PNC Bank 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Loan demand and utilization of credit commitments,

• Movement of customer deposits from lower to higher

rate accounts or to off-balance sheet accounts,

• The level of interest rates, and the shape of the

interest rate yield curve,

• The performance of the capital markets, and

• Customer demand for other products and services.

In addition to changes in general economic conditions,

including the direction, timing and magnitude of movement in

interest rates and the performance of the capital markets, our

success in 2007 will depend, among other things, upon:

• Further success in the acquisition, growth and

retention of customers,

• The successful consummation and integration of the

planned Mercantile acquisition,

• Revenue growth,

• A sustained focus on expense management and

efficiency,

• Maintaining strong overall asset quality, and

• Prudent risk and capital management.

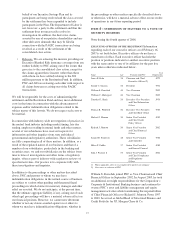

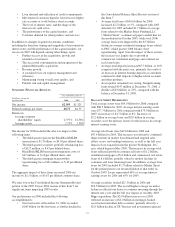

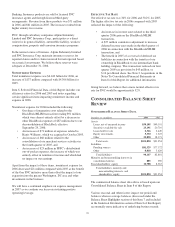

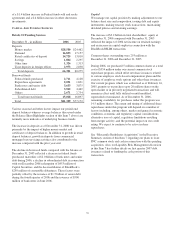

S

UMMARY

F

INANCIAL

R

ESULTS

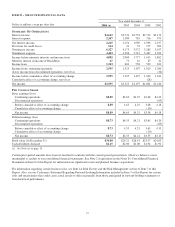

Year ended December 31

In billions, except for

per share data 2006 2005

Net income $2.595 $1.325

Diluted earnings per share $8.73 $4.55

Return on

Average common

shareholders’ equity 27.97% 16.58%

Average assets 2.73% 1.50%

Net income for 2006 included the after-tax impact of the

following items:

• The third quarter gain on the BlackRock/MLIM

transaction of $1.3 billion, or $4.36 per diluted share;

• The third quarter securities portfolio rebalancing loss

of $127 million, or $.43 per diluted share;

• BlackRock/MLIM transaction integration costs of

$47 million, or $.16 per diluted share, and

• The third quarter mortgage loan portfolio

repositioning loss of $31 million, or $.10 per diluted

share.

The aggregate impact of these items increased 2006 net

income by $1.1 billion, or $3.67 per diluted common share.

We refer you to the Consolidated Income Statement Review

portion of the 2005 Versus 2004 section of this Item 7 for

significant items impacting 2005 results.

Our performance in 2006 included the following

accomplishments:

• Our total assets at December 31, 2006 exceeded

$100 billion for the first time, as further detailed in

the Consolidated Balance Sheet Review section of

this Item 7.

• Average total loans of $49.6 billion for 2006

increased $2.2 billion, or 5%, compared with 2005.

Amounts for 2005 included $1.7 billion of average

loans related to the Market Street Funding LLC

(“Market Street”) commercial paper conduit that we

deconsolidated in October 2005, while total 2006

average loans were impacted by the $.5 billion

decline in average residential mortgage loans related

to PNC’s third quarter 2006 balance sheet

repositioning. Apart from the impact of these actions,

the increase was largely due to growth in

commercial, residential mortgage and commercial

real estate loans.

• Average total deposits increased $5.7 billion, or 10%,

compared with the prior year, primarily the result of

an increase in interest-bearing deposits as customers

continued to shift deposits to higher-return accounts

and other products.

• Asset quality remained very strong. Nonperforming

loans totaled $147 million at December 31, 2006, a

decline of $43 million, or 23%, compared with the

balance at December 31, 2005.

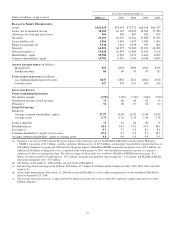

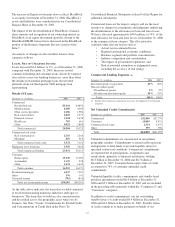

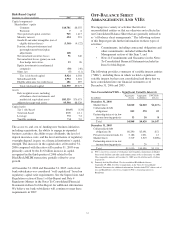

B

ALANCE

S

HEET

H

IGHLIGHTS

Total average assets were $95.0 billion for 2006 compared

with $88.5 billion for 2005. Average interest-earning assets

were $77.7 billion for 2006 compared with $73.0 billion in

2005, an increase of $4.7 billion or 6%. Increases of

$2.2 billion in average loans and $2.0 billion in average

securities were the primary factors for the increase in average

interest-earning assets.

Average total loans were $49.6 billion in 2006 and

$47.4 billion for 2005. This increase was driven by continued

improvements in market loan demand and targeted sales

efforts across our banking businesses, as well as the full year

impact of our expansion into the greater Washington, D.C.

area, which began in May 2005. The increase in average total

loans reflected growth in commercial loans of $1.2 billion,

residential mortgages of $.8 billion and commercial real estate

loans of $.6 billion, partially offset by modest declines in

consumer and lease financing loans. In addition, average total

loans for 2005 included $1.7 billion related to Market Street

for the period prior to our deconsolidation of that entity in

October 2005. Loans represented 64% of average interest-

earning assets for 2006 and 65% for 2005.

Average securities totaled $21.3 billion in 2006 and

$19.3 billion for 2005. The overall higher average securities

balances reflected our desire to continue investing through the

interest rate cycle and the full year impact of our May 2005

Riggs acquisition. The $2.0 billion increase over 2005

reflected an increase of $4.0 billion in mortgage-backed,

asset-backed and other debt securities, partially offset by a

$2.0 billion decline in US Treasury and government agencies

21