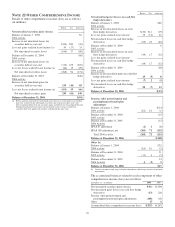

PNC Bank 2006 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

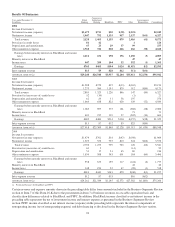

S

TATISTICAL

I

NFORMATION

(

UNAUDITED

)

T

HE

PNC F

INANCIAL

S

ERVICES

G

ROUP

,I

NC

.

S

ELECTED

Q

UARTERLY

F

INANCIAL

D

ATA

(a)

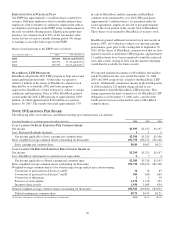

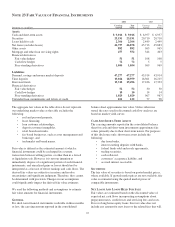

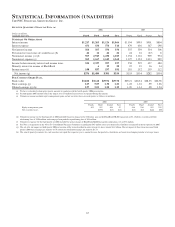

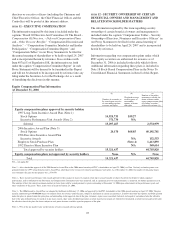

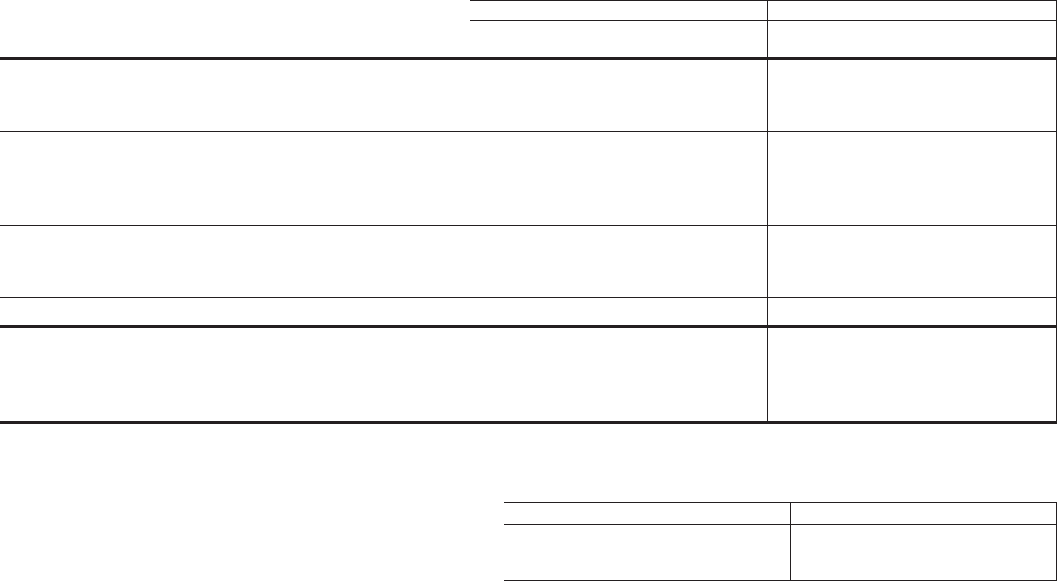

2006 2005

Dollars in millions,

except per share data Fourth Third Second First Fourth Third Second First

S

UMMARY

O

F

O

PERATIONS

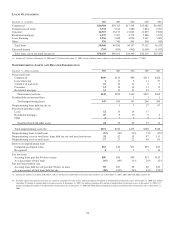

Interest income $1,217 $1,203 $1,126 $1,066 $1,034 $995 $901 $804

Interest expense 651 636 570 510 479 436 367 298

Net interest income 566 567 556 556 555 559 534 506

Provision for (recoveries of) credit losses (b) 42 16 44 22 24 16 (27) 8

Noninterest income (c) (d) 969 2,943 1,230 1,185 1,154 1,116 929 974

Noninterest expense (e) 969 1,167 1,145 1,162 1,127 1,154 1,033 992

Income before minority interest and income taxes 524 2,327 597 557 558 505 457 480

Minority interest in income of BlackRock 61922 22 19 16 14

Income taxes (f) 148 837 197 181 181 152 159 112

Net income (g) $376 $1,484 $381 $354 $355 $334 $282 $354

P

ER

C

OMMON

S

HARE

D

ATA

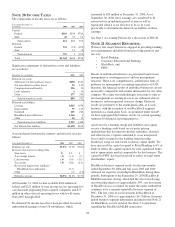

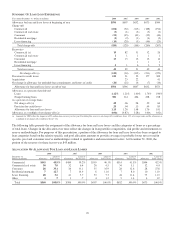

Book value $36.80 $36.60 $29.92 $29.70 $29.21 $28.54 $28.35 $26.78

Basic earnings (g) 1.29 5.09 1.30 1.21 1.22 1.16 .99 1.26

Diluted earnings (g) (h) 1.27 5.01 1.28 1.19 1.20 1.14 .98 1.24

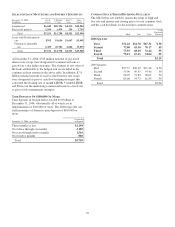

(a) We have reclassified certain prior quarter amounts to conform with the fourth quarter 2006 presentation.

(b) Second quarter 2005 amount reflects the impact of a $53 million loan recovery recognized during that quarter.

(c) Noninterest income included equity management gains and net securities losses in each quarter as follows (in millions):

2006 2005

Fourth Third Second First Fourth Third Second First

Equity management gains $25 $21 $54 $7 $16 $36 $12 $32

Net securities losses $(195) $(8) $(4) $(4) $(2) $(26) $(9)

(d) Noninterest income for the third quarter of 2006 included the pretax impact of the following: gain on the BlackRock/MLIM transaction of $2.1 billion; securities portfolio

rebalancing loss of $196 million; and mortgage loan portfolio repositioning loss of $48 million.

(e) Noninterest expense for the third quarter of 2006 included the pretax impact of BlackRock/MLIM transaction integration costs of $72 million.

(f) See Note 2 Acquisitions in the Notes To Consolidated Financial Statements regarding the $45 million reversal of deferred tax liabilities recognized in the first quarter of 2005.

(g) The net after-tax impact on third quarter 2006 net income of the items described in notes (d) and (e) above totaled $1.1 billion. The net impact of these items increased third

quarter 2006 basic earnings per share by $3.79 and increased diluted earnings per share by $3.73.

(h) The sum of quarterly amounts for each year does not equal the respective year’s amount because the quarterly calculations are based on a changing number of average shares.

117