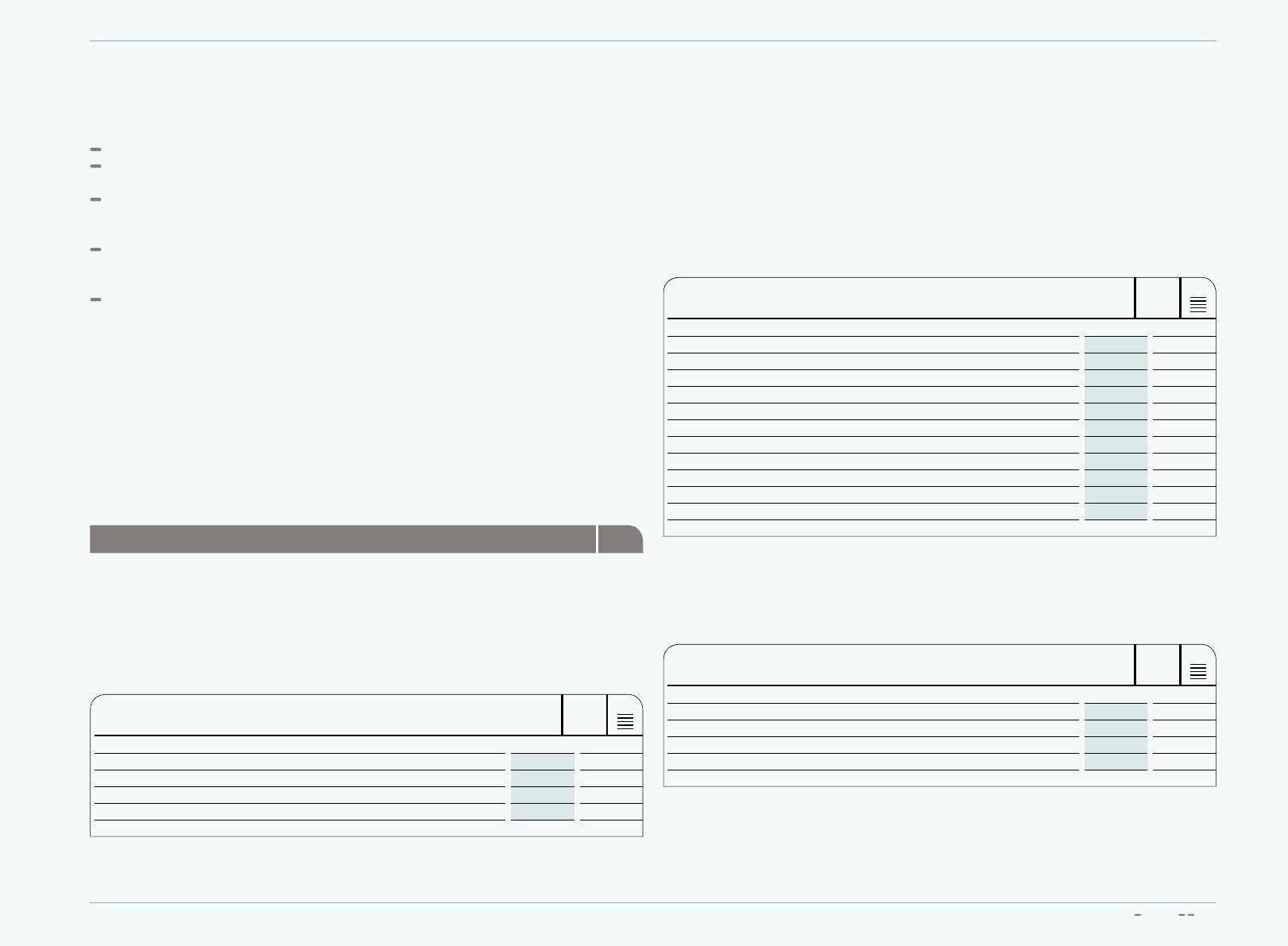

MINIMUM LEASE PAYMENTS FOR OPERATING LEASES

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008

Within 1 year 360 213

Between 1 and 5 years 619 516

After 5 years 320 340

Total 1,299 1,069

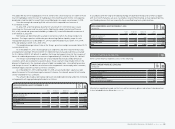

Finance leases Finance leases

The Group also leases various premises for administration, warehousing, research and develop-

ment as well as production, which are classified as finance leases.

The net carrying amount of these assets of € 3 million and € 5 million was included in prop-

erty, plant and equipment as at December 31, 2009 and 2008, respectively. Interest expenses were

€ 1 million (2008: € 2 million) and depreciation expenses were € 1 million (2008: € 1 million) for

the year ending December 31, 2009.

The minimum lease payments under these contracts over their remaining terms which

extend up to 2016 and their net present values are as follows:

N

°-

27

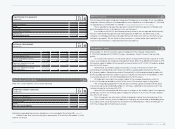

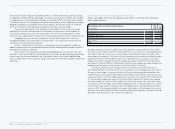

MINIMUM LEASE PAYMENTS FOR FINANCE LEASES

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008

Lease payments falling due:

Within 1 year 1 2

Between 1 and 5 years 1 2

After 5 years 1 1

Total lease payments 3 5

Less: estimated amount representing interest 0 0

Obligation under finance leases 3 5

Thereof falling due:

Within 1 year 1 2

Between 1 and 5 years 1 2

After 5 years 1 1

Service arrangements Service arrangements

The Group has outsourced certain logistics and information technology functions, for which it

has entered into long-term contracts. Financial commitments under these contracts mature as

follows:

N

°-

27

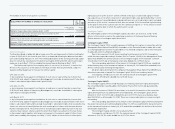

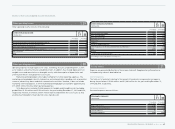

FINANCIAL COMMITMENTS FOR SERVICE ARRANGEMENTS

€ IN MILLIONS

Dec. 31, 2009 Dec. 31, 2008

Within 1 year 42 49

Between 1 and 5 years 59 48

After 5 years — —

Total 101 97