PNC Bank 2006 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

directors and sometimes employees and agents at the time of

acquisition. We advanced such costs on behalf of several such

individuals (including some from Riggs) with respect to

pending litigation or investigations during 2006. It is not

possible for us to determine the aggregate potential exposure

resulting from the obligation to provide this indemnity or to

advance such costs.

In connection with the lending of securities held by PFPC as an

intermediary on behalf of certain of its clients, we provide

indemnification to those clients against the failure of the

borrowers to return the securities. The market value of the

securities lent is fully secured on a daily basis; therefore, the

exposure to us is limited to temporary shortfalls in the collateral

as a result of short-term fluctuations in trading prices of the

loaned securities. At December 31, 2006, the total maximum

potential exposure as a result of these indemnity obligations

was approximately $13.0 billion, although we held collateral at

the time in excess of that amount.

O

THER

G

UARANTEES

We write caps and floors for customers, risk management and

proprietary trading purposes. At December 31, 2006, the fair

value of the written caps and floors liability on our

Consolidated Balance Sheet was $53 million. Our ultimate

obligation under written options is based on future market

conditions and is only quantifiable at settlement. We manage

our market risk exposure from customer positions through

transactions with third-party dealers.

We also enter into credit default swaps under which we buy

loss protection from or sell loss protection to a counterparty

for the occurrence of a credit event of a reference entity. The

fair value of the contracts sold on our Consolidated Balance

Sheet was a net asset of $4 million at December 31, 2006. The

maximum amount we would be required to pay under the

credit default swaps in which we sold protection, assuming all

reference obligations experience a credit event at a total loss,

without recoveries, was $933 million at December 31, 2006.

We purchased $827 million notional of credit default swaps to

mitigate the exposure of certain written credit default swaps at

December 31, 2006.

We have entered into various contingent performance

guarantees through credit risk participation arrangements with

terms ranging from less than one year to 11 years. We will be

required to make payments under these guarantees if a

customer defaults on its obligation to perform under certain

credit agreements with third parties. Our exposure under these

agreements is approximately $372 million at December 31,

2006.

C

ONTINGENT

P

AYMENTS

I

N

C

ONNECTION

W

ITH

C

ERTAIN

A

CQUISITIONS

A number of the acquisition agreements to which we are a

party and under which we have purchased various types of

assets, including the purchase of entire businesses, partial

interests in companies, or other types of assets, require us to

make additional payments in future years if certain

predetermined goals are achieved or not achieved within a

specific time period. Due to the nature of the contract

provisions, we cannot quantify our total exposure that may

result from these agreements.

N

OTE

25 P

ARENT

C

OMPANY

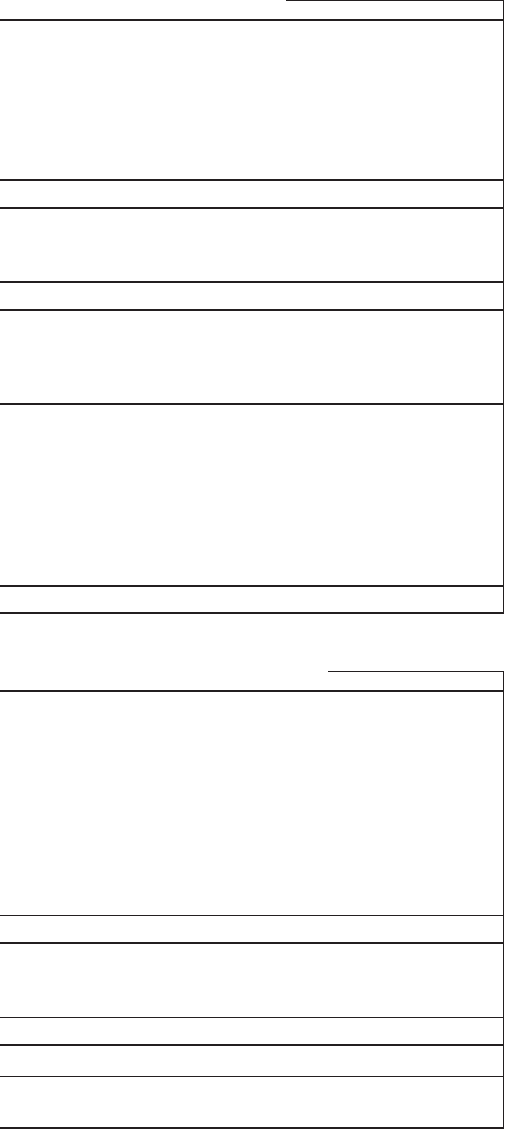

Summarized financial information of the parent company is as

follows:

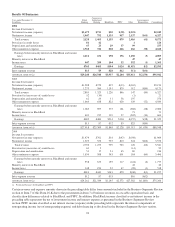

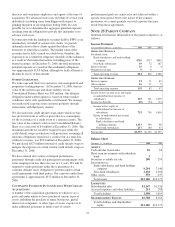

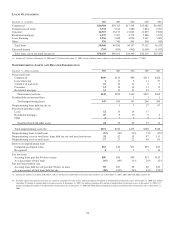

Income Statement

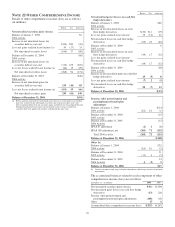

Year ended December 31 - in millions 2006 2005 2004

O

PERATING

R

EVENUE

Dividends from:

Bank subsidiaries and bank holding

company $710 $717 $895

Non-bank subsidiaries 69 72 187

Interest income 16 84

Noninterest income 96

Total operating revenue 804 803 1,086

O

PERATING

E

XPENSE

Interest expense 93 71 42

Other expense 46 11 5

Total operating expense 139 82 47

Income before income taxes and equity

in undistributed net income of

subsidiaries 665 721 1,039

Income tax benefits (60) (24) (17)

Income before equity in

undistributed net income of

subsidiaries 725 745 1,056

Equity in undistributed net income

of subsidiaries:

Bank subsidiaries and bank

holding company 1,653 396 98

Non-bank subsidiaries 217 184 43

Net income $2,595 $1,325 $1,197

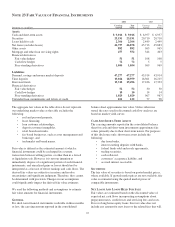

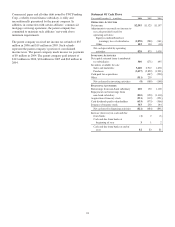

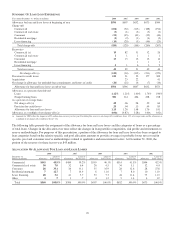

Balance Sheet

December 31 - in millions 2006 2005

A

SSETS

Cash and due from banks $2 $3

Short-term investments with subsidiary

bank 3

Securities available for sale 290 293

Investments in:

Bank subsidiaries and bank holding

company 9,294 7,140

Non-bank subsidiaries 2,038 2,504

Other assets 559 237

Total assets $12,186 $10,177

L

IABILITIES

Subordinated debt $1,147 $1,326

Accrued expenses and other liabilities 251 288

Total liabilities 1,398 1,614

S

HAREHOLDERS

’E

QUITY

10,788 8,563

Total liabilities and shareholders’

equity $12,186 $10,177

115