PNC Bank 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

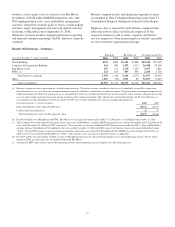

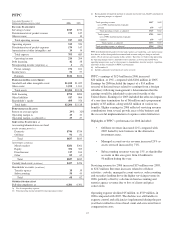

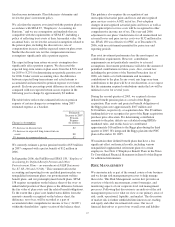

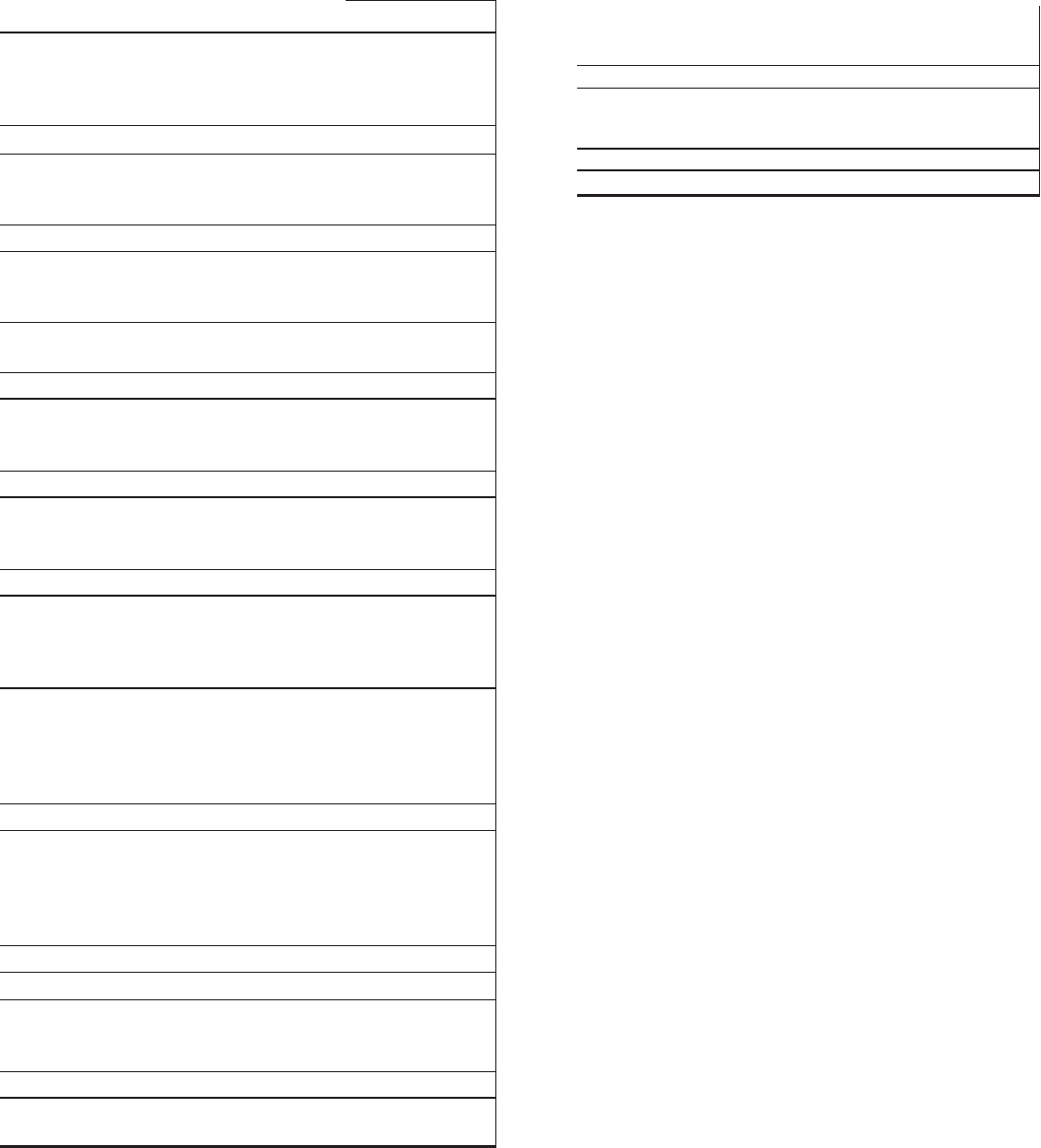

PFPC

Year ended December 31

Dollars in millions except as noted 2006 2005

I

NCOME

S

TATEMENT

Servicing revenue $747 $732

Distribution/out-of-pocket revenue 170 147

Other revenue 10

Total operating revenue 917 889

Operating expense 519 524

Distribution/out-of-pocket expenses 170 147

Amortization of other intangibles, net 14 14

Total expense 703 685

Operating income 214 204

Debt financing 42 38

Nonoperating income (expense) (a) 4(5)

Pretax earnings 176 161

Income taxes 52 57

Earnings $124 $104

P

ERIOD

-

END

B

ALANCE

S

HEET

Goodwill and other intangible assets $1,012 $1,025

Other assets 1,192 1,103

Total assets $2,204 $2,128

Debt financing $792 $890

Other liabilities 917 864

Shareholder’s equity 495 374

Total funds $2,204 $2,128

P

ERFORMANCE

R

ATIOS

Return on average equity 29% 32%

Operating margin (b) 23 23

Operating margin, as adjusted (c) 29 27

S

ERVICING

S

TATISTICS

(d)

Accounting/administration net fund

assets (

IN BILLIONS

)(e)

Domestic $746 $754

Offshore 91 81

Total $837 $835

Asset type (in billions)

Money market $281 $361

Equity 354 305

Fixed income 117 104

Other 85 65

Total $837 $835

Custody fund assets (in billions) $427 $476

Shareholder accounts (in millions)

Transfer agency 18 19

Subaccounting 50 43

Total 68 62

O

THER INFORMATION

Full-time employees (d) 4,381 4,391

(a) Net of nonoperating expense.

(b) Total operating income divided by total operating revenue.

(c) Reconciliation of reported amounts to amounts used in the non-GAAP calculation of

the operating margin, as adjusted:

Total operating revenue $917 $889

Less: PFPC distribution/out-of-pocket

revenue 170 147

Total operating revenue, as adjusted $747 $742

Total expense $703 $685

Less: PFPC distribution/out-of-pocket

expenses 170 147

Total expense, as adjusted $533 $538

Total operating income, as adjusted $214 $204

PFPC distribution/out-of-pocket revenue and expenses are marketing, sales and servicing

fees that we collect from pooled investment fund accounts and pass along to our fund

clients. We do not earn any margin on this activity. Therefore, we believe that presenting

the operating margin ratio as adjusted for these amounts, as well as the GAAP basis

operating margin ratio, may be of assistance to shareholders, investor analysts, regulators

and others in their evaluation of PFPC’s performance.

(d) At December 31.

(e) Includes alternative investment net assets serviced.

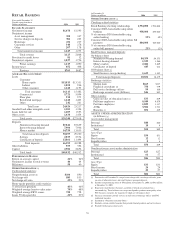

PFPC’s earnings of $124 million in 2006 increased

$20 million, or 19%, compared with $104 million in 2005.

Earnings for 2006 included the impact of a $14 million

reversal of deferred taxes related to earnings from a foreign

subsidiary following management’s determination that the

earnings would be indefinitely reinvested outside of the

United States. Earnings for 2005 included the after-tax impact

of a one time termination fee of $6 million and a prepayment

penalty of $5 million, along with $4 million of various tax

benefits. Higher earnings in 2006 reflected servicing revenue

contributions from several growth areas of the business and

the successful implementation of expense control initiatives.

Highlights of PFPC’s performance in 2006 included:

• Offshore revenues increased 22% compared with

2005 fueled by new business in the alternative

investment arena.

• Managed account service revenue increased 29% as

assets serviced increased by 71%.

• Subaccounting revenues were up 15% as shareholder

accounts in this area grew from 43 million to

50 million during the year.

Servicing revenue for 2006 increased $15 million over 2005,

to $747 million. Revenue increases related to offshore

activities, custody, managed account services, subaccounting

and securities lending drove the higher servicing revenue in

2006, partially offset by a decline in fund accounting and

transfer agency revenue due to loss of clients and price

concessions.

Operating expense declined $5 million, to $519 million, in

2006 compared with 2005. The decline was attributable to

expense control and efficiencies implemented during the past

year that resulted in a lower head count and associated lower

compensation costs.

43