PNC Bank 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

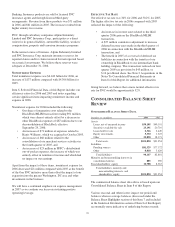

securities. Our third quarter 2006 securities portfolio

rebalancing actions are further described in the Consolidated

Balance Sheet Review section of this Item 7. Securities

comprised 27% of average interest-earning assets for 2006

and 26% for 2005.

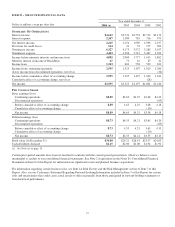

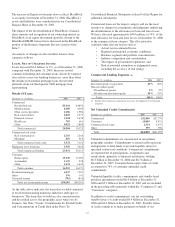

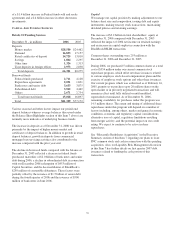

Average total deposits were $63.3 billion for 2006 compared

with $57.6 billion for 2005. The increase in average total

deposits was driven primarily by the impact of higher

certificates of deposit, money market account and noninterest-

bearing deposit balances, and by higher Eurodollar deposits.

Growth in deposits from commercial mortgage loan servicing

activities also contributed to the increase compared with 2005.

Similar to its impact on average loans and securities described

above, our expansion into the greater Washington, DC area

also contributed to the increase in average total deposits.

Average total deposits represented 67% of total sources of

funds for 2006 and 65% for 2005. Average transaction

deposits were $42.3 billion for 2006 and $39.5 billion for

2005.

Average borrowed funds were $15.0 billion for 2006 and

$16.2 billion for 2005. Commercial paper declined

$2.1 billion in the comparison as 2005 included $1.8 billion of

commercial paper related to Market Street, which was

deconsolidated in October 2005. Apart from the decrease in

commercial paper, average borrowed funds increased

$.9 billion in 2006 compared with the prior year primarily due

to net increases in fed funds purchased.

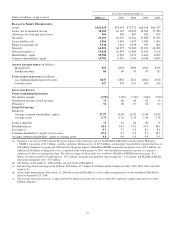

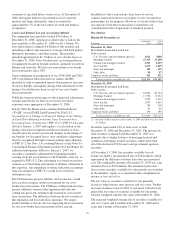

Shareholders’ equity totaled $10.8 billion at December 31,

2006, compared with $8.6 billion at December 31, 2005. The

increase of $2.2 billion in total shareholders’ equity compared

with December 31, 2005 reflected the impact of 2006 net

income on retained earnings and an increase in capital surplus

in connection with the BlackRock/MLIM transaction.

L

INE OF

B

USINESS

H

IGHLIGHTS

We refer you to Item 1 of this Report for an overview of our

business segments in Review of Lines of Business and to the

“Results of Businesses – Summary” table in the Business

Segments Review section of this Item 7. Total business

segment earnings were $1.5 billion for 2006 and $1.4 billion

for 2005.

See Note 21 Segment Reporting in the Notes To Consolidated

Financial Statements in Item 8 of this Report for a

reconciliation of total business segment earnings to total PNC

consolidated earnings as reported on a GAAP basis.

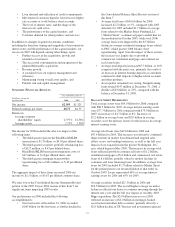

Retail Banking

Retail Banking’s 2006 earnings increased $83 million, or

12%, to $765 million compared with 2005. Revenue increased

9% and noninterest expense increased 6% compared with the

prior year, creating positive operating leverage. The increase

in earnings was driven by improved fee income from

customers, higher taxable-equivalent net interest income

fueled by continued customer and balance sheet growth, and a

sustained focus on expense management. Positive operating

leverage allows for annual earnings growth as well as the

ability to reinvest in the business for future growth.

Corporate & Institutional Banking

Earnings from Corporate & Institutional Banking for 2006

totaled $463 million compared with $480 million for 2005.

This decline was primarily attributable to the year-over- year

$72 million change in the provision for credit losses

principally as a result of a $53 million loan recovery

recognized in the second quarter of 2005. The provision for

credit losses was $42 million in 2006. In addition, the

comparison was impacted by a $137 million increase in total

revenue while noninterest expenses grew by $91 million in

2006 compared with 2005.

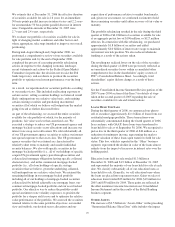

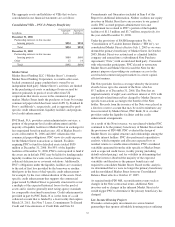

BlackRock

Our BlackRock business segment earned $187 million for

2006 and $152 million for 2005. These amounts represent

BlackRock’s contribution to PNC’s earnings, including the

impact of minority interest expense, as applicable, and

additional income taxes recognized by PNC related to

BlackRock’s earnings. For our BlackRock business segment

reporting presentation in this Item 7, we have reflected our

portion of the 2006 BlackRock/MLIM integration costs in

“Other” rather than in earnings from our BlackRock

investment. BlackRock business segment earnings for 2006

reflected higher investment advisory and administration fees

due to an increase in assets under management and increased

performance fees. These factors more than offset the increase

in expense due to increased compensation and benefits and

higher general and administration expense, and a one-time

expense of $34 million incurred during the first quarter of

2006 related to the January 2005 acquisition of State Street

Research and Management.

22