PNC Bank 2006 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

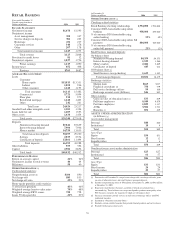

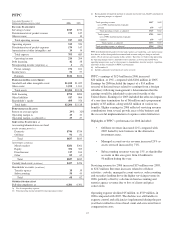

C

ORPORATE

&I

NSTITUTIONAL

B

ANKING

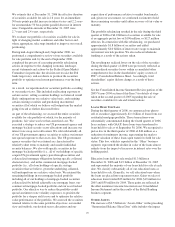

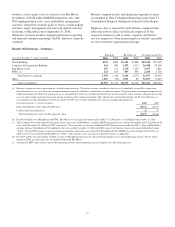

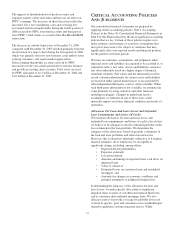

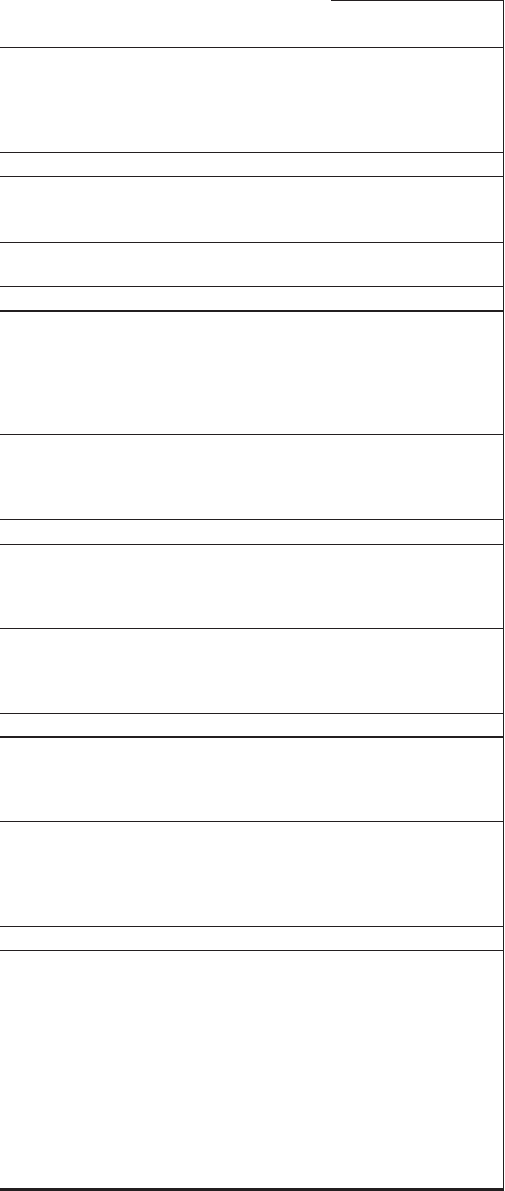

Year ended December 31

Taxable-equivalent basis

Dollars in millions except as noted 2006 2005

I

NCOME

S

TATEMENT

Net interest income $720 $739

Noninterest income

Corporate service fees 526 398

Other 226 198

Noninterest income 752 596

Total revenue 1,472 1,335

Provision for (recoveries of) credit losses 42 (30)

Noninterest expense 749 658

Pretax earnings 681 707

Income taxes 218 227

Earnings $463 $480

A

VERAGE

B

ALANCE

S

HEET

Loans

Corporate (a) (b) $9,925 $10,656

Commercial real estate 2,876 2,289

Commercial – real estate related 2,433 2,071

Asset-based lending 4,467 4,203

Total loans 19,701 19,219

Loans held for sale 893 752

Goodwill and other intangible assets 1,352 1,064

Other assets 4,602 4,274

Total assets $26,548 $25,309

Deposits

Noninterest-bearing demand $6,771 $6,025

Money market 2,654 2,670

Other 907 687

Total deposits 10,332 9,382

Commercial paper (b) 1,838

Other liabilities 3,771 3,348

Capital 1,976 1,724

Total funds $16,079 $16,292

P

ERFORMANCE

R

ATIOS

Return on average capital 23% 28%

Noninterest income to total revenue 51 45

Efficiency 51 49

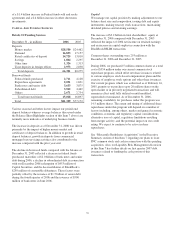

C

OMMERCIAL

M

ORTGAGE

S

ERVICING

P

ORTFOLIO

(in billions)

Beginning of period $136 $98

Acquisitions/additions 102 74

Repayments/transfers (38) (36)

End of period $200 $136

O

THER

I

NFORMATION

Consolidated revenue from (c):

Treasury management $424 $410

Capital markets $283 $175

Midland Loan Services $184 $144

Total loans (d) $20,054 $18,817

Nonperforming assets (d) (e) $63 $124

Net charge-offs (recoveries) $54 $(23)

Full-time employees (d) 1,936 1,861

Net gains on commercial mortgage loan sales $55 $61

Net carrying amount of commercial mortgage

servicing rights (d) $471 $344

(a) Includes lease financing.

(b) Includes Market Street as applicable for 2005. Market Street was deconsolidated

from our Consolidated Balance Sheet effective October 17, 2005.

(c) Represents consolidated PNC amounts.

(d) Presented as of period end.

(e) Includes nonperforming loans of $50 million at December 31, 2006 and $108

million at December 31, 2005.

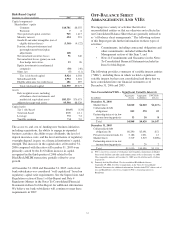

Earnings from Corporate & Institutional Banking for 2006

totaled $463 million compared with $480 million for 2005.

This decline was primarily attributable to the year over year

$72 million change in the provision for credit losses

principally as a result of a $53 million loan recovery

recognized in the second quarter of 2005. In addition, the

comparison was impacted by a $137 million increase in total

revenue, while noninterest expenses grew by $91 million in

2006 compared with 2005.

Highlights of 2006 for Corporate & Institutional Banking

included:

• Average loan balances increased $482 million, or 3%,

over 2005. The prior year average of $19.2 billion

included $1.7 billion in loans from the Market Street

commercial paper conduit that was deconsolidated in

October 2005. Excluding the impact of deconsolidating

the conduit, average loan balances increased 12%. The

growth in loans was driven by continuing customer

demand for corporate, commercial real estate, and asset-

based lending loans, and our expansion into the greater

Washington, DC area beginning in May 2005. The large

amount of liquidity in the credit markets has increased

competitive pressures for risk-adjusted returns. This has

resulted in shrinking loan spreads and a progressive

slowing of loan growth. We expect this trend to continue

into 2007 as we expect to maintain our moderate risk

profile.

• Asset quality continued to be strong. Nonperforming

assets at December 31, 2006 declined to $63 million

compared with $124 million at December 31, 2005, while

net charge-offs during 2006 were $54 million. Based on

the assets we currently hold and current business trends

and activities, we believe that overall asset quality will

remain strong by historical standards, at least for the near

term. We expect the provision to increase with loan

growth in 2007.

• Average deposits increased $950 million, or 10%, over

the comparable prior year period. The increase was

primarily driven by noninterest-bearing deposit growth

related to our commercial mortgage servicing portfolio

and a modest increase in the sale of treasury management

products. Money market deposits have remained

relatively flat due to the attraction of customers to

off-balance sheet sweep products in the current rate

environment. Growth in deposits is expected to continue,

however, at a moderate pace.

• Total revenue increased 10% compared with 2005 as

strong growth in fee income offset a decline in taxable-

equivalent net interest income. Fee income growth was

driven by increases in merger and acquisition advisory

activity, capital market-related activities, and treasury

management products and services.

Commercial mortgage servicing revenue, which includes fees

and net interest income, totaled $184 million for 2006, an

39