PNC Bank 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

6S

ECURITIES

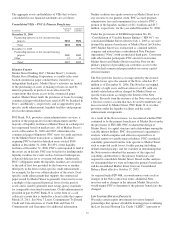

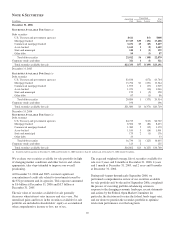

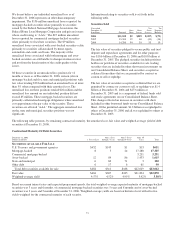

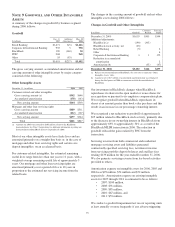

In millions

Amortized

Cost

Unrealized Fair

ValueGains Losses

December 31, 2006

S

ECURITIES

A

VAILABLE

F

OR

S

ALE

(a)

Debt securities

U.S. Treasury and government agencies $611 $(3) $608

Mortgage-backed 17,325 $39 (156) 17,208

Commercial mortgage-backed 3,231 13 (25) 3,219

Asset-backed 1,615 3 (9) 1,609

State and municipal 140 1 (2) 139

Other debt 90 (3) 87

Total debt securities 23,012 56 (198) 22,870

Corporate stocks and other 321 1 (1) 321

Total securities available for sale $23,333 $57 $(199) $23,191

December 31, 2005

S

ECURITIES

A

VAILABLE

F

OR

S

ALE

(a)

Debt securities

U.S. Treasury and government agencies $3,816 $(72) $3,744

Mortgage-backed 13,794 $1 (251) 13,544

Commercial mortgage-backed 1,955 1 (37) 1,919

Asset-backed 1,073 (10) 1,063

State and municipal 159 1 (2) 158

Other debt 87 (1) 86

Total debt securities 20,884 3 (373) 20,514

Corporate stocks and other 196 196

Total securities available for sale $21,080 $3 $(373) $20,710

December 31, 2004

S

ECURITIES

A

VAILABLE

F

OR

S

ALE

(a)

Debt securities

U.S. Treasury and government agencies $4,735 $(13) $4,722

Mortgage-backed 8,506 $9 (82) 8,433

Commercial mortgage-backed 1,380 5 (15) 1,370

Asset-backed 1,910 5 (14) 1,901

State and municipal 175 2 (1) 176

Other debt 33 33

Total debt securities 16,739 21 (125) 16,635

Corporate stocks and other 123 2 125

Total securities available for sale $16,862 $23 $(125) $16,760

(a) Securities held to maturity at December 31, 2006 and December 31, 2005 totaled less than $.5 million and at December 31, 2004 totaled $1 million.

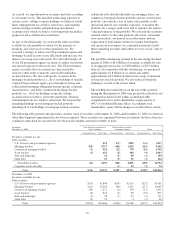

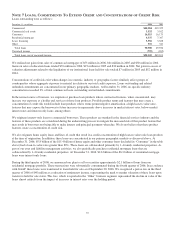

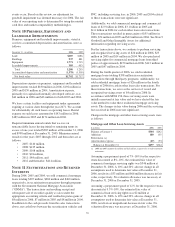

We evaluate our securities available for sale portfolio in light

of changing market conditions and other factors and, where

appropriate, take steps intended to improve our overall

positioning.

At December 31, 2006 and 2005, our most significant

concentration of credit risk related to investments issued by

the US government and its agencies. This exposure amounted

to $.6 billion at December 31, 2006 and $3.7 billion at

December 31, 2005.

The fair value of securities available for sale generally

decreases when interest rates increase and vice versa. Net

unrealized gains and losses in the securities available for sale

portfolio are included in shareholders’ equity as accumulated

other comprehensive income or loss, net of tax.

The expected weighted-average life of securities available for

sale was 3 years and 8 months at December 31, 2006, 4 years

and 1 month at December 31, 2005, and 2 years and 8 months

at December 31, 2004.

During mid-August through early September 2006, we

performed a comprehensive review of our securities available

for sale portfolio and, by the end of September 2006, completed

the process of executing portfolio rebalancing actions in

response to the changing economic landscape, recent statements

and actions by the Federal Open Market Committee (in

particular, the decision not to raise the federal funds target rate),

and our desire to position the securities portfolio to optimize

total return performance over the long term.

89