PNC Bank 2006 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

N

OTE

20 I

NCOME

T

AXES

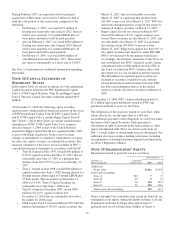

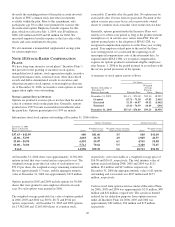

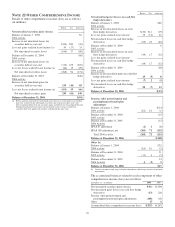

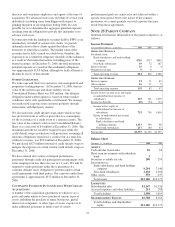

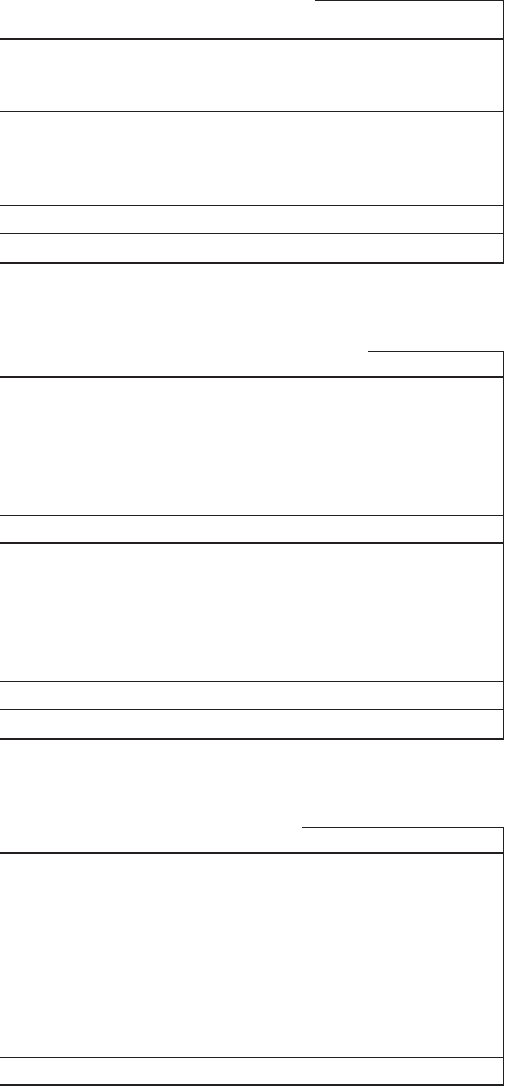

The components of income taxes are as follows:

Year ended December 31

In millions 2006 2005 2004

Current

Federal $565 $550 $720

State 46 53 12

Total current 611 603 732

Deferred

Federal 752 (12) (192)

State 13 (2)

Total deferred 752 1 (194)

Total $1,363 $604 $538

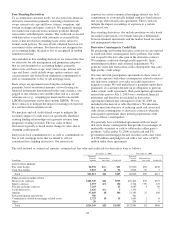

Significant components of deferred tax assets and liabilities

are as follows:

December 31 - in millions 2006 2005

Deferred tax assets

Allowance for loan and lease losses $258 $311

Net unrealized securities losses 52 135

Compensation and benefits 296 56

Loan valuation 610

Other 277 240

Total deferred tax assets 889 752

Deferred tax liabilities

Leasing 1,025 1,078

Depreciation 75 103

Goodwill 205 206

BlackRock basis difference 1,166 6

Other 56 15

Total deferred tax liabilities 2,527 1,408

Net deferred tax liability $1,638 $656

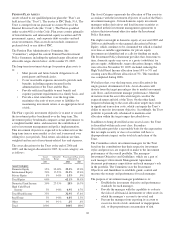

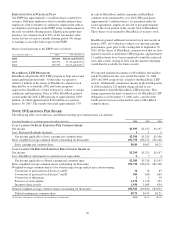

A reconciliation between the statutory and effective tax rates

follows:

Year ended December 31 2006 2005 2004

Statutory tax rate 35.0% 35.0% 35.0%

Increases (decreases) resulting from

State taxes .8 2.1 .4

Tax-exempt interest (.3) (1.1) (.7)

Life insurance (.6) (1.0) (1.1)

Tax credits (.9) (1.8) (2.3)

Reversal of deferred tax liabilities –

BlackRock basis allocation (2.3)

Other (.7) (1.0)

Effective tax rate 34.0% 30.2% 30.3%

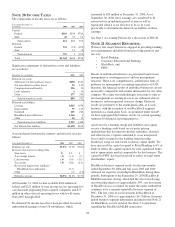

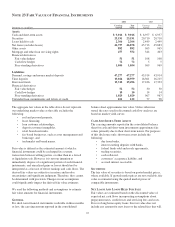

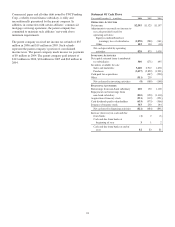

At December 31, 2006 we had available $104 million of

federal and $221 million of state income tax net operating loss

carryforwards originating from acquired companies and $73

million in other state net operating losses which will expire

from 2007 through 2026.

No deferred US income taxes have been provided on certain

undistributed earnings of non-US subsidiaries, which

amounted to $39 million at December 31, 2006. As of

September 30, 2006, these earnings are considered to be

reinvested for an indefinite period of time or will be

repatriated when it is tax effective to do so. It is not

practicable to determine the deferred tax liability on these

earnings.

See Note 1 Accounting Policies for a discussion of FIN 48.

N

OTE

21 S

EGMENT

R

EPORTING

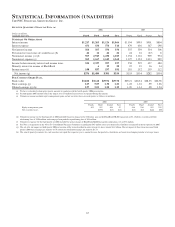

We have four major businesses engaged in providing banking,

asset management and global fund processing products and

services:

• Retail Banking,

• Corporate & Institutional Banking,

• BlackRock, and

• PFPC.

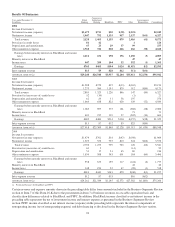

Results of individual businesses are presented based on our

management accounting practices and our management

structure. There is no comprehensive, authoritative body of

guidance for management accounting equivalent to GAAP;

therefore, the financial results of individual businesses are not

necessarily comparable with similar information for any other

company. We refine our methodologies from time to time as

our management accounting practices are enhanced and our

businesses and management structure change. Financial

results are presented, to the extent practicable, as if each

business, with the exception of our BlackRock segment,

operated on a stand-alone basis. As permitted under GAAP,

we have aggregated the business results for certain operating

segments for financial reporting purposes.

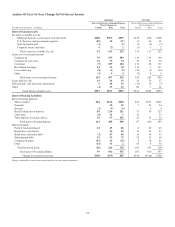

Assets receive a funding charge and liabilities and capital

receive a funding credit based on a transfer pricing

methodology that incorporates product maturities, duration

and other factors. Capital is intended to cover unexpected

losses and is assigned to the banking and processing

businesses using our risk-based economic capital model. We

have increased the capital assigned to Retail Banking to 6% of

funds to reflect the capital required for well-capitalized banks

and to approximate market comparables for this business. The

capital for PFPC has been increased to reflect its legal entity

shareholders’ equity.

BlackRock business segment results for the nine months

ended September 30, 2006 and full years 2005 and 2004

reflected our majority ownership in BlackRock during those

periods. Subsequent to the September 29, 2006 BlackRock/

MLIM transaction closing, which had the effect of reducing

our ownership interest to approximately 34%, our investment

in BlackRock was accounted for under the equity method but

continues to be a separate reportable business segment of

PNC. The fair value of our investment in BlackRock at

December 31, 2006 was approximately $6.7 billion. Our prior

period business segment information included in this Note 21

for BlackRock was not restated. See Note 2 Acquisitions

regarding the BlackRock/MLIM transaction.

108