PNC Bank 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$200 million Floating Rate Junior Subordinated Notes issued

on June 9, 1998. We agreed in the Covenant that neither we

nor our subsidiaries (other than PNC Bank, N.A. and its

subsidiaries) would purchase the Trust Securities, the LLC

Preferred Securities or the PNC Bank Preferred Stock

(collectively, the “Covenant Securities”) unless: (i) we have

received the prior approval of the Federal Reserve Board, if

such approval is then required by the Federal Reserve Board

and (ii) during the 180-day period prior to the date of

purchase, we or our subsidiaries, as applicable, have received

proceeds from the sale of Qualifying Securities in the amounts

specified in the Covenant (which amounts will vary based on

the type of securities sold). “Qualifying Securities” means

debt and equity securities having terms and provisions

specified in the Covenant and that, generally described, are

intended to contribute to our capital base in a manner that is

similar to the contribution to our capital base made by the

Covenant Securities. The Covenant does not apply to

redemptions of the Covered Securities by the issuers of those

securities. We filed a copy of the Covenant with the SEC as

Exhibit 99.1 to PNC’s Form 8-K filed on December 8, 2006.

PNC Bank, N.A. has contractually committed to PNC

Preferred Funding Trust I that if full dividends are not paid in

a dividend period on the Trust Securities, LLC Preferred

Securities or any other parity equity securities issued by the

LLC, neither PNC Bank, N. A. nor its subsidiaries will declare

or pay dividends or other distributions with respect to, or

redeem, purchase or acquire or make a liquidation payment

with respect to, any of its equity capital securities during the

next succeeding dividend period (other than to holders of the

LLC Preferred Securities and any parity equity securities

issued by the LLC) except: (i) in the case of dividends payable

to subsidiaries of PNC Bank, N.A., to PNC Bank, N.A. or

another wholly-owned subsidiary of PNC Bank, N.A. or (ii) in

the case of dividends payable to persons that are not

subsidiaries of PNC Bank, N.A., to such persons only if,

(A) in the case of a cash dividend, PNC has first irrevocably

committed to contribute amounts at least equal to such cash

dividend or (B) in the case of in-kind dividends payable by

PNC REIT Corp., PNC has committed to purchase such

in-kind dividend from the applicable PNC REIT Corp. holders

in exchange for a cash payment representing the market value

of such in-kind dividend, and PNC has committed to

contribute such in-kind dividend to PNC Bank. N.A.

B

USINESS

S

EGMENTS

R

EVIEW

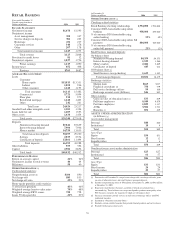

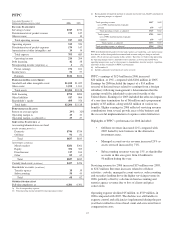

We have four major businesses engaged in providing banking,

asset management and global fund processing services: Retail

Banking; Corporate & Institutional Banking; BlackRock; and

PFPC.

Certain of our products and services are offered through

Corporate & Institutional Banking and marketed by several

businesses across PNC, such as our treasury management

activities, which include cash and investment management,

receivables management, disbursement services, funds

transfer services, information reporting, and global trade

services; capital markets-related products and services, which

include foreign exchange, derivatives, loan syndications,

securities underwriting, securities sales and trading, and

mergers and acquisitions advisory and related services to

middle-market companies; commercial loan servicing, real

estate advisory and technology solutions for the commercial

real estate finance industry; and equipment leasing products.

Results of individual businesses are presented based on our

management accounting practices and our operating structure.

There is no comprehensive, authoritative body of guidance for

management accounting equivalent to GAAP; therefore, the

financial results of individual businesses are not necessarily

comparable with similar information for any other company.

We refine our methodologies from time to time as our

management accounting practices are enhanced and our

businesses and management structure change. Financial

results are presented, to the extent practicable, as if each

business operated on a stand-alone basis. As permitted under

GAAP, we have aggregated the business results for certain

operating segments for financial reporting purposes.

Our capital measurement methodology is based on the concept

of economic capital for our banking businesses. However, we

have increased the capital assigned to Retail Banking to 6% of

funds to reflect the capital required for well-capitalized banks

and to approximate market comparables for this business. The

capital for PFPC has been increased to reflect its legal entity

shareholders’ equity.

BlackRock business segment results for the nine months

ended September 30, 2006 and full year 2005 reflected our

majority ownership in BlackRock during those periods.

Subsequent to the September 29, 2006 BlackRock/MLIM

transaction closing, our investment in BlackRock and capital

position increased significantly but our ownership interest was

reduced to approximately 34%. BlackRock is now accounted

for under the equity method and continues to be a separate

reportable business segment. For our business segment

reporting presentation, we have reclassified historical

BlackRock segment results to conform to our current

approach, as further described on page 41.

We have allocated the allowances for loan and lease losses

and unfunded loan commitments and letters of credit based on

our assessment of risk inherent in the loan portfolios. Our

allocation of the costs incurred by operations and other

support areas not directly aligned with the businesses is

primarily based on the use of services.

Total business segment financial results differ from total

consolidated results. The impact of these differences is

reflected in the “Intercompany Eliminations” and “Other”

categories. “Intercompany Eliminations” reflects activities

conducted among our businesses that are eliminated in the

consolidated results. “Other” includes residual activities that

do not meet the criteria for disclosure as a separate reportable

34