PNC Bank 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

“Accounting by Creditors for Impairment of a Loan.” All

nonperforming loans are considered impaired under SFAS

114. Specific allowances for individual loans over a set dollar

threshold are determined by our Special Asset Committee

based on an analysis of the present value of expected future

cash flows from the loans discounted at their effective interest

rate, observable market price, or the fair value of the

underlying collateral. We establish specific allowance on all

other impaired loans based on the loss given default credit risk

rating.

Allocations to non-impaired commercial and commercial real

estate loans (pool reserve allocations) are assigned to pools of

loans as defined by our business structure and are based on

internal probability of default and loss given default credit risk

ratings.

Key elements of the pool reserve methodology include:

• Probability of default (“PD”), which is based on

historical default analyses and is derived from the

borrower’s internal PD credit risk rating and

expected loan term;

• Exposure at default (“EAD”), which is derived from

historical default data; and

• Loss given default (“LGD”), which is based on

historical loss data, collateral value and other

structural factors that may affect our ultimate ability

to collect on the loan and is derived from the loan’s

internal LGD credit risk rating.

Our pool reserve methodology is sensitive to changes in key

risk parameters such as PDs, LGDs and EADs. In general, a

given change in any of the major risk parameters will have a

corresponding change in the pool reserve allocations for

non-impaired commercial loans. Our commercial loans are the

largest category of credits and are most sensitive to changes in

the key risk parameters and pool reserve loss rates. To

illustrate, if we increase the pool reserve loss rates by 5% for

all categories of non-impaired commercial loans, then the

aggregate of the allowance for loan and lease losses and

allowance for unfunded loan commitments and letters of

credit would increase by $29 million. Additionally, other

factors such as the rate of migration in the severity of problem

loans or changes in the maturity distribution of the loans will

contribute to the final pool reserve allocations.

We make consumer (including residential mortgage) loan

allocations at a total portfolio level by consumer product line

based on historical loss experience. We compute a four-

quarter average loss rate from net charge-offs for the prior

four quarters as a percentage of the average loans outstanding

in those quarters. We apply this loss rate to loans outstanding

at the end of the current period to determine the consumer

loan allocation.

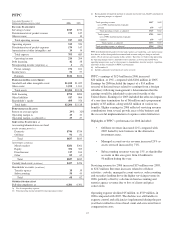

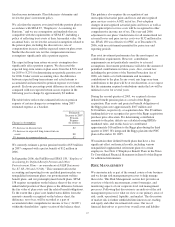

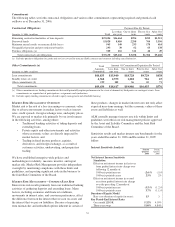

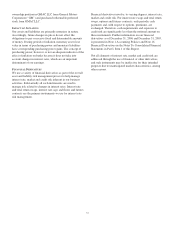

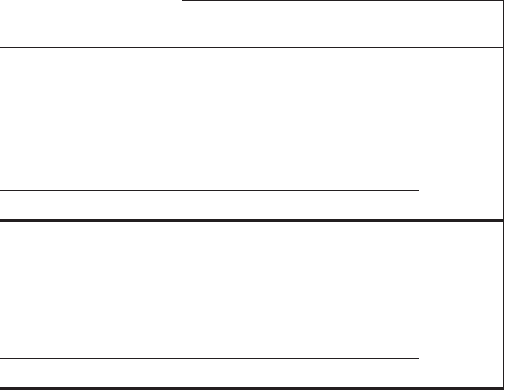

Charge-Offs And Recoveries

Year ended December 31

Dollars in millions Charge-offs Recoveries

Net

Charge-offs

(Recoveries)

Percent of

Average

Loans

2006

Commercial $108 $19 $ 89 .44%

Commercial real estate 3 1 2 .06

Consumer 52 15 37 .23

Residential mortgage 3 3 .04

Lease financing 14 5 9 .32

Total $180 $40 $140 .28

2005

Commercial (a) $ 52 $82 $ (30) (.16)%

Commercial real estate 1 1

Consumer 45 15 30 .19

Residential mortgage 2 2 .03

Lease financing 29 1 28 .95

Total $129 $99 $ 30 .06

(a) Includes a $53 million loan recovery.

We establish reserves to provide coverage for probable losses

not considered in the specific, pool and consumer reserve

methodologies, such as, but not limited to, industry

concentrations and conditions, credit quality trends, recent

loss experience in particular sectors of the portfolio, ability

and depth of lending management, changes in risk selection

and underwriting standards and the timing of available

information. The amount of reserves for these qualitative

factors is assigned to loan categories and to business segments

primarily based on the relative specific and pool allocation

amounts. The amount of reserve allocated for qualitative

factors represented 8.0% of the total allowance and .09% of

total loans at December 31, 2006.

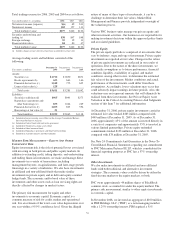

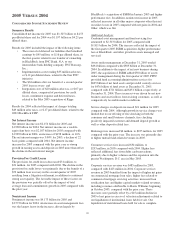

The provision for credit losses for the year ended

December 31, 2006 and the evaluation of the allowances for

loan and lease losses and unfunded loan commitments and

letters of credit as of December 31, 2006 reflected loan

growth, changes in loan portfolio composition, the impact of

refinements to our reserve methodology, and changes in asset

quality. The provision includes amounts for probable losses on

loans and credit exposure related to unfunded loan

commitments and letters of credit.

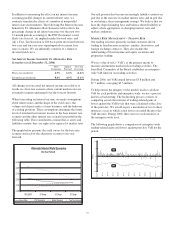

We do not expect to sustain asset quality at its current level.

However, based on the assets we currently hold and current

business trends and activities, we believe that overall asset

quality will remain strong by historical standards for at least

the near term. This outlook, combined with expected loan

growth, may result in an increase in the allowance for loan

and lease losses in future periods.

The allowance as a percent of nonperforming loans was 381%

and as a percent of total loans was 1.12% at December 31,

50