PNC Bank 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

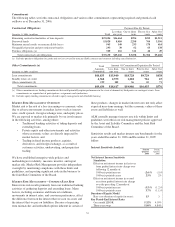

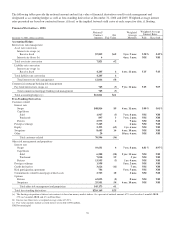

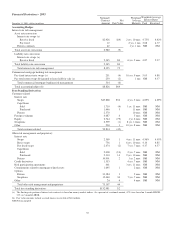

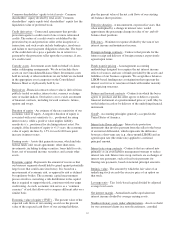

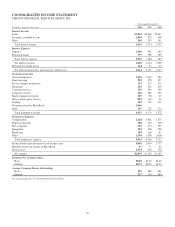

The following tables provide the notional amount and net fair value of financial derivatives used for risk management and

designated as accounting hedges as well as free-standing derivatives at December 31, 2006 and 2005. Weighted-average interest

rates presented are based on contractual terms, if fixed, or the implied forward yield curve at each respective date, if floating.

Financial Derivatives - 2006

December 31, 2006 - dollars in millions

Notional/

Contract

Amount

Net

Fair Value

Weighted

Average

Maturity

Weighted-Average

Interest Rates

Paid Received

Accounting Hedges

Interest rate risk management

Asset rate conversion

Interest rate swaps (a)

Receive fixed $7,815 $62 3 yrs. 9 mos. 5.30% 5.43%

Interest rate floors (b) 6 4 yrs. 3 mos. NM NM

Total asset rate conversion 7,821 62

Liability rate conversion

Interest rate swaps (a)

Receive fixed 4,245 6 6 yrs. 11 mos. 5.15 5.43

Total liability rate conversion 4,245 6

Total interest rate risk management 12,066 68

Commercial mortgage banking risk management

Pay fixed interest rate swaps (a) 745 (7) 9 yrs. 11 mos. 5.25 5.09

Total commercial mortgage banking risk management 745 (7)

Total accounting hedges (c) $12,811 $61

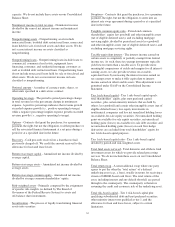

Free-Standing Derivatives

Customer-related

Interest rate

Swaps $48,816 $9 4 yrs. 11 mos. 5.00% 5.01%

Caps/floors

Sold 1,967 (3) 7 yrs. 4 mos. NM NM

Purchased 897 3 7 yrs. 2 mos. NM NM

Futures 2,973 2 9 mos. NM NM

Foreign exchange 5,245 6 mos. NM NM

Equity 2,393 (63) 1 yr. 6 mos. NM NM

Swaptions 8,685 16 6 yrs. 10 mos. NM NM

Other 20 10 yrs. 6 mos. NM NM

Total customer-related 70,996 (36)

Other risk management and proprietary

Interest rate

Swaps 19,631 4 7 yrs. 8 mos. 4.81% 4.97%

Caps/floors

Sold 6,500 (50) 2 yrs. 11 mos. NM NM

Purchased 7,010 59 3 yrs. NM NM

Futures 13,955 (3) 1 yr. 4 mos. NM NM

Foreign exchange 1,958 5 yrs. 2 mos. NM NM

Credit derivatives 3,626 (11) 7 yrs. NM NM

Risk participation agreements 786 5 yrs. 5 mos. NM NM

Commitments related to mortgage-related assets 2,723 10 2 mos. NM NM

Options

Futures 63,033 (2) 8 mos. NM NM

Swaptions 25,951 54 6 yrs. 10 mos. NM NM

Total other risk management and proprietary 145,173 61

Total free-standing derivatives $216,169 $25

(a) The floating rate portion of interest rate contracts is based on money-market indices. As a percent of notional amount, 67% were based on 1-month LIBOR,

27% on 3-month LIBOR and 6% on Prime Rate.

(b) Interest rate floors have a weighted-average strike of 3.21%.

(c) Fair value amounts include accrued interest receivable of $94 million.

NM Not meaningful

58