PNC Bank 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Equity management (private equity) net gains on portfolio

investments totaled $96 million for 2005 and $67 million for

2004.

Net securities losses amounted to $41 million for 2005

compared with net securities gains of $55 million in 2004. In

late April and early May 2005 we sold $2.1 billion of

securities available for sale and terminated $1.0 billion of

resale agreements that were most sensitive to extension risk

due to rising short-term interest rates. We also purchased

$2.1 billion of securities with higher yields and lower

extension risk. These transactions resulted in realized net

securities and other losses of approximately $31 million.

Noninterest revenue from trading activities totaled

$157 million for 2005 and $113 million for 2004. While

customer activity represented the majority of trading revenue,

the increase compared with 2004 was primarily the result of

proprietary trading activities. We provide additional

information on our trading activities under Market Risk

Management – Trading Risk in the Risk Management section

of this Item 7.

Other noninterest income decreased $1 million, to

$372 million, in 2005 compared with 2004. Other noninterest

income typically fluctuates from period to period depending

on the nature and magnitude of transactions completed.

Other noninterest income for 2005 included the following

pretax items:

• A $33 million gain related to contributions of

BlackRock stock to the PNC Foundation,

transactions that also impacted noninterest expense,

and

• Income related to the 2005 SSRM and Riggs

acquisitions.

The factors above offset the impact of the following pretax

gains in 2004:

• A first quarter $34 million gain related to the sale of

our modified coinsurance contracts, and

• A second quarter $13 million gain recognized in

connection with BlackRock’s sale of its interest in

Trepp LLC, a provider of commercial mortgage-

backed security information, analytics and

technology.

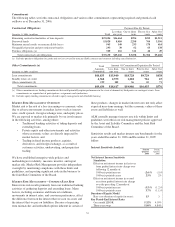

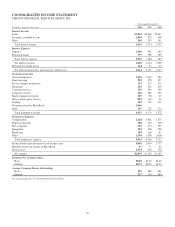

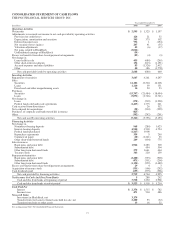

Noninterest Expense

Total noninterest expense was $4.306 billion for 2005, an

increase of $594 million compared with 2004. The efficiency

ratio was 68% for 2005 and 67% for 2004.

Noninterest expense for 2005 included the following:

• An increase of $325 million in BlackRock non-LTIP

operating expenses that reflected the impact of costs

resulting from the first quarter 2005 SSRM

acquisition and other investments to fund growth;

• Costs totaling approximately $132 million resulting

from our Riggs acquisition, including approximately

$16 million of integration costs;

• BlackRock LTIP charges of $64 million;

• Implementation costs totaling $53 million related to

the One PNC initiative;

• Contributions of BlackRock stock to the PNC

Foundation of $40 million; and

• Costs totaling $17 million related to the Harris

Williams acquisition.

The effect of these increases was partially offset by cost

reductions of approximately $90 million realized in 2005 from

the One PNC initiative. The impact of the Riggs integration

and One PNC implementation costs was reflected in several

noninterest expense items in the Consolidated Income

Statement.

Noninterest expense of $3.712 billion for 2004 included a

$110 million charge associated with the BlackRock LTIP and

conversion-related and other nonrecurring costs totaling

approximately $11 million related to our acquisition of United

National Bancorp, Inc.

Apart from the impact of these items, noninterest expense

increased $174 million, or 5%, in 2005 compared with 2004.

These higher expenses were driven by investments in our

businesses and increased sales incentives.

E

FFECTIVE

T

AX

R

ATE

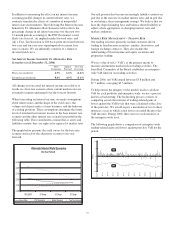

Our effective tax rate was 30.2% for 2005 and 30.3% for

2004. The low effective tax rate for 2005 was primarily

attributable to the impact of the reversal of deferred tax

liabilities that year in connection with the transfer of our

ownership in BlackRock described under “Summary Results”

above.

The following favorably impacted the effective tax rate for

2004:

• A reduced state and local tax expense due to tax

benefits of $18 million recorded in connection with

New York state and city audit findings, primarily

associated with BlackRock, and

• A $14 million reduction in income tax expense

following our determination that we no longer

required an income tax reserve related to bank-owned

life insurance.

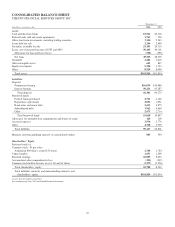

C

ONSOLIDATED

B

ALANCE

S

HEET

R

EVIEW

Loans

Loans increased $5.6 billion, or 13%, as of December 31,

2005 compared with December 31, 2004. The increase in total

loans reflected the following, in part due to our expansion into

the greater Washington, DC market beginning in May 2005:

• Residential mortgage loans increased $2.5 billion,

and

61