Reebok 2009 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2009 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118 GROUP MANAGEMENT REPORT – FINANCIAL REVIEW GROUP BUSINESS PERFORMANCE Income Statement

N

°-

1 9

N

°-

20

N

°-

21

N

°-

22

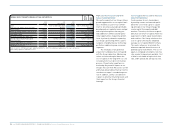

OTHER OPERATING EXPENSES

€ IN MILLIONS

OTHER OPERATING EXPENSES

IN % OF NET SALES

SALES WORKING BUDGET

IN % OF NET SALES

MARKETING WORKING BUDGET

IN % OF NET SALES

2005 1 )

2006 2 )

2007

2008

2009

2005 1 )

2006 2 )

2007

2008

2009

2008

2009

2008

2009

2,573

3,759

4,115

4,378

4,390

38.8

37.3

40.0

40.5

42.3

2.7

2.3

10.5

9.9

1) Reflects continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok, Rockport and Reebok-CCM Hockey from February 1, 2006

onwards.

1) Reflects continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok, Rockport and Reebok-CCM Hockey from February 1, 2006

onwards.

Currency-neutral royalty and

commission income declines

Royalty and commission income for the

adidas Group decreased 4% to € 86 mil-

lion in 2009 from € 89 million in the prior

year. On a currency-neutral basis, royalty

and commission income declined 7%,

primarily due to the non-recurrence of

Reebok royalties from distribution part-

ners in Brazil/Paraguay and Argentina.

The distribution partnerships in these

countries were replaced by own compa-

nies whose sales were consolidated for

the first time effective April and June

2008, respectively.

Other operating income declines 3%

Other operating income includes items

such as releases of accruals and provi-

sions and gains from the disposal of

fixed assets. Other operating income

declined 3% to € 100 million in 2009 from

€ 103 million in 2008. This development

was mainly due to the non-recurrence of

one-time book gains realised in the prior

year in connection with the acquisition

of Ashworth and the divestiture of the

Maxfli business. These effects more than

offset higher income from the release of

accruals for personnel costs see Note

29, p. 201.

Higher other operating expenses

as a percentage of sales

Other operating expenses, including

depreciation and amortisation, consist

of items such as sales working budget,

marketing working budget and operating

overhead costs. Other operating

expenses as a percentage of sales

increased 1.7 percentage points to 42.3%

in 2009 from 40.5% in 2008, mainly as

a result of higher expenses to support

the Group’s development in emerging

markets see 20. Costs related to

the Group’s reorganisation and the

integration of the Ashworth business

also contributed to this development.

In absolute terms, other operating

expenses remained almost unchanged at

€ 4.390 billion in 2009 (2008: € 4.378 bil-

lion) see 19.

Sales working budget decreases

as a percentage of sales

Sales working budget expenditures

relate to advertising and promotion

initiatives at the point of sale as well

as store fittings and furniture. As sales

working budget expenses are channel

specific, they are allocated to the Group’s

operating segments. The Group’s sales

working budget as a percentage of

sales decreased 0.4 percentage points

to 2.3% in 2009 (2008: 2.7%), primarily

as a result of the non-recurrence of

major sporting events in the prior year

see 21. In absolute terms, sales work-

ing budget expenditures decreased 19%

to € 241 million in 2009 from € 297 mil-

lion in the prior year see 23.