PNC Bank 2006 Annual Report Download - page 35

Download and view the complete annual report

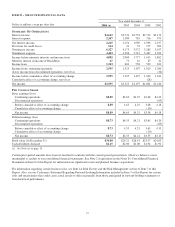

Please find page 35 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Consumer services fees increased $72 million, to

$365 million, in 2006 compared with 2005. Higher fees

reflected the impact of consolidating our merchant services

activities in the fourth quarter of 2005 as a result of our

increased ownership interest in the merchant services

business. The increase was also due to higher debit card

revenues resulting from higher transaction volumes, our

expansion into the greater Washington, DC area, and pricing

actions related to the One PNC initiative. These factors were

partially offset by lower ATM surcharge revenue in 2006

resulting from changing customer behavior and a strategic

decision to reduce the out-of-footprint ATM network.

Corporate services revenue was $626 million for 2006,

compared with $485 million in 2005. The increase in

corporate services revenue compared with the prior year was

primarily due to the full year benefit in 2006 of our October

2005 acquisition of Harris Williams.

Equity management (private equity) net gains on portfolio

investments totaled $107 million in 2006 and $96 million for

2005. Based on the nature of private equity activities, net

gains or losses may be volatile from period to period.

Net securities losses totaled $207 million in 2006 and

$41 million in 2005. Our discussion under the Consolidated

Balance Sheet Review section of this Item 7 provides

additional information regarding actions we took during the

third quarter of 2006 that resulted in the sale of approximately

$6 billion of securities available for sale at an aggregate pretax

loss of $196 million during that quarter.

Noninterest revenue from trading activities, which is primarily

customer-related, totaled $183 million in 2006 compared with

$157 million for 2005. We provide additional information on

our trading activities under Market Risk Management –

Trading Risk in the Risk Management section of this Item 7.

Net gains related to our BlackRock investment were

$2.066 billion for 2006, comprised of the $2.078 billion gain

on the BlackRock/MLIM transaction partially offset by a

fourth quarter mark-to-market adjustment of $12 million on

our BlackRock long-term incentive plan (“LTIP”) obligation.

See the BlackRock portion of the Business Segments Review

section of Item 7 of this Report for further information.

Other noninterest income decreased $57 million, to

$315 million, in 2006 compared with 2005. Other noninterest

income for 2006 included the impact of the following:

• A $48 million pretax loss incurred in the third quarter

of 2006 in connection with the rebalancing of our

residential mortgage portfolio. Further information

on these actions is included in the Loans Held For

Sale portion of the Consolidated Balance Sheet

Review section of this Item 7;

• A $20 million charge for an accounting adjustment

related to our trust preferred securities hedges

recognized during the third quarter of 2006; and

• Lower other equity management income.

These factors were partially offset by higher gains on sales of

education loans held for sale in 2006 compared with the prior

year.

Other noninterest income typically fluctuates from period to

period depending on the nature and magnitude of transactions

completed.

P

RODUCT

R

EVENUE

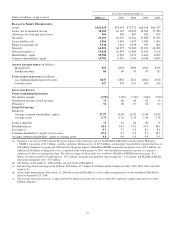

In addition to credit products to commercial customers,

Corporate & Institutional Banking offers treasury

management and capital markets-related products and

services, commercial loan servicing, and equipment leasing

products that are marketed by several businesses across PNC.

Treasury management revenue, which includes fees as well as

net interest income from customer deposit balances, totaled

$424 million for 2006 and $410 million for 2005. The higher

revenue in 2006 reflected continued expansion and client

utilization of commercial payment card services, strong

revenue growth in various electronic payment and information

services, and a steady increase in business-to-business

processing volumes, which more than offset the reduced net

interest margin due to rising rates.

Revenue from capital markets-related products and services,

including mergers and acquisitions advisory activities, was

$283 million for 2006 compared with $175 million for 2005.

The acquisition of Harris Williams in October 2005 together

with improved customer and proprietary trading activities

drove the increase in capital markets revenue in the

comparison.

Midland Loan Services offers servicing, real estate advisory

and technology solutions for the commercial real estate

finance industry. Midland’s revenue, which includes servicing

fees and net interest income from servicing portfolio deposit

balances, totaled $184 million for 2006 and $144 million for

2005. Revenue growth was primarily driven by growth in the

commercial mortgage servicing portfolio and related services.

As a component of our advisory services to clients, we

provide a select set of insurance products to fulfill specific

customer financial needs. Primary insurance offerings include:

• Annuities,

• Life,

• Credit life,

• Health,

• Disability, and

• Commercial lines coverage.

Client segments served by these insurance solutions include

those in Retail Banking and Corporate & Institutional

25