PNC Bank 2006 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

directors or executive officers (including the Chairman and

Chief Executive Officer, the Chief Financial Officer and the

Controller) will be posted at this internet address.

ITEM

11 - EXECUTIVE COMPENSATION

The information required by this item is included under the

captions “Board Of Directors And Committees Of The Board –

Compensation Of Directors,–Deferred Compensation Plans,

and – Other Director Benefits,” “Compensation Discussion and

Analysis,” – “Compensation Committee Interlocks and Insider

Participation,” “Compensation Committee Report,” and

“Compensation Tables” in our Proxy Statement to be filed for

the annual meeting of shareholders to be held on April 24, 2007

and is incorporated herein by reference. In accordance with

Item 407(e)(5) of Regulation S-K, the information set forth

under the caption “Compensation Committee Report” in such

Proxy Statement will be deemed to be furnished in this Report

and will not be deemed to be incorporated by reference into any

filing under the Securities Act or the Exchange Act as a result

of furnishing the disclosure in this manner.

ITEM

12 - SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT AND

RELATED STOCKHOLDER MATTERS

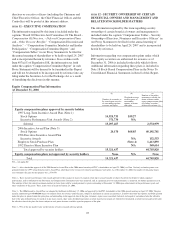

The information required by this item regarding security

ownership of certain beneficial owners and management is

included under the caption “Compensation Tables – Security

Ownership of Directors, Nominees and Executive Officers” in

our Proxy Statement to be filed for the annual meeting of

shareholders to be held on April 24, 2007 and is incorporated

herein by reference.

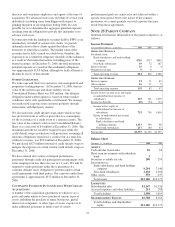

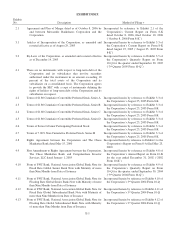

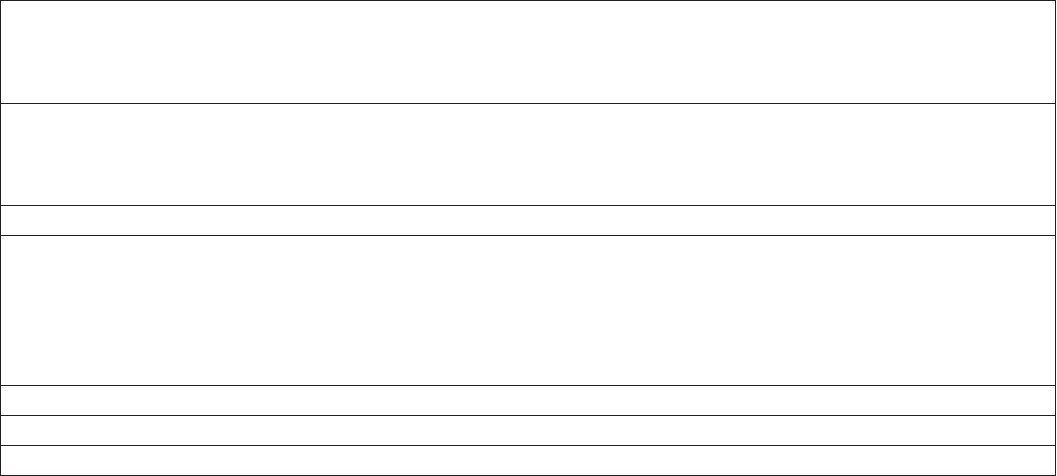

Information regarding our compensation plans under which

PNC equity securities are authorized for issuance as of

December 31, 2006 is included in the table which follows.

Additional information regarding these plans is included in

Note 18 Stock-Based Compensation Plans in the Notes To

Consolidated Financial Statements in Item 8 of this Report.

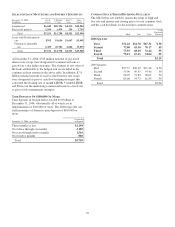

Equity Compensation Plan Information

At December 31, 2006

(a) (b) (c)

Number of securities to

be issued upon exercise

of outstanding options,

warrants and rights

Weighted-average

exercise price of

outstanding

options, warrants

and rights

Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a))

Equity compensation plans approved by security holders

1997 Long-Term Incentive Award Plan (Note 1)

Stock Options 14,925,733 $59.27

Incentive Performance Unit Awards (Note 2) 371,734 N/A

Subtotal 15,297,467 2,574,979

2006 Incentive Award Plan (Note 3)

Stock Options 24,170 $68.85 40,192,781

1996 Executive Incentive Award Plan

Incentive Awards N/A 152,553

Employee Stock Purchase Plan (Note 4) 1,413,893

1992 Director Share Incentive Plan N/A 369,614

Total approved by security holders 15,321,637 44,703,820

Equity compensation plans not approved by security holders None N/A None

Total 15,321,637 44,703,820

N/A – not applicable

Note 1 – After shareholder approval of the 2006 Incentive Award Plan at the 2006 annual meeting of PNC’s shareholders on April 25, 2006 (see Note 3 below), no further grants were

permitted under the 1997 Long-Term Incentive Award Plan, other than for the exercise of reload or performance unit rights. As of December 31, 2006, the number of remaining shares

reserved under this plan for that purpose was 2,574,979.

Note 2 – These incentive performance unit awards provide for the issuance of shares of common stock (up to a target number of shares) based on the degree to which corporate

performance goals established by the Personnel and Compensation Committee have been achieved, and, if a premium level of such performance is achieved, for further payment in cash.

This number reflects the current maximum number of shares that could be issued pursuant to grants outstanding at December 31, 2006 upon achievement of the performance goals and

other conditions of the grants. These grants were all made on January 23, 2006.

Note 3 – The 2006 Incentive Award Plan was adopted by the Board on February 15, 2006 and approved by the PNC shareholders at the 2006 annual meeting on April 25, 2006. The plan

initially authorized up to 40,000,000 shares of common stock for issuance under the plan, subject to adjustment in certain circumstances. If and to the extent that options and SARs granted

under the plan, or granted under the prior plan and outstanding on the approval date of the plan, terminate, expire or are cancelled, forfeited, exchanged or surrendered after the effective

date of the plan without being exercised or if any share awards, share units, dividend equivalents or other share-based awards are forfeited or terminated, or otherwise not paid in full, after

the effective date of the plan, the shares subject to such grants become available again for purposes of the plan.

Note 4 – 95% of the fair market value on the last day of each six-month offering period.

125