PNC Bank 2006 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2006 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

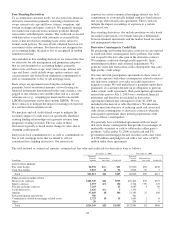

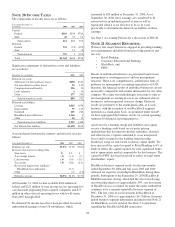

diversify the matching portion of their plan account invested

in shares of PNC common stock into other investments

available within the plan. Prior to this amendment, only

participants age 50 or older were permitted to exercise this

diversification option. Employee benefits expense for this

plan, which was effective July 1, 2004, was $9 million in

2006, $12 million in 2005 and $5 million for 2004. We

measured employee benefits expense as the fair value of the

shares and cash contributed to the plan.

We also maintain a nonqualified supplemental savings plan

for certain employees.

N

OTE

18 S

TOCK

-B

ASED

C

OMPENSATION

P

LANS

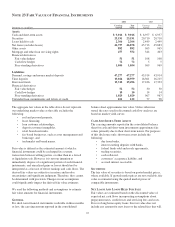

We have long-term incentive award plans (“Incentive Plans”)

that provide for the granting of incentive stock options,

nonqualified stock options, stock appreciation rights, incentive

shares/performance units, restricted stock, other share-based

awards and dollar-denominated awards to executives and,

other than incentive stock options, to non-employee directors.

As of December 31, 2006, no incentive stock options or stock

appreciation rights were outstanding.

N

ONQUALIFIED

S

TOCK

O

PTIONS

Options are granted at exercise prices not less than the market

value of common stock on the grant date. Generally, options

granted since 1999 become exercisable in installments after

the grant date. Options granted prior to 1999 are mainly

exercisable 12 months after the grant date. No option may be

exercisable after 10 years from its grant date. Payment of the

option exercise price may be in cash or previously owned

shares of common stock at market value on the exercise date.

Generally, options granted under the Incentive Plans vest

ratably over a three-year period as long as the grantee remains

an employee or, in certain cases, retires from PNC. For all

options granted prior to the adoption of SFAS 123R, we

recognized compensation expense over the three-year vesting

period. If an employee retired prior to the end of the three-

year vesting period, we accelerated the expensing of all

unrecognized compensation costs at the retirement date. As

required under SFAS 123R, we recognize compensation

expense for options granted to retirement-eligible employees

after January 1, 2006 in the period granted, in accordance with

the service period provisions of the options.

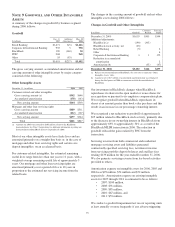

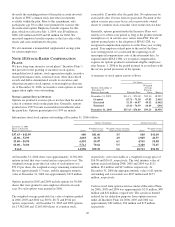

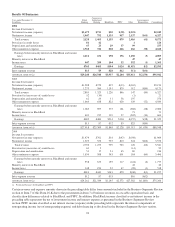

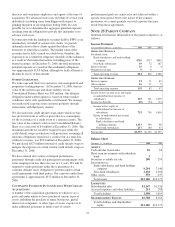

A summary of stock option activity follows:

Per Option

Options outstanding at

December 31

Shares in thousands Exercise Price

Weighted

-Average

Exercise

Price Shares

December 31, 2005 $31.13 – $76.00 $55.30 18,292

Granted 62.71 – 71.38 67.83 2,410

Exercised 31.13 – 66.97 49.32 (5,462)

Forfeited 43.41 – 74.59 66.49 (290)

December 31, 2006 $37.43 – $76.00 $59.29 14,950

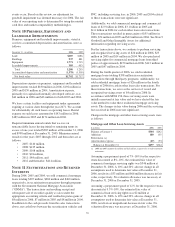

Information about stock options outstanding at December 31, 2006 follows:

Options Outstanding Options Exercisable

December 31, 2006

Shares in thousands

Range of exercise prices Shares

Weighted-average

exercise price

Weighted-average remaining

contractual life (in years) Shares

Weighted-average

exercise price

$37.43 – $42.99 680 $41.60 3.5 680 $41.60

43.00 – 52.99 2,003 46.70 4.9 1,949 46.55

53.00 – 59.99 6,555 55.07 6.1 4,765 55.58

60.00 – 76.00 5,712 70.64 5.5 3,349 72.65

Total 14,950 $59.29 5.6 10,743 $58.38

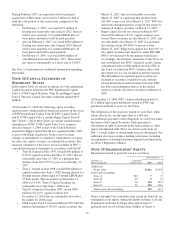

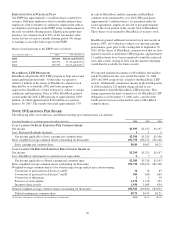

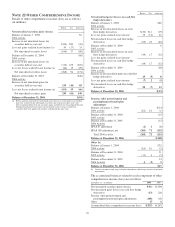

At December 31, 2006, there were approximately 14,304,000

options in total that were vested and are expected to vest. The

weighted-average grant-date fair value of such options was

$59.19 per share, the weighted-average remaining contractual

life was approximately 5.5 years, and the aggregate intrinsic

value at December 31, 2006 was approximately $219 million.

Options granted in 2005 and 2004 include options for 30,000

shares that were granted to non-employee directors in each

year. No such options were granted in 2006.

The weighted-average grant-date fair value of options granted

in 2006, 2005 and 2004 was $9.94, $8.72 and $9.64 per

option, respectively. At December 31, 2005 and 2004 options

for 13,582,000 and 12,693,000 shares of common stock,

respectively, were exercisable at a weighted-average price of

$56.58 and $56.41, respectively. The total intrinsic value of

options exercised during 2006, 2005 and 2004 was $111

million, $31 million and $17 million, respectively. At

December 31, 2006 the aggregate intrinsic value of all options

outstanding and exercisable was $227 million and $173

million, respectively.

Cash received from option exercises under all Incentive Plans

for 2006, 2005 and 2004 was approximately $233 million, $98

million and $42 million, respectively. The actual tax benefit

realized for tax deduction purposes from option exercises

under all Incentive Plans for 2006, 2005 and 2004 was

approximately $82 million, $34 million and $15 million,

respectively.

105