PNC Bank 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

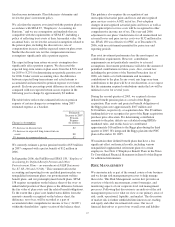

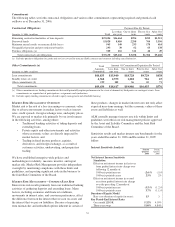

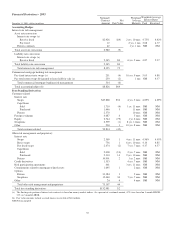

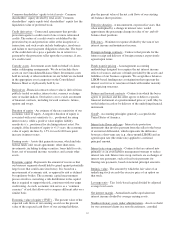

Commitments

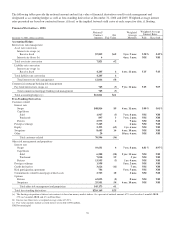

The following tables set forth contractual obligations and various other commitments representing required and potential cash

outflows as of December 31, 2006.

Contractual Obligations Payment Due By Period

December 31, 2006 - in millions Total

Less than

one year

One to three

years

Four to five

years

After five

years

Remaining contractual maturities of time deposits $19,024 $16,464 $994 $255 $1,311

Borrowed funds 15,028 8,410 2,298 764 3,556

Minimum annual rentals on noncancellable leases 965 140 233 178 414

Nonqualified pension and post retirement benefits 293 30 62 63 138

Purchase obligations (a) 320 116 111 44 49

Total contractual cash obligations $35,630 $25,160 $3,698 $1,304 $5,468

(a) Includes purchase obligations for goods and services covered by noncancellable contracts and contracts including cancellation fees.

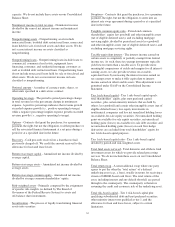

Other Commitments (a) Total

Amounts

Committed

Amount Of Commitment Expiration By Period

December 31, 2006 - in millions

Less than

one year

One to three

years

Four to five

years

After five

years

Loan commitments $44,835 $15,940 $18,728 $9,729 $438

Standby letters of credit 4,360 2,375 1,202 716 67

Other commitments (b) 239 102 56 10 71

Total commitments $49,434 $18,417 $19,986 $10,455 $576

(a) Other commitments are funding commitments that could potentially require performance in the event of demands by third parties or contingent events. Loan

commitments are reported net of participations, assignments and syndications.

(b) Includes equity funding commitments related to equity management and affordable housing.

M

ARKET

R

ISK

M

ANAGEMENT

O

VERVIEW

Market risk is the risk of a loss in earnings or economic value

due to adverse movements in market factors such as interest

rates, credit spreads, foreign exchange rates, and equity prices.

We are exposed to market risk primarily by our involvement

in the following activities, among others:

• Traditional banking activities of taking deposits and

extending loans,

• Private equity and other investments and activities

whose economic values are directly impacted by

market factors, and

• Trading in fixed income products, equities,

derivatives, and foreign exchange, as a result of

customer activities, underwriting, and proprietary

trading.

We have established enterprise-wide policies and

methodologies to identify, measure, monitor, and report

market risk. Market Risk Management provides independent

oversight by monitoring compliance with these limits and

guidelines, and reporting significant risks in the business to

the Joint Risk Committee of the Board.

M

ARKET

R

ISK

M

ANAGEMENT

–I

NTEREST

R

ATE

R

ISK

Interest rate risk results primarily from our traditional banking

activities of gathering deposits and extending loans. Many

factors, including economic and financial conditions,

movements in interest rates, and consumer preferences, affect

the difference between the interest that we earn on assets and

the interest that we pay on liabilities. Because of repricing

term mismatches and embedded options inherent in certain of

these products, changes in market interest rates not only affect

expected near-term earnings, but the economic values of these

assets and liabilities as well.

ALM centrally manages interest rate risk within limits and

guidelines set forth in our risk management policies approved

by the Asset and Liability Committee and the Joint Risk

Committee of the Board.

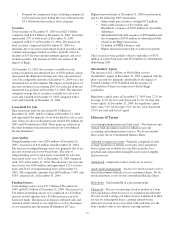

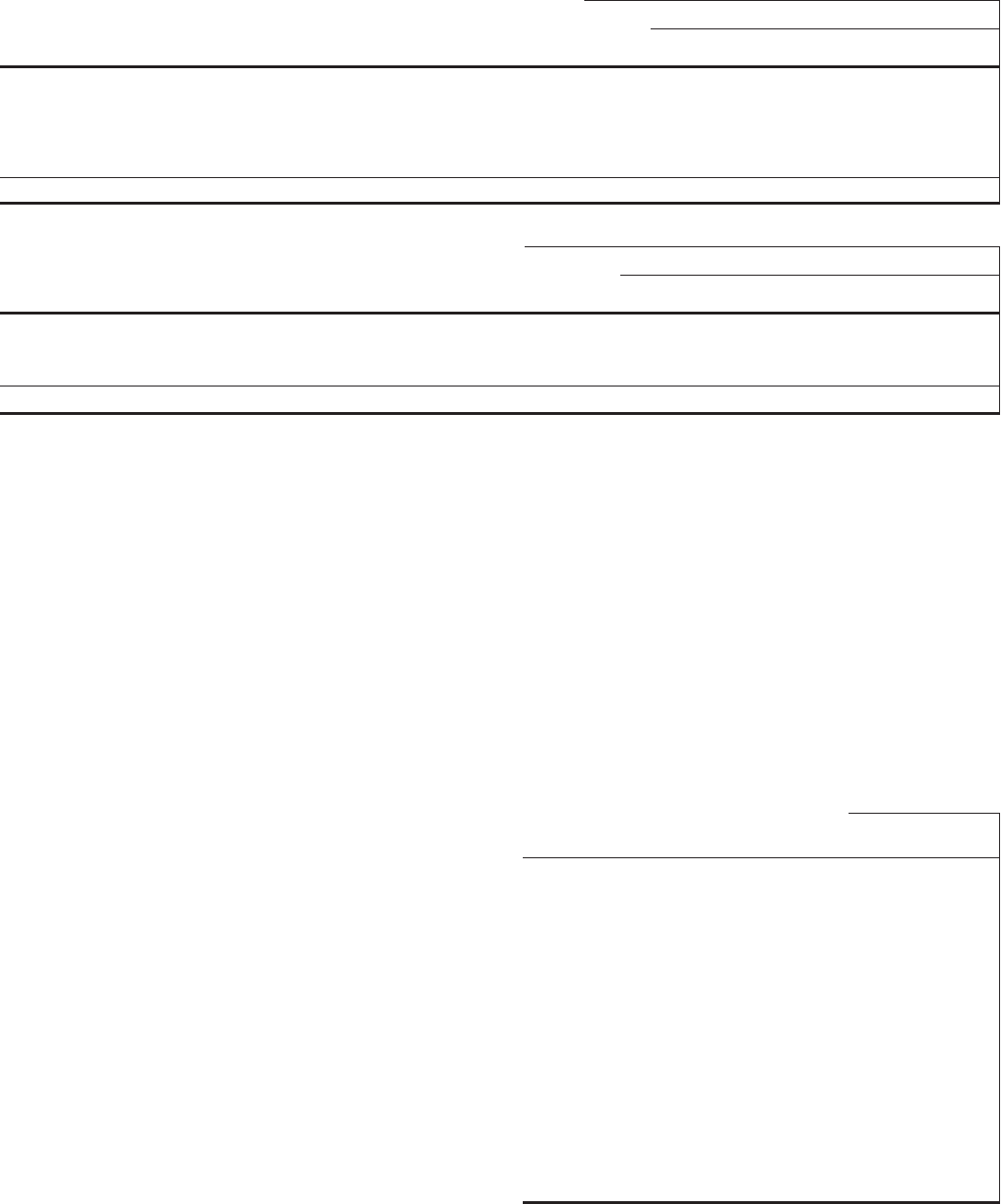

Sensitivity results and market interest rate benchmarks for the

years ended December 31, 2006 and December 31, 2005

follow:

Interest Sensitivity Analysis Fourth

Quarter

2006

Fourth

Quarter

2005

Net Interest Income Sensitivity

Simulation

Effect on net interest income in first year

from gradual interest rate change over

following 12 months of:

100 basis point increase (2.6)% (.5)%

100 basis point decrease 2.5% .2%

Effect on net interest income in second

year from gradual interest rate change

over the preceding 12 months of:

100 basis point increase (5.5)% (1.2)%

100 basis point decrease 3.7% (1.1)%

Duration of Equity Model

Base case duration of equity (in years): 1.5 .3

Key Period-End Interest Rates

One month LIBOR 5.32% 4.39%

Three-year swap 5.10% 4.84%

54