PNC Bank 2006 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

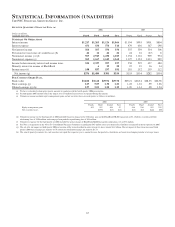

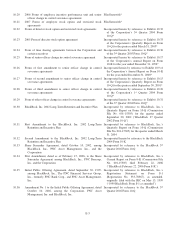

L

OANS

O

UTSTANDING

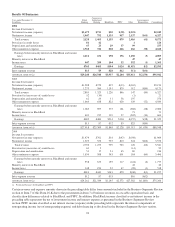

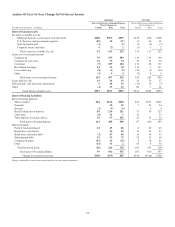

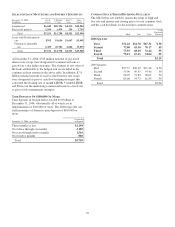

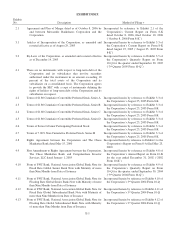

December 31 - in millions 2006 2005 2004 2003 2002

Commercial $20,584 $19,325 $17,438 $15,082 $14,987

Commercial real estate 3,532 3,162 1,980 1,824 2,267

Consumer 16,515 16,173 15,606 11,855 9,854

Residential mortgage 6,337 7,307 4,772 2,886 3,921

Lease financing 3,556 3,628 4,096 5,147 5,081

Other 376 341 505 518 415

Total loans 50,900 49,936 44,397 37,312 36,525

Unearned income (795) (835) (902) (1,009) (1,075)

Total loans, net of unearned income (a) $50,105 $49,101 $43,495 $36,303 $35,450

(a) Includes $2.3 billion at December 31, 2004 and $2.2 billion at December 31, 2003 related to Market Street, which was deconsolidated effective October 17, 2005.

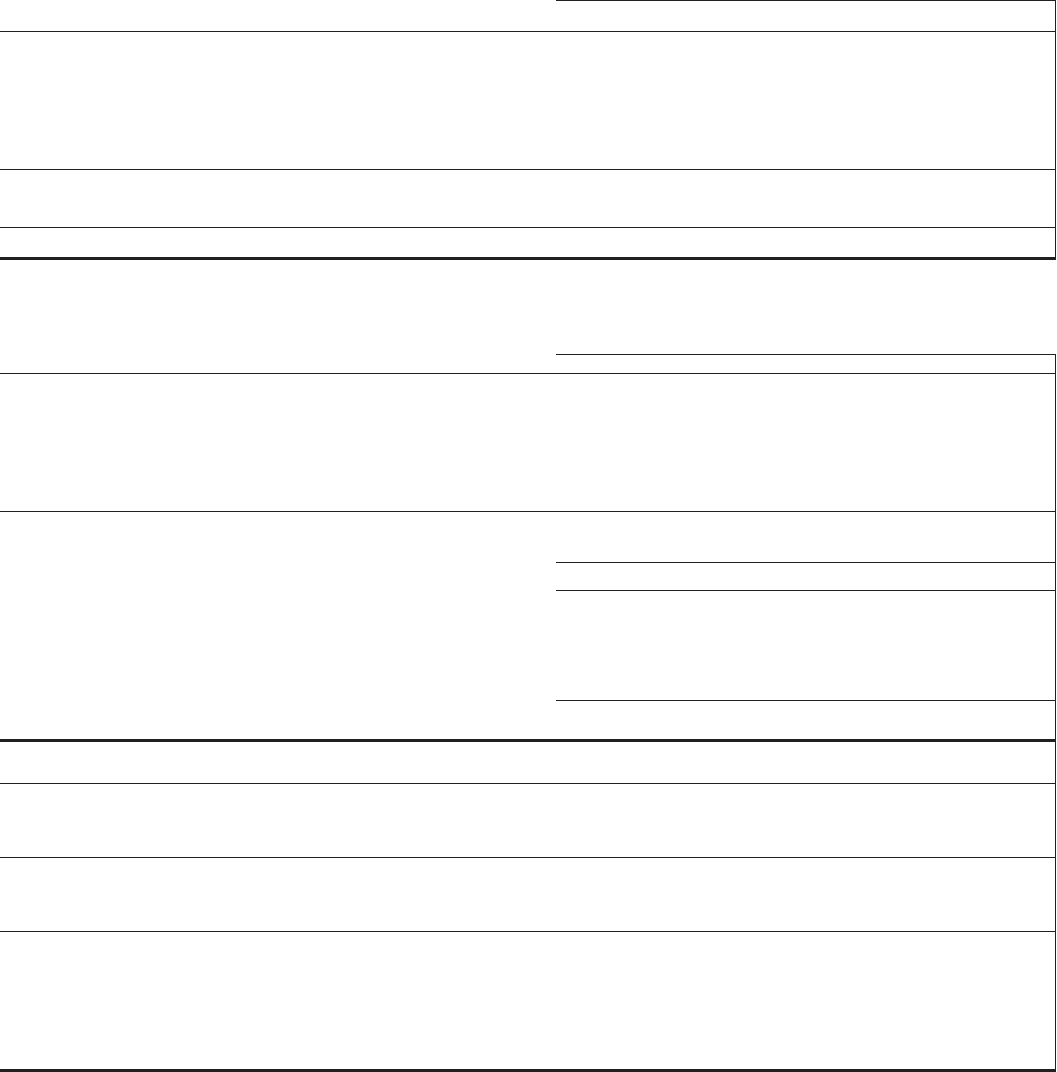

N

ONPERFORMING

A

SSETS AND

R

ELATED

I

NFORMATION

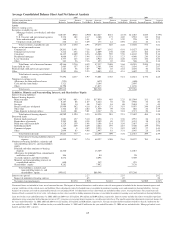

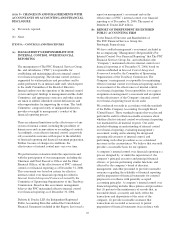

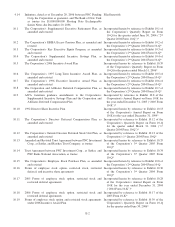

December 31 - dollars in millions 2006 2005 2004 2003 2002

Nonaccrual loans

Commercial $109 $134 $89 $213 $226

Lease financing 117 5 11 57

Commercial real estate 12 14 14 6 7

Consumer 13 10 11 11 11

Residential mortgage 12 15 21 24 7

Total nonaccrual loans $147 $190 $140 $265 $308

Troubled debt restructured loan 311

Total nonperforming loans 147 190 143 266 309

Nonperforming loans held for sale (a) 1 3 27 97

Foreclosed and other assets

Lease 12 13 14 17

Residential mortgage 10 910 96

Other 23596

Total foreclosed and other assets 24 25 29 35 12

Total nonperforming assets (b) $171 $216 $175 $328 $418

Nonperforming loans to total loans .29% .39% .33% .73% .87%

Nonperforming assets to total loans, loans held for sale and foreclosed assets .33 .42 .39 .87 1.13

Nonperforming assets to total assets .17 .23 .22 .48 .63

Interest on nonperforming loans

Computed on original terms $15 $16 $11 $29 $23

Recognized 452510

Past due loans

Accruing loans past due 90 days or more $50 $46 $49 $57 $115

As a percentage of total loans .10% .09% .11% .16% .32%

Past due loans held for sale

Accruing loans held for sale past due 90 days or more $9 $47 $9 $6 $32

As a percentage of total loans held for sale .38% 1.92% .54% .43% 1.99%

(a) Includes $1 million, $2 million, $10 million, and $17 million of troubled debt restructured loans held for sale at December 31, 2005, 2004, 2003 and 2002, respectively.

(b) Excludes equity management assets that are carried at estimated fair value of $11 million (including $4 million of troubled debt restructured assets) at December 31, 2006, $25 million

(including $7 million of troubled debt restructured assets) at December 31, 2005, $32 million (including $11 million of troubled debt restructured assets) at December 31, 2004, $37

million (including $5 million of troubled debt restructured assets) at December 31, 2003 and $40 million (including $12 million of troubled debt restructured assets) at December 31,

2002.

120