PNC Bank 2006 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

M

ERCANTILE

B

ANKSHARES

C

ORPORATION

On October 8, 2006 we entered into a definitive agreement

with Mercantile Bankshares Corporation (“Mercantile”) for

PNC to acquire Mercantile. Mercantile shareholders will be

entitled to .4184 shares of PNC common stock and $16.45 in

cash for each share of Mercantile, or in the aggregate

approximately 53 million shares of PNC common stock and

$2.1 billion in cash. Based on PNC’s recent stock prices, the

transaction is valued at approximately $6.0 billion in the

aggregate.

Mercantile is a bank holding company with approximately

$18 billion in assets that provides banking and investment and

wealth management services through 240 offices in Maryland,

Virginia, the District of Columbia, Delaware and southeastern

Pennsylvania. The transaction is expected to close in March

2007 and is subject to customary closing conditions, including

regulatory approvals. See Note 13 Borrowed Funds regarding

February 2007 debt issuances related to this planned

acquisition.

2005

SSRM H

OLDINGS

,I

NC

.

Effective January 31, 2005, BlackRock closed the acquisition

of SSRM Holdings, Inc. (“SSRM”), the holding company of

State Street Research & Management Company and SSR

Realty Advisors Inc., from MetLife, Inc. for an adjusted

purchase price of approximately $265 million in cash and

approximately 550,000 shares of BlackRock restricted class A

common stock valued at $37 million. SSRM, through its

subsidiaries, actively manages stock, bond, balanced and real

estate portfolios for both institutional and individual investors.

Substantially all of SSRM’s operations were integrated into

BlackRock as of the closing date. BlackRock acquired assets

under management totaling $50 billion in connection with this

transaction.

On January 18, 2005, our ownership in BlackRock was

transferred from PNC Bank, N.A. to PNC Bancorp, Inc., our

intermediate bank holding company. The transfer was effected

primarily to give BlackRock more operating flexibility,

particularly in connection with its acquisition of SSRM. As a

result of the transfer, certain deferred tax liabilities recorded

by PNC were reversed in the first quarter of 2005 in

accordance with SFAS 109, “Accounting for Income Taxes.”

The reversal of deferred tax liabilities increased our earnings

by $45 million, or approximately $.16 per diluted share, in the

first quarter of 2005.

R

IGGS

N

ATIONAL

C

ORPORATION

We acquired Riggs National Corporation (“Riggs”), a

Washington, D.C. based banking company, effective May 13,

2005. Under the terms of the agreement, Riggs merged into

The PNC Financial Services Group, Inc. and PNC Bank,

National Association (“PNC Bank, N.A.”) acquired

substantially all of the assets of Riggs Bank, National

Association, the principal banking subsidiary of Riggs. The

acquisition gave us a substantial presence on which to build a

market leading franchise in the affluent Washington, D.C.

metropolitan area. In connection with the acquisition, Riggs

shareholders received an aggregate of approximately $297

million in cash and 6.6 million shares of PNC common stock

valued at $356 million.

H

ARRIS

W

ILLIAMS

&C

O

.

On October 11, 2005, we acquired Harris Williams & Co., one

of the nation’s largest firms focused on providing mergers and

acquisitions advisory and related services to middle market

companies, including private equity firms and private and

public companies.

N

OTE

3V

ARIABLE

I

NTEREST

E

NTITIES

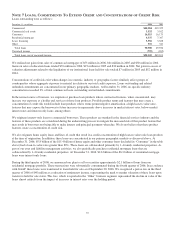

We are involved with various entities in the normal course of

business that may be deemed to be VIEs. We consolidated

certain VIEs as of December 31, 2006 and 2005 for which we

were determined to be the primary beneficiary.

We hold significant variable interests in VIEs that have not

been consolidated because we are not considered the primary

beneficiary. Information on these VIEs follows:

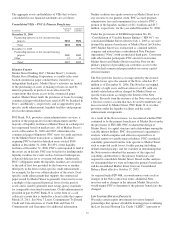

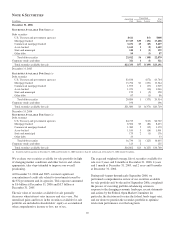

Non-Consolidated VIEs – Significant Variable Interests

In millions

Aggregate

Assets

Aggregate

Liabilities

PNC Risk

of Loss

December 31, 2006

Market Street $ 4,020 $ 4,020 $ 6,117(a)

Collateralized debt

obligations 815 570 22

Partnership interests in low

income housing projects 33 30 8

Total $ 4,868 $ 4,620 $ 6,147

December 31, 2005

Collateralized debt

obligations (b) $ 6,290 $ 5,491 $ 51

Private investment funds (b) 5,186 1,051 13

Market Street 3,519 3,519 5,089 (a)

Partnership interests in low

income housing projects 35 29 2

Total $15,030 $10,090 $ 5,155

(a) PNC’s risk of loss consists of off-balance sheet liquidity commitments to Market

Street of $5.6 billion and other credit enhancements of $.6 billion at December 31,

2006. The comparable amounts at December 31, 2005 were $4.6 billion and $.4

billion, respectively.

(b) Primarily held by BlackRock. We deconsolidated BlackRock effective

September 29, 2006. See Note 2 Acquisitions for additional information. Includes

both PNC’s direct risk of loss and BlackRock’s risk of loss, limited to PNC’s

ownership interest in BlackRock.

82