PNC Bank 2006 Annual Report Download - page 134

Download and view the complete annual report

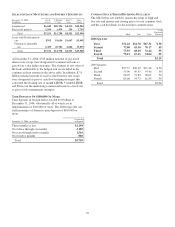

Please find page 134 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.generally accepted accounting principles, and that

receipts and expenditures of the company are being made

only in accordance with authorizations of management

and directors of the company; and (3) provide reasonable

assurance regarding prevention or timely detection of

unauthorized acquisition, use, or disposition of the

company’s assets that could have a material effect on the

financial statements.

Because of the inherent limitations of internal control

over financial reporting, including the possibility of

collusion or improper management override of controls,

material misstatements due to error or fraud may not be

prevented or detected on a timely basis. Also, projections

of any evaluation of the effectiveness of the internal

control over financial reporting to future periods are

subject to the risk that the controls may become

inadequate because of changes in conditions, or that the

degree of compliance with the policies or procedures

may deteriorate.

In our opinion, management’s assessment that the

Company maintained effective internal control over

financial reporting as of December 31, 2006, is fairly

stated, in all material respects, based on the criteria

established in Internal Control-Integrated Framework

issued by the Committee of Sponsoring Organizations of

the Treadway Commission. Also in our opinion, the

Company maintained, in all material respects, effective

internal control over financial reporting as of

December 31, 2006, based on the criteria established in

Internal Control-Integrated Framework issued by the

Committee of Sponsoring Organizations of the Treadway

Commission.

We have also audited, in accordance with the standards

of the Public Company Accounting Oversight Board

(United States), the consolidated balance sheet as of

December 31, 2006 and the related consolidated

statements of income, shareholders’ equity and cash

flows for the year then ended of the Company and our

report dated March 1, 2007 expressed an unqualified

opinion on those financial statements and included

explanatory paragraphs regarding the Company’s

adoption of Statement of Financial Accounting Standard

No. 158, “Employers’ Accounting for Defined Benefit

Pension and Other Postretirement Plans – an amendment

of FASB Statements No. 87,88,106, and 132(R)” and the

Company’s use of the equity method of accounting to

recognize its investment in BlackRock, Inc.

/s/ Deloitte & Touche LLP

Pittsburgh, Pennsylvania

March 1, 2007

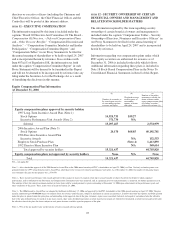

(c) Internal Controls and Disclosure Controls and

Procedures

As of December 31, 2006, we performed an evaluation

under the supervision and with the participation of our

management, including the Chairman and Chief

Executive Officer and the Chief Financial Officer, of the

effectiveness of the design and operation of our

disclosure controls and procedures and of changes in our

internal control over financial reporting.

Based on that evaluation, our management, including the

Chairman and Chief Executive Officer and the Chief

Financial Officer, concluded that our disclosure controls

and procedures were effective as of December 31, 2006,

and that there has been no change in internal control over

financial reporting that occurred during the fourth quarter

of 2006 that has materially affected, or is reasonably

likely to materially affect, our internal control over

financial reporting.

ITEM

9B - OTHER INFORMATION

None.

PART III

ITEM

10 – DIRECTORS, EXECUTIVE OFFICERS AND

CORPORATE GOVERNANCE

Certain of the information regarding our directors, nominees

for director, executive officers, Audit Committee (and Audit

Committee financial experts), and shareholder nomination

process required by this item is included under the captions

“Election of Directors – Information Concerning Nominees,”

“Transactions Involving Directors And Executive Officers –

Family Relationships,” and “Corporate Governance At PNC –

The Audit Committee –Our Code of Business Conduct and

Ethics,” and – “Shareholder Proposals And Nominations”in

our Proxy Statement to be filed for the annual meeting of

shareholders to be held on April 24, 2007 and is incorporated

herein by reference. In accordance with Item 407(d)(3) of

Regulation S-K, the information set forth under the caption

“Report of the Audit Committee” in such Proxy Statement

will be deemed to be furnished in this Report and will not be

deemed to be incorporated by reference into any filing under

the Securities Act or the Exchange Act as a result of

furnishing the disclosure in this manner.

Information regarding our compliance with Section 16(a) of

the Securities Exchange Act of 1934 is included under the

caption “Section 16(a) Beneficial Ownership Reporting

Compliance” in our Proxy Statement to be filed for the annual

meeting of shareholders to be held on April 24, 2007 and is

incorporated herein by reference.

Additional information regarding our executive officers and

our directors is included in Part I of this Report under the

captions “Executive Officers of the Registrant” and “Directors

of the Registrant.”

Our PNC Code of Business Conduct and Ethics is available on

our corporate website at www.pnc.com under “About PNC –

Investor Relations – Corporate Governance.” In addition, any

future amendments to, or waivers from, a provision of the

PNC Code of Business Conduct and Ethics that applies to our

124