PNC Bank 2006 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

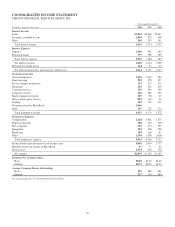

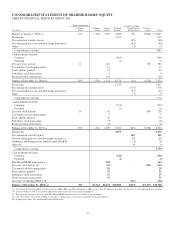

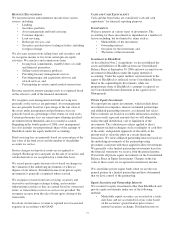

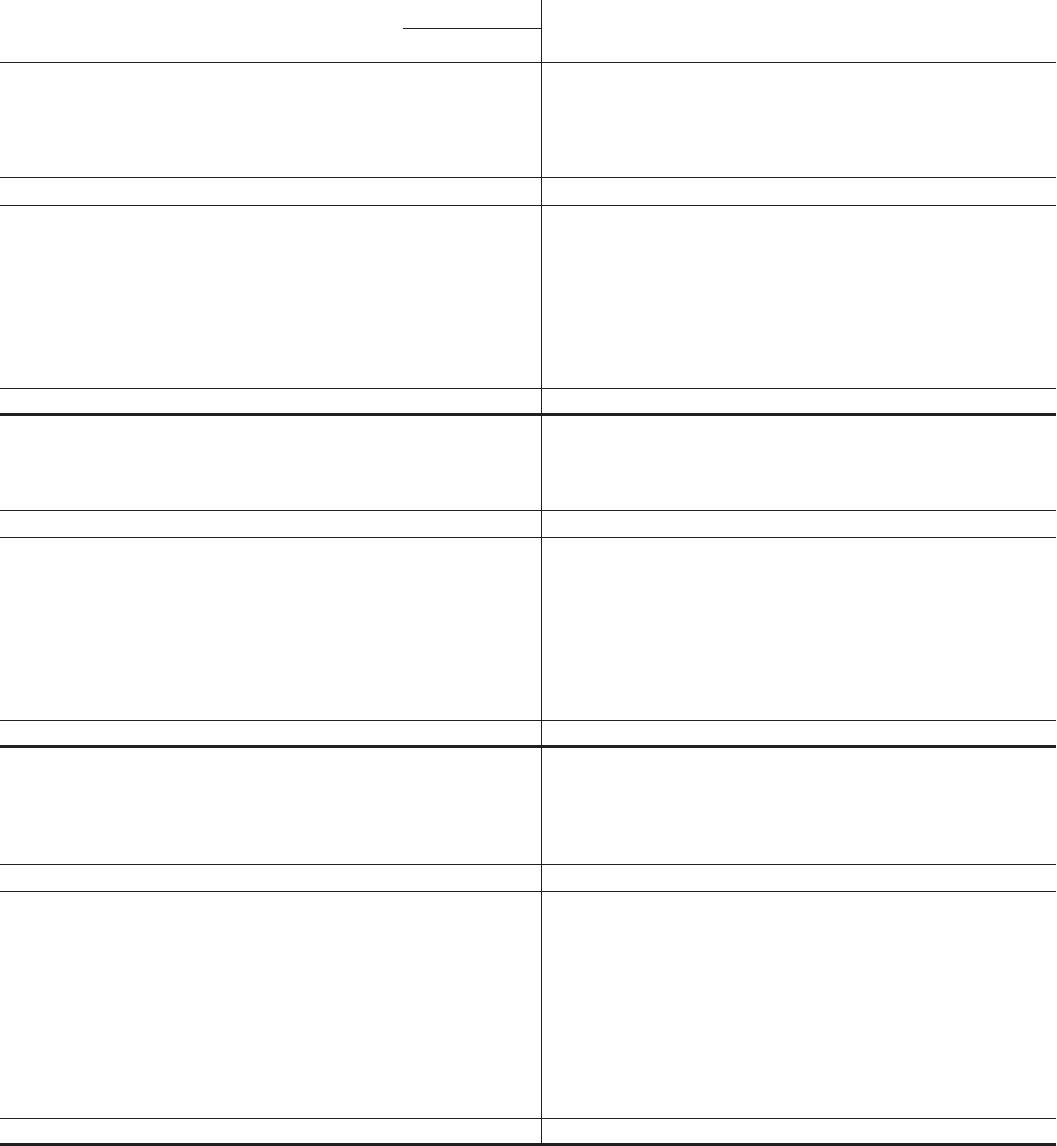

CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY

THE PNC FINANCIAL SERVICES GROUP, INC.

Shares Outstanding

Common

Stock

Capital

Surplus

Retained

Earnings

Accumulated Other

Comprehensive

Income (Loss)

Treasury

Stock TotalIn millions

Common

Stock

Balance at January 1, 2004 (a) 277 1,764 1,079 7,642 60 (3,900) $ 6,645

Net income 1,197 1,197

Net unrealized securities losses (69) (69)

Net unrealized losses on cash flow hedge derivatives (42) (42)

Other (3) (3)

Comprehensive income 1,083

Cash dividends declared

Common (565) (565)

Preferred (1) (1)

Treasury stock activity 6 116 176 292

Tax benefit of stock option plans 15 15

Stock options granted 22 22

Subsidiary stock transactions 4 4

Restricted stock transactions (22) (22)

Balance at December 31, 2004 (a) 283 1,764 1,214 8,273 (54) (3,724) 7,473

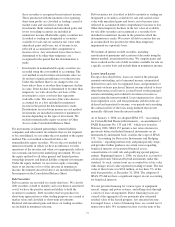

Net income 1,325 1,325

Net unrealized securities losses (174) (174)

Net unrealized losses on cash flow hedge derivatives (32) (32)

Other (7) (7)

Comprehensive income 1,112

Cash dividends declared

Common (574) (574)

Preferred (1) (1)

Treasury stock activity 10 61 468 529

Tax benefit of stock option plans 7 7

Stock options granted 30 30

Subsidiary stock transactions (5) (5)

Restricted stock transactions (8) (8)

Balance at December 31, 2005 (a) 293 1,764 1,299 9,023 (267) (3,256) 8,563

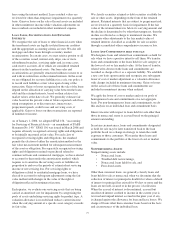

Net income 2,595 2,595

Net unrealized securities gains 149 149

Net unrealized gains on cash flow hedge derivatives 13 13

Additional minimum pension liability under SFAS 87 (1) (1)

Other (b) 33

Comprehensive income 2,759

Cash dividends declared

Common (632) (632)

Preferred (1) (1)

BlackRock/MLIM transaction (c) 262 ` 262

Treasury stock activity (d) (12) (121) (133)

Tax benefit of stock option plans 29 29

Stock options granted 31 31

Subsidiary stock transactions 27 27

Restricted stock transactions 15 15

Net effect of adopting SFAS 158 (132) (132)

Balance at December 31, 2006 (a) 293 $1,764 $1,651 $10,985 $(235) $(3,377) $10,788

(a) Our preferred stock outstanding as of December 31, 2006, 2005, and 2004 and January 1, 2004 was less than $.5 million at each date and, therefore, is excluded from this presentation.

(b) Consists of interest-only strip valuation adjustments and foreign currency translation adjustments.

(c) Represents the portion of our gain on the BlackRock/MLIM transaction that was credited to capital surplus.

(d) Our net treasury stock activity in 2006 was less than .1 million shares issued and is excluded from this presentation.

See accompanying Notes To Consolidated Financial Statements.

70