PNC Bank 2006 Annual Report Download - page 84

Download and view the complete annual report

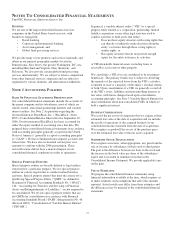

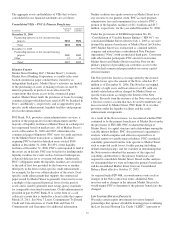

Please find page 84 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.these securities is recognized in net interest income.

Those purchased with the intention of recognizing

short-term profits are classified as trading, carried at

market value and classified as short-term

investments. Both realized and unrealized gains and

losses on trading securities are included in

noninterest income. Marketable equity securities not

classified as trading are designated as securities

available for sale and are carried at fair value with

unrealized gains and losses, net of income taxes,

reflected in accumulated other comprehensive

income or loss. Any unrealized losses that we have

determined to be other-than-temporary are

recognized in the period that the determination is

made.

• Investments in nonmarketable equity securities are

recorded using the cost method of accounting. The

cost method is used for those investments since we

do not have significant influence over the investee.

Under this method, there is no change to the cost

basis unless there is an other-than-temporary decline

in value. If the decline is determined to be other than

temporary, we write down the cost basis of the

investment to a new cost basis that represents

realizable value. The amount of the write-down is

accounted for as a loss included in noninterest

income in the period the determination is made.

Distributions received from income on cost method

investments are included in interest or noninterest

income depending on the type of investment. We

include nonmarketable equity securities in Other

Assets on the Consolidated Balance Sheet.

For investments in limited partnerships, limited liability

companies and other minor investments that are not required

to be consolidated, we use either the cost method or the equity

method. The cost method is described above for

nonmarketable equity securities. We use the cost method for

minor investments in which we have no influence over the

operations of the investee and when cost appropriately reflects

our economic interest in the underlying investment. We use

the equity method for all other general and limited partner

ownership interests and limited liability company investments.

Under the equity method, we record our equity ownership

share of net income or loss of the investee in noninterest

income. Investments described above are included in Equity

Investments on the Consolidated Balance Sheet.

Debt Securities

Debt securities are recorded on a trade-date basis. We classify

debt securities as held to maturity and carry them at amortized

cost if we have the positive intent and ability to hold the

securities to maturity. Debt securities that we purchase for

short-term appreciation or other trading purposes are carried at

market value and classified as short-term investments.

Realized and unrealized gains and losses on trading securities

are included in noninterest income.

Debt securities not classified as held to maturity or trading are

designated as securities available for sale and carried at fair

value with unrealized gains and losses, net of income taxes,

reflected in accumulated other comprehensive income or loss.

Other-than-temporary declines in the fair value of available

for sale debt securities are recognized as a securities loss

included in noninterest income in the period in which the

determination is made. We review all debt securities that are

in an unrealized loss position for other-than-temporary

impairment on a quarterly basis.

We include all interest on debt securities, including

amortization of premiums and accretion of discounts using the

interest method, in net interest income. We compute gains and

losses realized on the sale of debt securities available for sale on

a specific security basis and include them in noninterest income.

L

OANS

A

ND

L

EASES

Except as described below, loans are stated at the principal

amounts outstanding, net of unearned income, unamortized

deferred fees and costs on originated loans, and premiums or

discounts on loans purchased. Interest income related to loans

other than nonaccrual loans is accrued based on the principal

amount outstanding and credited to net interest income as

earned using the interest method. Loan origination fees, direct

loan origination costs, and loan premiums and discounts are

deferred and amortized to income, over periods not exceeding

the contractual life of the loan, using methods that are not

materially different from the interest method.

As of January 1, 2006, we adopted SFAS 155, “Accounting

for Certain Hybrid Financial Instruments – an amendment of

FASB Statements No. 133 and 140,” which was issued in

February 2006. SFAS 155 permits a fair value election for

previously bifurcated hybrid financial instruments on an

instrument-by-instrument basis, clarifies the scope of SFAS

133, “Accounting for Derivative Instruments and Hedging

Activities,” regarding interest-only and principal-only strips,

and provides further guidance on certain issues regarding

beneficial interests in securitized financial assets,

concentrations of credit risk and qualifying special purpose

entities. Beginning January 1, 2006, we elected to account for

certain previously bifurcated hybrid instruments under this

standard. As such, certain loans are accounted for at fair value

with changes in fair value reported in trading revenue. The fair

value of these loans was $216 million, or less than .5% of the

total loan portfolio, at December 31, 2006. The adoption of

SFAS 155 did not have a significant impact on our accounting

for beneficial interests.

We also provide financing for various types of equipment,

aircraft, energy and power systems, and rolling stock through

a variety of lease arrangements. Direct financing leases are

carried at the aggregate of lease payments plus estimated

residual value of the leased property, less unearned income.

Leveraged leases, a form of financing lease, are carried net of

nonrecourse debt. We recognize income over the term of the

74