PNC Bank 2006 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Section 42 of the Internal Revenue Code. The purpose of these

investments is to achieve a satisfactory return on capital, to

facilitate the sale of additional affordable housing product

offerings and to assist us in achieving goals associated with

the Community Reinvestment Act. The primary activities of

the limited partnerships include the identification,

development and operation of multi-family housing that is

leased to qualifying residential tenants. Generally, these types

of investments are funded through a combination of debt and

equity, with equity typically comprising 30% to 60% of the

total project capital.

We consolidated those LIHTC investments in which we own a

majority of the limited partnership interests. We also

consolidated entities in which we, as a national syndicator of

affordable housing equity, serve as the general partner

(together with the aforementioned LIHTC investments), and

no other entity owns a majority of the limited partnership

interests. In these syndication transactions, we create funds in

which our subsidiary is the general partner and sells limited

partnership interests to third parties, and in some cases may

also purchase a limited partnership interest in the fund. The

fund’s limited partners can generally remove the general

partner without cause at any time. The purpose of this

business is to generate income from the syndication of these

funds and to generate servicing fees by managing the funds.

General partner activities include selecting, evaluating,

structuring, negotiating, and closing the fund investments in

operating limited partnerships, as well as oversight of the

ongoing operations of the fund portfolio. The assets are

primarily included in Equity Investments on our Consolidated

Balance Sheet. Neither creditors nor equity investors in the

LIHTC investments have any recourse to our general credit.

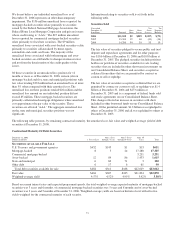

The consolidated aggregate assets and debt of these LIHTC

investments are provided in the Consolidated VIEs – PNC Is

Primary Beneficiary table and reflected in the Corporate &

Institutional Banking business segment.

We have a significant variable interest in certain other limited

partnerships that sponsor affordable housing projects. We do

not own a majority of the limited partnership interests in these

entities and are not the primary beneficiary. We use the equity

method to account for our investment in these entities.

Information regarding these partnership interests is reflected

in the Non-Consolidated VIEs – Significant Variable Interests

table.

We also have subsidiaries that invest in and act as the

investment manager for private equity funds organized as

limited partnerships as part of our equity management

activities. The funds invest in private equity investments to

generate capital appreciation and profits. As permitted by FIN

46R, we have deferred applying the provisions of the

interpretation for these entities pending further action by the

FASB. Information on these entities follows:

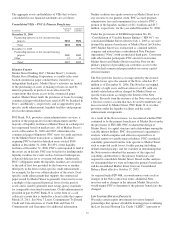

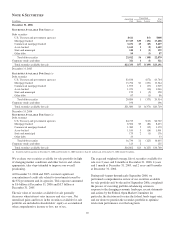

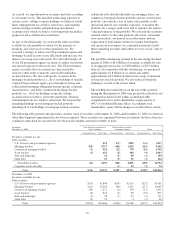

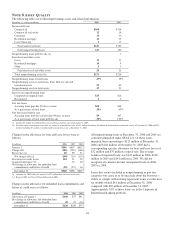

Investment Company Accounting – Deferred Application

In millions

Aggregate

Assets

Aggregate

Equity

PNC Risk

of Loss

Private Equity Funds

December 31, 2006 $102 $102 $104

December 31, 2005 $109 $109 $ 35

PNC’s risk of loss in the tables above includes both the value

of our equity investments and any unfunded commitments to

the respective entities.

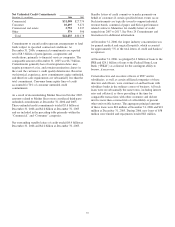

P

ERPETUAL

T

RUST

S

ECURITIES

In December 2006, one of our indirect subsidiaries, PNC

REIT Corp., sold $500 million of 6.517% Fixed-to-Floating

Rate Non-Cumulative Exchangeable Perpetual Trust

Securities (the “Trust Securities”) of PNC Preferred Funding

Trust I, in a private placement. PNC REIT Corp. had

previously acquired the Trust Securities from the trust in

exchange for an equivalent amount of Fixed-to-Floating Rate

Non-Cumulative Perpetual Preferred Securities (the “LLC

Preferred Securities”), of PNC Preferred Funding LLC, (the

“LLC”), held by PNC REIT Corp. The LLC’s initial material

assets consist of indirect interests in mortgages and mortgage-

related assets previously owned by PNC REIT Corp.

PNC REIT Corp. also owns 100% of the LLC’s common

voting securities. As a result, the LLC is an indirect subsidiary

of PNC Bank, N.A. and is consolidated on our Consolidated

Balance Sheet. PNC Preferred Funding Trust I’s investment in

the LLC Preferred Securities is characterized as a minority

interest on our Consolidated Balance Sheet since we are not

the primary beneficiary of PNC Preferred Funding Trust I.

This minority interest totaled $490 million at December 31,

2006.

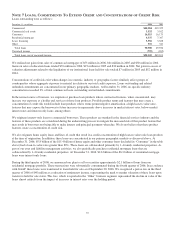

N

OTE

4R

EGULATORY

M

ATTERS

We are subject to the regulations of certain federal and state

agencies and undergo periodic examinations by such

regulatory authorities.

The access to and cost of funding new business initiatives

including acquisitions, the ability to pay dividends, the level

of deposit insurance costs, and the level and nature of

regulatory oversight depend, in large part, on a financial

institution’s capital strength. The minimum regulatory capital

ratios are 4% for tier 1 risk-based, 8% for total risk-based and

4% for leverage. However, regulators may require higher

capital levels when particular circumstances warrant. To

qualify as “well capitalized,” regulators require banks to

maintain capital ratios of at least 6% for tier 1 risk-based, 10%

for total risk-based and 5% for leverage. At December 31,

2006 and December 31, 2005, each of our bank subsidiaries

met the “well capitalized” capital ratio requirements. We

believe our bank subsidiaries will continue to meet these

requirements in 2007.

84